Gino Delaere is master in Applied Economics (University of Antwerp) and holds an MBA (Xavier Institute of Management in Bhubaneswar, India). For over two decades he has been specializing in emerging markets worldwide and traveling the world looking for interesting investment opportunities. Previously he worked for several large asset managers where he was actively involved in several thematically inspired equity funds. He joined Econopolis in 2010 and in his current role he is co-responsible for managing the emerging markets and climate funds.

The offshore wind industry is navigating turbulent waters

This year, numerous offshore wind projects, particularly in the US and the UK, have encountered a challenging "triple whammy." This situation involves a blend of three factors: 1) escalating financing costs caused by increasing interest rates, 2) fluctuating commodity prices, and 3) persistent supply chain problems. Furthermore, until recently, the situation worsened due to government reluctance to modify auction parameters to accommodate these new realities. This hesitance largely stemmed from a desire to curb the additional costs that such changes would impose on end consumers.

UK and US offshore projects face setbacks and uncertain futures

But then we witnessed the climate ambitions in the UK experiencing a setback when no new offshore windfarms were secured in a recent government’s clean energy auction. To provide a bit more background: a potential for no less than 5 Gigawatts of projects was available for auctioning, but no interested parties from the offshore wind industry could be found. It really shouldn’t have come as a big surprise as many offshore wind developers which took part in the auction had complained to the UK government that the maximum price for the auction had been set too low for their projects to make any money.

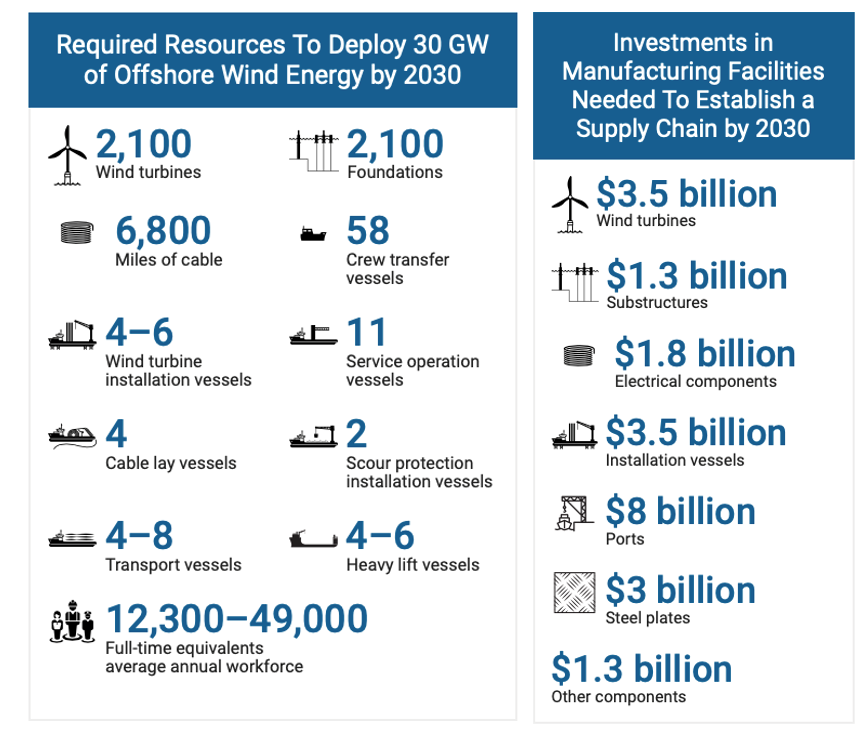

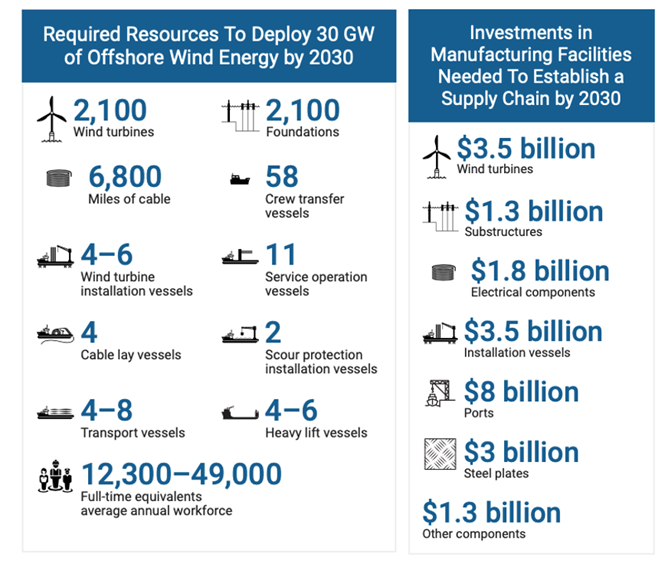

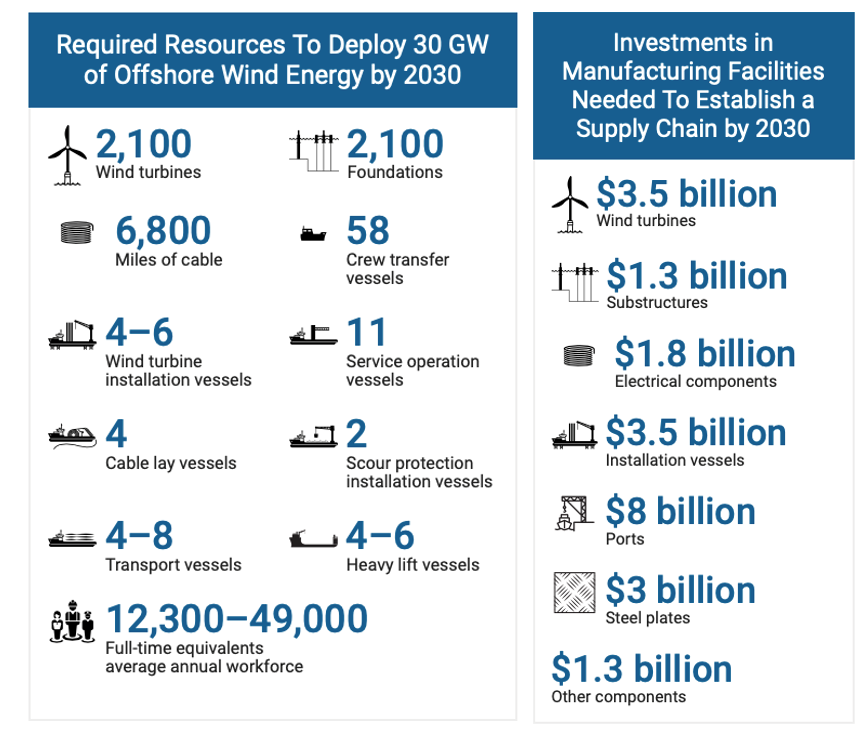

Soon after that, Denmark’s Orsted decided to cancel two big offshore windfarm projects in the US, leaving the company no choice but to take significant impairment charges. Again, this announcement came as a shock and even put into question the US’ governments target to roll out 30 Gigawatts of offshore wind capacity in US waters by 2030. As a reminder, the US’ national offshore wind energy target of 30 Gigawatts by 2030 was set to establish a domestic supply chain, including providing existing suppliers with the ability to produce thousands of components while creating tens of thousands of US jobs. With the recent cancellations and doom and gloom reporting around it, these targets suddenly seemed incredibly unrealistic.

Source: US Department of Energy

Winds of change: governments respond to offshore wind industry's call for higher auction prices

The good news is that the outcome of these auctions has more or less acted as a wake-up call for governments. Developers had been lobbying hard with politicians and regulators to be able to fix long-term deals at prices that reflect the higher costs of construction and financing. Therefore, recent decisions both in the US and the UK to accept higher prices for offshore wind developments were a welcome sign that authorities are now starting to adjust to this new reality. In the UK for instance, the guaranteed price offered for offshore wind projects in its next renewables auction has been said to be increased by 66% (yes, that is sixty six percent). Nobody will argue that this is a step in the right direction, but it seems we are still lacking a broader sense of urgency. This has left the offshore wind industry at a critical juncture.

Let's remember that from 2015 to 2021, the average annual addition of offshore wind capacity outside China was only about 3 Gigawatts. By 2030, these additions are anticipated to increase tenfold, as per Wood Mackenzie, a global consultancy specializing in renewables, energy, and natural resources. They contend that realizing their projected 30 Gigawatts annually will be unrealistic without more immediate investment in the offshore wind supply chain.

Examining the European wind industry in the pursuit of EU's 2030 renewable energy goals

In what follows, we will zoom in specifically on the European wind industry as this is a good illustration of all the above. Wind energy is indeed pivotal to meeting the EU’s decarbonisation objectives and delivering clean, affordable and secure electricity. The EU target of at least 42.5% of renewables by 2030 (with an ambition to reach 45% renewables) will require installed capacity to grow massively from 204 Gigawatts in 2022 to more than 500 Gigawatts in 2030. Yet, the European wind industry has recently faced difficulties in operating its businesses. These include slow and complex permitting, lack of access to raw materials, uncertain demand, high inflation, increased pressure from international competitors and unsupportive design of national tenders. Because of these challenges, all largest European wind turbine manufacturers reported significant operating losses in 2022. And with only 16 Gigawatts of new wind projects installed last year, we are nowhere close to the 37 Gigawatts per year needed as a cost-effective contribution to achieve the EU 2030 targets.

The European Wind Power Action Plan: a strategic roadmap for accelerating the green transition in the EU

Therefore, the urgency for more immediate action prompted the announcement of a new European Wind Power Action Plan in October this year. The plan aims to bolster European companies in the wind sector and enhance their competitiveness. This support is crucial to ensure the European wind industry continues to be a major contributor to the green transition. The action plan is based on six primary pillars of coordinated action, a few of which we will discuss here.

To meet the goal of 37 Gigawatts per year, necessary for reaching the EU's 2030 renewable energy targets, the EU is prioritizing the digitalization of permitting processes. This move aims to increase predictability through long-term planning, pledges and faster permitting, next to support for the necessary build-out of electricity grids. Another pillar is around improved auction design. The EU wants to improve auctions with well-designed and ojective criteria which reward higher value-added equipment and ensure that projects are realised fully and on time.

Source: European Union

EU's strategy for investment, fair trade, and workforce development

To speed up investment and financing for wind energy manufacturing, the EU will also facilitate access to EU financing, notably through the Innovation Fund, while the European Investment Bank will make de-risking guarantees available. A fourth pillar focuses on a fair and competitive international environment. To ensure the wind sector can operate on a level playing field, the EU will closely monitor possible unfair trade practices which benefit foreign wind producers, and will continue to use trade agreements to facilitate access to foreign markets. Other pillars have to do with upskilling and reskilling workers, and finally industry engagement to improve the enabling conditions for the European wind industry to remain competitive.

Securing the future of offshore wind

In conclusion, governments globally have committed to offshore wind as an important pillar of decarbonisation and energy security. But recent struggles in the industry put these decarbonisation targets in doubt if change does not happen soon. With developers cancelling or delaying projects, these targets surely seem to be getting out of reach. Policymakers have an important role to play in this debate to chart a more sustainable path for offshore wind. The EU’s new wind power package is a good example of that. The EU is doubling down on its effort to the offshore renewables sector specifically, setting out additional actions to strengthen grid infrastructure, accelerate permitting, strengthen resilience of infrastructure, sustain research and innovation, and develop supply chains and skills. Its new action plan wants to ensure that the clean energy transition goes hand-in-hand with industrial competitiveness and that wind power continues to be a European success story.