EU Taxonomy: Solution or Driver of Greenwashing?

In a bold stride towards a greener future, the European Union unveiled the EU Taxonomy, a pioneering framework with the ambitious goal of steering the financial sector towards sustainability. This innovative classification system seeks to define what truly constitutes an environmentally sustainable economic activity. Its mission? To combat greenwashing by promoting transparency and ensuring investments flow into projects that offer tangible environmental benefits. Yet, as the implementation of the EU Taxonomy unfolds, a paradox emerges: could this well-intentioned framework inadvertently fuel the very issue it seeks to eradicate?

Challenges within this framework

The taxonomy's intricate and detailed criteria, while rigorous, present significant compliance challenges, especially for small and medium-sized enterprises (SMEs) that may lack the resources to navigate its complexities. This has raised concerns that the taxonomy might inadvertently concentrate opportunities among larger entities that can meet its demands, sidelining smaller players and potentially stifling innovation in the green finance space. Furthermore, the application of the taxonomy's definitions does not always align with the diverse and transitional nature of sustainability pathways across different sectors. Industries in the midst of a gradual transition towards greener models may find their efforts unrecognized, potentially discouraging meaningful environmental progress. This misalignment between the taxonomy's stringent criteria and the realities of market transitions underscores a critical gap in the framework's ability to foster broader sustainability efforts.

Complicating matters further, the phenomenon of "green bleaching" emerges as a byproduct of the taxonomy's implementation. Companies may opt to minimize the sustainability qualifications of their funds to sidestep additional regulatory obligations, creating a facade of sustainability that meets the letter of the taxonomy but not its spirit. Moreover, another strategy that emerges in this context is called “green hushing”. This involves the intentional restriction of sharing information about a company's environmental and social efforts with the public. This strategy is motivated by worries over possible backlash, negative perceptions from the public, or legal repercussions. These approaches to sustainability underscore a fundamental tension in the taxonomy's design, raising questions about its effectiveness in promoting genuine environmental stewardship.

Central to these challenges is the issue of alignment with the EU Taxonomy, which has revealed varying interpretations and applications across companies and sectors. Such inconsistencies undermine the goal of creating a uniform standard and fuel accusations of greenwashing. Moreover, the rapidly evolving nature of sustainability technologies and practices can outpace the taxonomy's updates, leading to a misalignment between current sustainability best practices and what the taxonomy recognizes. This lag disadvantages innovative companies at the forefront of sustainability but may not fit neatly within the taxonomy's current criteria.

The EU taxonomy: is it effective?

The EU Taxonomy is a critical component of the European Union's sustainable finance framework. Another important part of this framework, is the EU’s Sustainable Finance Disclosure Regulation (SFDR). The SFDR categorizes funds into three main articles based on their sustainability focus: Article 6, Article 8, and Article 9. Article 6 funds do not have such a sustainability focus, but Article 8 funds, also known as "light green" funds, promote environmental or social characteristics within their investment process. Article 9 funds, or "dark green" funds, have sustainable investment as their objective, aiming to achieve a measurable, positive environmental or social impact.

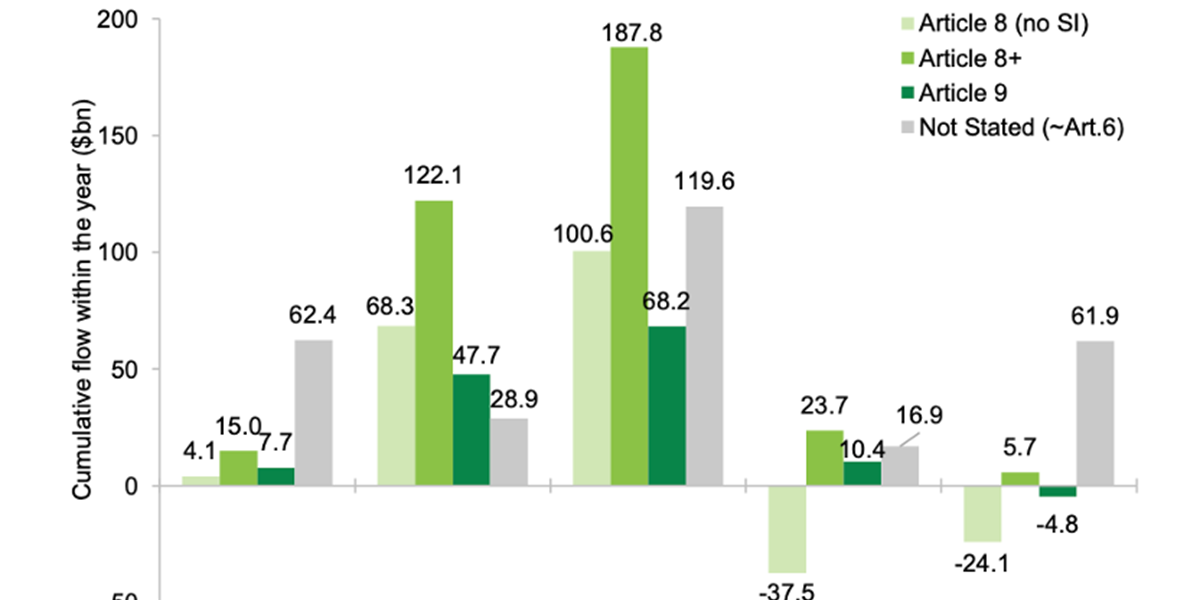

Expanding on this discussion of the EU Taxonomy's impact on sustainable finance, is a report of Goldman Sachs on Article 8 and 9 fund holdings. The shifting tides of investment underscored by this analysis reveals an intricate dance between ambition and reality within the sustainable finance sector. Notably, Article 8 and 9 equity funds witnessed significant dynamics in investor behavior. Despite the taxonomy's objective to steer investments into genuinely sustainable projects, these funds faced $24.1 billion in outflows in 2023, starkly contrasted with the $61.9 billion inflow towards their non-sustainable counterparts. These inflows and outflows of the different type of funds can be seen in Figure 1, for 2019 up until 2023. In 2020 and 2021, inflows in article 8, 8+ and 9 funds combined were well over the inflows of the article 6 funds. In 2022 however, this took a turn and inflows in article 9 funds drastically decreased and even became negative for article 8 funds.

Figure 1: Cumulative flows for European Equity funds per year ($bn), 2019 – 2023. Source: Morningstar, Goldman Sachs Global Investment Research

Nevertheless, the EU responded to these challenges in 2022 by organizing Q&A’s, so that the distinction between Article 8 and Article 9 funds could be further clarified, the range of investments they can encompass could be discussed and other pressing questions by fund managers could be addressed. By doing so, the EU seek to ensure that the taxonomy remains a flexible tool, adaptable to the evolving landscape of sustainable finance. However, it appeared that the further clarification on SFDR by the EU did not result in the expected surge of fund classification upgrades in 2023.

Of course, it would be wrong to claim that this reversal in flows is solely due to a lack in effectiveness of the EU Taxonomy. This reversal could be explained by several factors, such as market volatility, economic uncertainty and so on. However, while the taxonomy aims to provide clarity, its complexity and the stringency of its criteria may have posed challenges for funds striving to achieve or maintain their Article 8 or 9 classifications. This was especially noticeable in 2022 and 2023, where more than 300 funds were unable to keep their Article 8 or 9 classifications and were consecutively downgraded. Furthermore, other issues rose, such as performance challenges faced by sustainable funds, particularly those heavily invested in sectors like renewables, which may have underperformed in the short term due to various macroeconomic factors. Investors' concern over performance relative to non-sustainable funds could have contributed to the shift in inflows. Lastly, the initial surge in Article 8 and 9 funds could have been driven by early adopters and enthusiasm for sustainable investments. As the market matures and more detailed assessments of sustainability and performance are made, investors may become more discerning, leading to a temporary realignment of inflows.

In conclusion, the EU Taxonomy aims to standardize sustainable finance and combat greenwashing. However, the juxtaposition of ambition and implementation complexity raises critical questions about the taxonomy's efficacy in bridging the gap between sustainable aspirations and the market's capacity to adapt. While the EU Taxonomy and SFDR are pivotal in promoting transparency and combating greenwashing, the evolving investor trends and market dynamics underscore the necessity for a balanced and flexible approach. Such an approach would recognize diverse sustainability pathways, accommodate emerging technologies and practices, and support the gradual transition of various sectors towards greener models.