Leona Tan Siew Hoon graduated from Indiana University Bloomington, US, majored in Finance and International Business. She started her career as an analyst in a financial-data company in the US. Upon her return to Singapore, she spent a few years in corporate finance before dedicating herself to working as an equity analyst at a brokerage firm in 2004. She joined a large Singaporean asset manager in 2007 and was involved in various roles such as portfolio manager for global and China-India equities funds. She joined Econopolis Singapore Pte Ltd in April 2017 and was responsible for stock selection in the emerging markets funds until 2023. Since then, she has been advising Econopolis on emerging market equity markets as an associate of Sunline (Singapore).

Rise of the “Nasdaq of the East” - Shanghai’s Star Board

Chinese regulators decided to launch a new Nasdaq-style Shanghai’s Star Board on 13 June 2019. Their vision is to make the Star Board a serious competitor to the Nasdaq - an attractive financing option for dynamic companies while offering investment opportunities. It wants to create a fundraising platform for promising technology firms in key fields such as chip making, artificial intelligence and biotechnology.

In the meantime, it is Beijing’s intent to be able to keep its best companies listed at home. China has produced some of the world’s largest technology companies, but they had initially chosen to list overseas. That was partly due to stringent profitability requirements at home and the brand credibility offered by markets such as New York or Hong Kong. The concept of the Star Board now has a big advocate in Chinese President Xi Jinping, whose goal is to spur a new burst of economic growth in his country and to make China a global technology leader. The aim is to go far beyond its current role as a low-cost manufacturing and assembly venue for foreign tech firms.

The launch of Star Board represents the start of China’s long-anticipated stock market reforms. The Star Board was designed to be very different from other onshore bourses. It runs a standard registration-based IPO system. The listing reviews are carried out very publicly and transparently with information such as the number of customers a company claims to have; its stated revenues and profits (or losses) and R&D spend; every inquiry from the regulator and each reply from the firm and its sponsors: it is all there for everyone to see. The intent is to create a high degree of transparency. The Star Board has adopted a more market-driven approach by utilizing a market-based underwriting mechanism, which is standard elsewhere but new to China. It allows the size and speed of an issuance to be set by the market, with institutional investors playing a far greater role in pricing. It waives the requirement that companies are profitable, which Shanghai’s main board still insists upon for new issuers. Firms with dual-class share structures are allowed. The less restrictive regulatory process is meant to facilitate the fast-tracking of Chinese technology start-ups to an IPO by lowering the entry barrier.

In past years, successful Chinese technology giants often pursued IPOs in New York, occasionally accompanied by a dual-listing in Hong Kong. Now, Shanghai’s Star Board has been growing in profile as more Chinese tech firms/start-ups view it as the preferred destination for listing. Semiconductor Manufacturing International Corporation (SMIC), the mainland’s dominant semiconductor foundry and a rival to Taiwan Semiconductor Manufacturing Company (TSMC), debuted on the Star Board and raised 20 billion yuan ($2.8 billion). It was a secondary listing for SMIC, which dual-listed on New York and Hong Kong stock exchanges in 2004, but delisted from Nasdaq last year.

Ant’s choice on Star Board is a demonstration of Star Board’s attraction and global competitiveness as the “first choice” for innovative technology companies in China for IPOs. JD Digits (formerly known as JD Finance), the financial technology arm of e-commerce giant JD.com, is also preparing for its IPO on Star Board. In addition to Chinese firms, some international companies are also considering this board to expand their presence in the Chinese market. AMC Research (NASDAQ: ACMR), a California-based company in the semiconductor industry, has revealed that following the acquisition of land for their Shanghai headquarters, the company will submit an application for an IPO on the Star Board this mid-year.

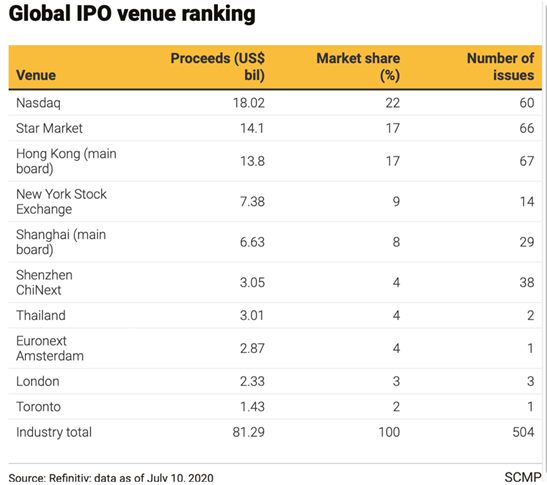

So far, the Star Board has been a resounding success during its first year of existence. The 133 companies listed on Star board have surged 201% on average from their IPO levels based on 21 July 2020 closing prices, according to data from Sina Finance. The NYSE FANG+ Index, which tracks 10 stocks including Facebook, Apple, Amazon, Netflix and Google, has advanced about 80% since a year ago. The Star Board has also done more IPOs and raised more capital than any other Chinese exchange – including Hong Kong. China’s two main growth markets, Shenzhen’s ChiNext and Hong Kong’s GEM, are also trailing in its wake. The Star Board saw proceeds raised from IPOs and second listings this year climb to $14.1 billion through 66 deals, a close second to Nasdaq but way ahead of New York Stock Exchange, Refinitiv data shows.

For equity investors, these reforms result in a larger investable universe. It will not only attract more global investors into the onshore market but also provide more investment options for onshore institutional investors such as the pension funds and asset managers, to diversify their investments for a better risk-return profile. China boasts the world’s second-largest equity market, just behind the U.S. More foreign capital is expected to flow into mainland Chinese stocks with their inclusion in major investment indexes. For global investors keen to put their money to work in good mainland stocks and in a venue they can trust, the new bourse should be able to go toe to toe with Hong Kong on a global footing.

READ THE PREVIOUS ARTICLE IN THIS SERIES: