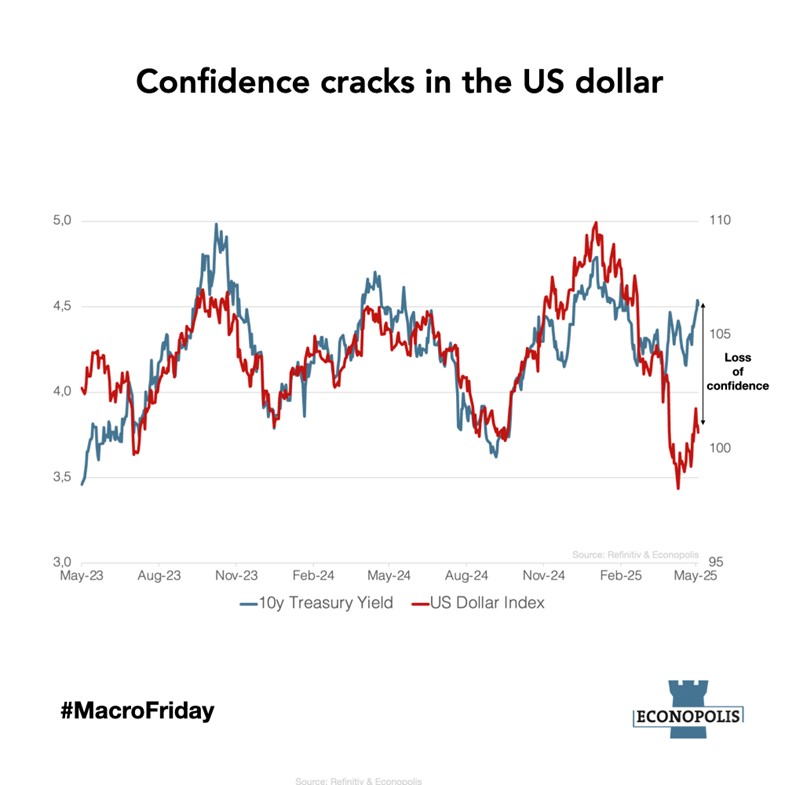

#MacroFriday: Confidence cracks in the US dollar

Since Liberation Day, equity markets have recovered much of their earlier losses, and credit spreads have narrowed to levels even tighter than those observed before April 2nd. However, this optimism hasn’t extended to long-term U.S. Treasuries or the U.S. dollar, both of which remain significantly weaker. This is a strong indication that financial markets are losing confidence in the U.S. government's (fiscal) credibility.

After briefly declining following April 2nd, the yield on 10-year U.S. government bonds surged from 3.8% to 4.5% in under a week. Normally, such a sharp move would coincide with a stronger dollar, yet the opposite occurred. The trade-weighted U.S. dollar has fallen more than 3% since Liberation Day and over 7% since the start of the year. Historically seen as a safe haven during turbulent periods, the recent depreciation of the dollar underscores a growing skepticism about the notion of U.S. exceptionalism.

At the same time, the U.S. fiscal position continues to deteriorate. The federal budget deficit currently exceeds 6% of GDP, and the outlook is set to worsen. This deficit needs to be financed by investors as cuts in spending remain absent. The likely extension of the Tax Cuts and Jobs Act (TCJA) and the refinancing of maturing debt at higher interest rates will further strain public finances. Alarmingly, approximately a quarter of the total federal debt of $ 36 trillion needs be refinanced between now and the end of 2026. In 2024, interest payments on the national debt have already surpassed defense spending.

To sustain its mounting debt obligations, the U.S. government is heavily reliant on the dollar’s status as the global reserve currency. Yet, growing policy uncertainty is prompting investors to question the durability of this privilege. If current trends continue, U.S. debt-to-GDP is projected to hit 200% by 2050. Current policy measures could accelerate the decline of U.S. dollar dominance on the world stage.

comments powered by Disqus