Heat pumps: employing sustainable energy for a low-carbon future - an overview and industry insight

In a world focused on decarbonization and electrification, electric vehicles (EVs) are likely a primary consideration for many. However, heat pumps deserve equal, if not more, attention. Recognized increasingly as a crucial component of sustainable energy systems, heat pumps are poised to become the most critical technology for decarbonizing heating.

Heat pump basics

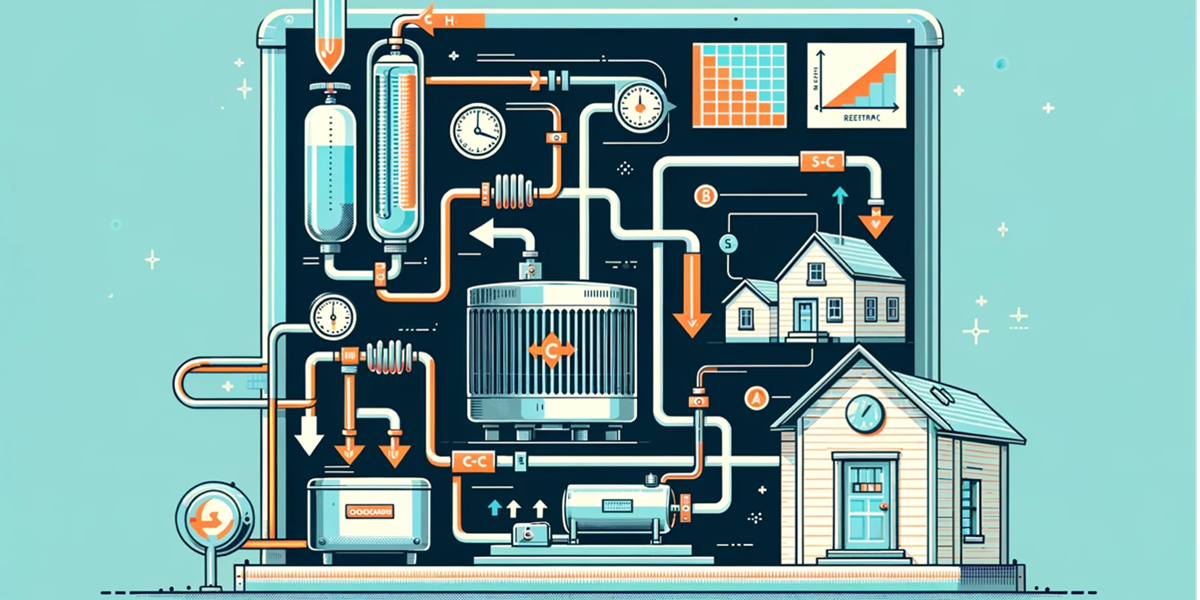

At their core, heat pumps simply transfer heat from external sources—such as air, ground, water, or waste heat—into buildings, district heating solutions, or industrial heating applications. This includes a variety of settings like homes, hospitals, schools, shops, and industrial buildings. They achieve this through a system comprising a refrigerant, evaporator, compressor, condenser, and expansion valves.

A bit of history

Despite common misconceptions that heat pump technology is a recent innovation, prompting concerns about its reliability and developmental stage, heat pumps have a long and rich history. Research into the principles behind heat pumps dates back to the 1700s. In 1748, Professor William Cullen demonstrated a rudimentary refrigeration device that used a pump to create a vacuum over diethyl ether, causing it to boil and absorb heat from the surrounding air. Advancing this early work, Peter von Rittinger, in Austria between 1855 and 1857, developed the first practical heat pump system. He utilized this system on an industrial scale for heating brine, a process integral to extracting salt from the solution, marking a significant milestone in the application of heat pump technology.

Types of heat pumps

Due to ongoing innovation, today, we have several types of heat pumps, each designed for specific applications and suited to varying environmental conditions.

Where the magic happens

One remarkable aspect of a heat pump is its ability to transfer several units of useful thermal energy while consuming just one unit of electricity. In comparison, traditional combustion-based heating systems only offer less than one unit of thermal energy for each unit of energy consumed. So, it could easily be assumed that transitioning to a heat pump is the most financially sound choice.

Not so fast though

It should be noted that the decision to transition to a heat pump isn't as straightforward as it might appear. The initial investment for a heat pump is significantly higher than that for a condensing boiler. Within the EU, the installation cost of a heat pump can be 2 to 3 times higher than that of a condensing boiler, with the exception of air-air heat pumps. Additionally, retrofitting, particularly in residential properties, often becomes necessary and is highly recommended, thus not optional. This could include measures such as adding insulation or replacing radiators. Another critical factor in assessing the cost-effectiveness of heat pumps relative to fossil fuel boilers is the price ratio of electricity to gas or oil.

And why is this so?

The efficiency of heat pumps is commonly measured by their coefficient of performance (COP), with a higher COP indicating greater efficiency. For a heat pump that maintains an average COP of 3 throughout the heating season, to remain economically competitive against a fossil fuel boiler, the price of electricity should not exceed three times the price of gas or oil. Since gas prices have significantly decreased from their peak in mid-2022, this dynamic does not favor the cost-effectiveness of heat pumps. Moreover, there are a lot of EU nations that impose higher levies on electricity compared to gas.

Climate impact: The more the better

According to the International Energy Agency (IEA), heating in buildings is responsible for 4 gigatonnes (Gt) of CO2 emissions annually, 10% of all global emissions.[1] Based on Eurostat data, approximately half of the energy consumed in the EU is utilized for heating and cooling, with over 70% sourced from fossil fuels, predominantly natural gas. In the residential sector, approximately 80% of the final energy consumption is dedicated to space and water heating.[2]

So, switching to heat pumps instead of fossil-fuel-based boilers can greatly decrease greenhouse gas emissions across various heating markets, especially as electricity systems become more environmentally friendly. However, heat pumps only fulfill approximately 10% of space heating requirements worldwide, although we see a huge variance across countries. In Norway, 60% of buildings have heat pumps, while Sweden and Finland have over 40%. This is the result of specific conditions in these countries that favor heat pumps over gas boilers, such as limited gas grids, high carbon prices, and substantial subsidies.

In absolute numbers these 10% of space heating compare to an aggregate capacity of heat pumps deployed in buildings that exceed 1,000 gigawatt, which is expected to grow to 2,600 gigawatt by 2030. Again, according to the IEA, this would increase their proportion of overall heating requirements in buildings to nearly 20%.

Investment Opportunity

Until a year ago, many manufacturers viewed heat pumps as a potential gold mine. The surge in demand was driven by increasing consumer awareness of their cost-effectiveness and energy-saving benefits. Additionally, governments on both sides of the Atlantic were introducing bans on new gas and oil systems, setting ambitious installation targets, and offering generous incentives to foster adoption. This led to installers experiencing extended order backlogs and a scarcity of skilled workers. U.S.-based Carrier Global announced a €12 billion deal to acquire its German competitor Viessmann, seizing what it saw as a once-in-a-lifetime opportunity. Even Elon Musk showed interest in the heat pump sector.

The landscape for the heat pump industry has shifted, now facing considerable challenges that are influencing demand. Firstly, higher interest rates are dampening demand for heat pumps, as consumers become more cautious about upgrading their heating systems. This rise in interest rates also adversely affects construction projects, further impacting heat pump sales. Additionally, distributors are currently dealing with high inventory levels, indicating that market adjustments are expected to continue for at least the next two quarters. Lastly, the decline in gas prices is altering the cost-benefit analysis in favor of gas-based heating systems, weakening the incentive for consumers to switch to heat pumps.

This confluence of factors led to a 5% decline in heat pump sales across 14 European countries in 2023.[3] While this downturn might seem unfavorable in light of the challenges mentioned, it's important to view it in a broader context. In 2022, there was an exceptionally strong surge in heat pump sales, with a 38% year-on-year increase, driven by the most severe energy crisis Europe has faced since the 1970s. However, what is more concerning is that the market downturn became most pronounced towards the end of the year, catching many industry participants by surprise.

From the supply side, companies have been expanding their capacity over the past few years. By the end of 2022, total production capacity reached approximately 3 million units, nearly matching the total sales for that year. With all the announced plans, this production capacity is projected to increase to about 16.1 million units by 2025. Industry participants had been banking on policy support from individual countries as well as from Europe as a whole. The EU's Heat Pump Action Plan, in particular, was expected to significantly boost heat pump adoption. However, the plan's implementation has been delayed.

As a consequence of these challenges, industry players are experiencing difficulties. Companies such as Daikin, OVO, and Vaillant are implementing selective price reductions on heat pumps, with some discounts reaching up to 40%. Consequently, firms like Nibe, a leading indicator in the European heat pump sector, find themselves compelled to implement cost-saving measures to maintain operational efficiency and agility, in anticipation of a market recovery.

The value chain

Many companies involved in the heat pump value chain also operate within the broader sector of HVAC (Heating, Ventilation, and Air Conditioning).

To begin with, let's examine the producers and brand names of heat pumps. The market is quite fragmented, with each brand's market presence being shaped by local preferences. Prominent companies in this sector include well-known names such as Daikin Industries, Mitsubishi Electric, Panasonic, Fujitsu General, Carrier (which acquired Viessmann), Trane Technologies, Johnson Controls, Robert Bosch, Stiebel Eltron, Atlantic International, Gree Electric Appliances, Midea Group, Nibe, Ariston, and others.

Expanding our focus, but still aligning with the underlying trend of increasing heat pump usage, are companies active as distributors or wholesalers of these brands. Notable publicly traded companies in this segment include Watsco and Beijer Ref. Another avenue for investing in this macro trend is to look into suppliers to these brands, where the heat pump activities are significant and not overly diluted by other industrial activities. One such listed company is Belimo, which is a global market leader in actuator solutions for controlling HVAC systems.

Conclusion

The overall trend for heat pumps remains positive, and the duration required to resolve inventory issues is yet to be determined. Once the demand and supply dynamics reach a more balanced state, the broader value chain of companies within the heat pump sector is anticipated to be well-positioned for sustained, long-term growth. However, it's important to keep in mind that investing in stocks heavily reliant on policy support can be challenging and subject to volatility.

[1] https://www.iea.org/reports/the-future-of-heat-pumps

[2] https://energy.ec.europa.eu/topics/energy-efficiency/heat-pumps_en

[3] https://www.ehpa.org/news-and-resources/news/heat-pump-sales-fall-by-5-while-eu-delays-action/