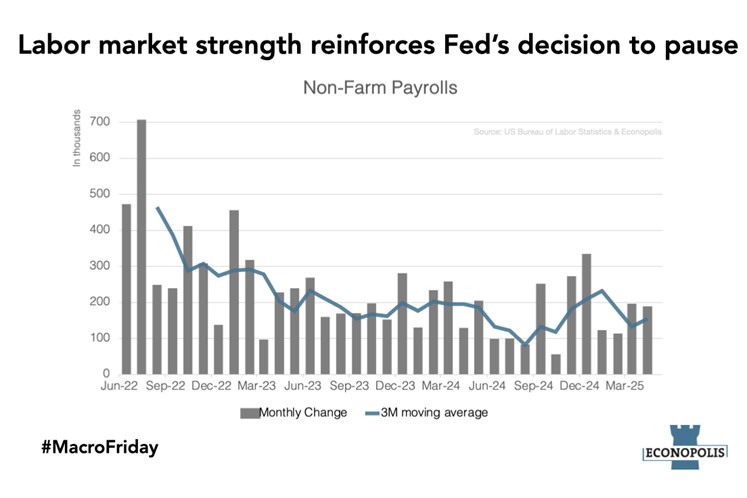

#MacroFriday: Labor market strength reinforces Fed's decision to pause

Defying pressures from President Trump to cut interest rates, the Federal Reserve decided to keep its policy rate unchanged on Wednesday. A robust Non-Farm Payrolls report helped tip the scales in favor of this decision. However, placing too much emphasis on the labor market could prove risky.

While the Fed left interest rates unchanged for now, Fed Chair Jerome Powell highlighted growing concerns around both elements of the Fed’s dual mandate: inflation and employment. Inflation risks appear to be mounting as consumer expectations surge, driven by renewed tariff fears. Meanwhile, April’s PMI data showed rising input and output prices for businesses, which are likely to be passed on to consumers.

Perhaps more unexpected was the Fed’s acknowledgment of emerging risks to employment. While the unemployment rate in April remained low at 4.2%, the central bank now sees an increased probability of a rise. It should be noted that the labour market is a lagging economic indicator.

This divergence in signals, rising inflation expectations alongside potential softness in employment, complicates the Fed’s policy path. Each requires a different policy response, which is why the Fed is taking a cautious, wait-and-see approach.

Soft survey data is painting a bleaker picture of the economy, but this has yet to be confirmed by hard economic indicators. Powell described recent data as solid but acknowledged growing uncertainty. The Fed appears unwilling to act decisively until signs of real weakness materialize in hard economic metrics. The risk is that relying too heavily on lagging indicators like job data, it could risk leave monetary policy behind the curve.

comments powered by Disqus