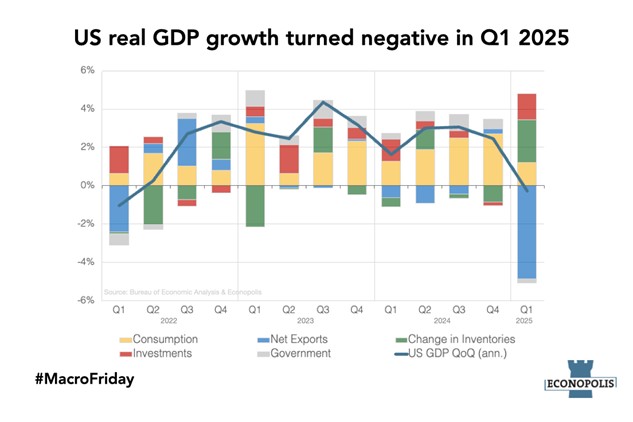

US Real GDP Growth Turned Negative in Q1 2025

Although real GDP Growth declined by an annualized -0,3% in Q1, the first quarterly contraction in three years, this reveals very little about the current state of the US economy or what lies ahead.

A deeper dive into the data uncovers major shifts beneath the surface. Consumer spending, the primary growth driver over the past two years, made its smallest contribution in this quarter. This could signal mounting spending constraints among U.S. households as consument sentiment tumbles. Meanwhile, private investment surged, but government spending declined, adding to the mixed picture.

As highlighted in previous MacroFridays, U.S. imports soared in Q1 as companies rushed to stockpile goods on American soil in anticipation of the Trump tariffs. According to the Bureau of Economic Analysis (BEA), imports rose sharply in both consumer goods (especially medicinal and pharmaceutical products) and capital goods (notably computers and peripherals). As a result, net exports (exports minus imports) made a significantly negative contribution to GDP growth in the quarter.

Furthermore, this data release showed a quarter-over-quarter increase in the PCE price index to 3,6%. This shows that inflationnary pressures for consumers were already intensifying in Q1.

Although Q1 ended just a month ago, it feels like ages ago given the rapidly changing economic environment. While the Q1 GDP data offers valuable insights, it may not accurately reflect the current state of the economy. For instance, the April release of the Conference Board’s Consumer Confidence Index showed a sharp decline in sentiment, suggesting weaker consumer spending. As the backbone of U.S. economic growth over the past two years begins to slow, this points to a cloudy outlook for the coming quarters.

comments powered by Disqus