Leona Tan Siew Hoon graduated from Indiana University Bloomington, US, majored in Finance and International Business. She started her career as an analyst in a financial-data company in the US. Upon her return to Singapore, she spent a few years in corporate finance before dedicating herself to working as an equity analyst at a brokerage firm in 2004. She joined a large Singaporean asset manager in 2007 and was involved in various roles such as portfolio manager for global and China-India equities funds. She joined Econopolis Singapore Pte Ltd in April 2017 and was responsible for stock selection in the emerging markets funds until 2023. Since then, she has been advising Econopolis on emerging market equity markets as an associate of Sunline (Singapore).

Chinese New Year: The Year of The Metal Ox… A New Bull Market?

Chinese New Year, also known as Lunar New Year, begins celebrations on the eve starting from February 11th, 2021 and lasts until February 26th, 2021. According to the Chinese zodiac, 2021 is a Metal Ox year. The most iconic sculpture of a Metal Ox is the Charging Bull on Wall Street, a bronze sculpture right in Manhattan’s Financial District. The Ox occupies the second position in the 12-year cycle of the Chinese zodiac and the reason for its placing can be found in a well-known story, The Great Race Story of the Chinese Zodiac.

The Great Race Story of the Chinese Zodiac

According to Chinese folklore, The Jade Emperor (The Emperor in Heaven) decreed that all animals would be designated as calendar signs and the order of the zodiac cycle would be decided in a race requiring them to cross a river. The Cat and the Rat, being the best of friends, hatched a plan to ride the Ox (which denotes diligence and steadfastness) to cross a river. But as the Ox started crossing, the Rat jolted forward, throwing the Cat into the water. The Rat did not bother to check on his friend, instead jumping down ahead of the Ox at the finishing line and taking first place in the zodiac pecking order - Rat, Ox, Tiger, Rabbit, Dragon, Snake, Horse, Sheep, Monkey, Rooster, Dog, Pig.

The Rat, the Ox and Financial Markets

This story is said to explain the poor relationship between the two animals ever since, as well as why the Cat never became one of the 12 zodiac animals. Perhaps it also points to some of the negative traits associated with the Rat.

Did you know that the last Year of the Earth Rat was in 2008? Few will remember it fondly, given that it coincided with the Global Financial Crisis. However, I doubt anyone will forget the soon-to-be ending Year of the Metal Rat which saw the global COVID-19 pandemic bring great anxiety and upheaval to everyone’s lives! Worldwide, the disease has infected more than 100 million people as of February 1st, 2021, including 2,222,647 deaths.

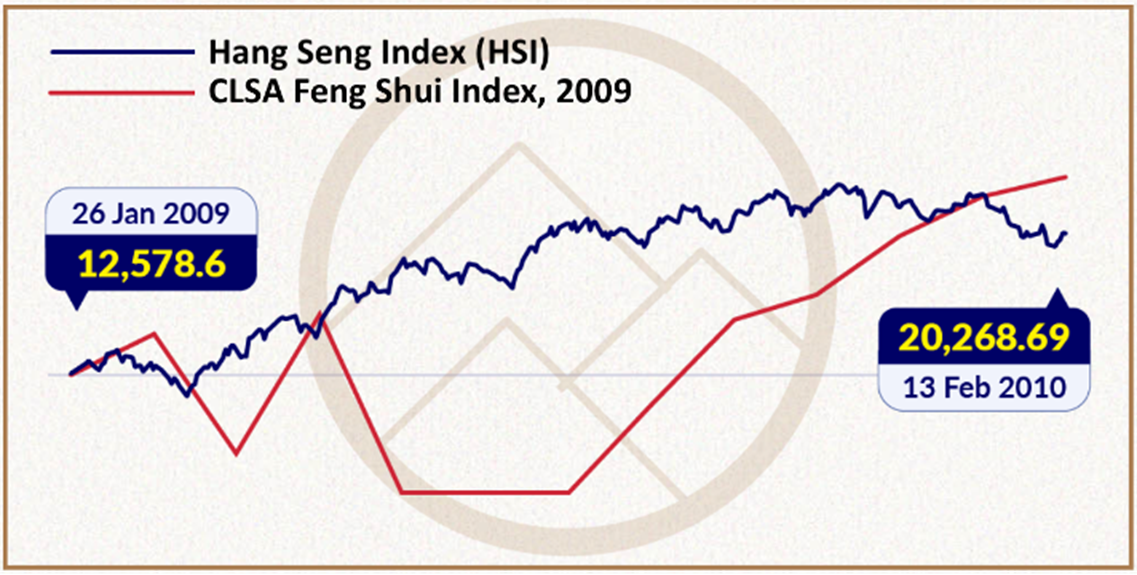

You will be glad to know that in 2009, the Earth Ox led the financial market up a meandering but steady cow path out of the Global Financial Crisis. Interestingly, one of the brokers we work with in Asia, CLSA, cleverly predicted the upward moves of the stock market in 2009 in their annual Feng Shui Guide (see chart below).

Welcoming the Year of the Metal Ox

In Chinese belief, the Ox is considered an animal of strength that is associated with harvest and fertility. So, what can we expect from the Year of the Metal Ox in 2021?

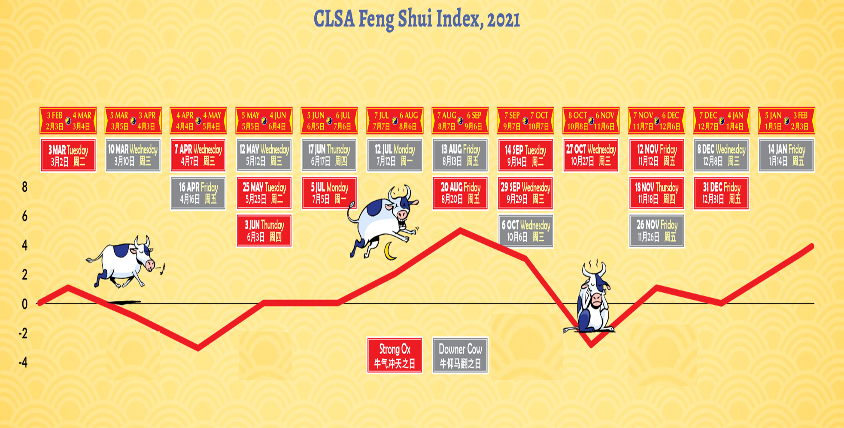

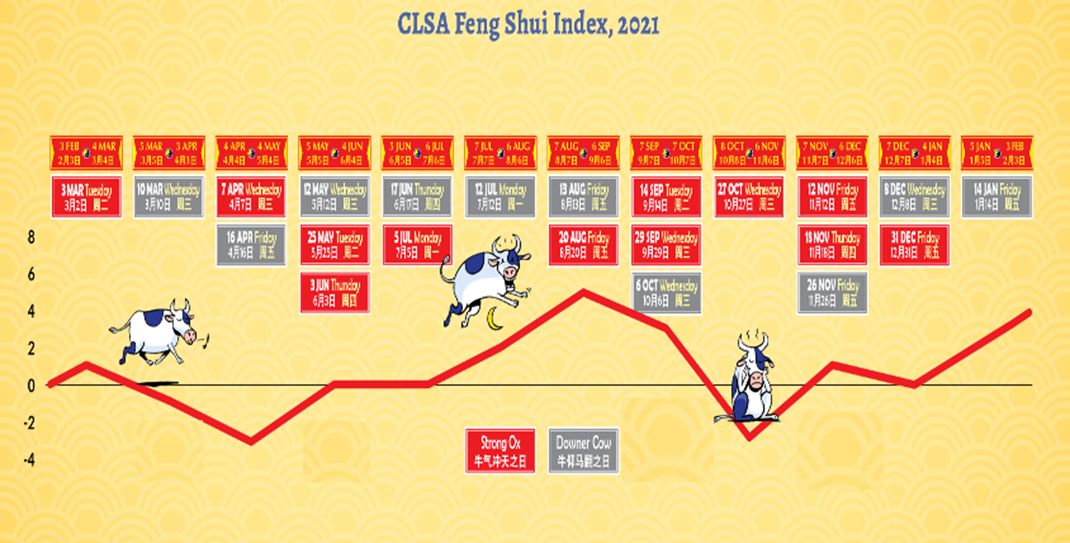

For those who follow Feng Shui, the close of the tragic and tumultuous Year of the Metal Rat is fast approaching, too. This faithful Metal Ox will help pull our way out of the slump once again. Summer and winter are the best periods, with gains and losses in other months. More for pleasure than profit, the CLSA 27th Feng Shui Guide (meant to be taken with a pinch of salt) predicts the year should start well, as the industrious Rat's hard work will carry over into the Ox year. It will be sometime in March before everyone realizes the Ox has been sleeping on the job. In the late spring, these two zodiacs will resolve their issues and the Ox will rouse itself and get to work. During summer, the living is more than easy, and the Ox will plough through financial fields day and night. They expect this rally to peak around August, and the autumn harvest will see profit-taking as well as a short, sharp decline caused by the conflict between two of the twelve earthly branches. After a modest drop, the remainder of the year will see a slow recovery and then a strong final push through winter’s end.

Econopolis’ take on 2021 is that, with the arrival of the vaccines, we can expect further economic recovery to take place. The past few months have also provided positive signals in this context, given that most of the macro-economic data published were generally better than expected, with almost all indicators offering a positive outlook across the global equities market. Positive elements such as US President Biden’s plan on the coronavirus and climate change, further fiscal and monetary policy for more stimulus, and improving earnings should accelerate the recovery in the second half. But this recovery is presently fragile and very unevenly distributed as some countries still face renewed lockdowns and uncertainties in vaccine rollouts. Till date, 10 Covid-19 vaccines have received authorization and 71 million doses have been administered worldwide. Europe’s economy is seen as lagging the US, China and parts of Asia on this pandemic recovery. With low rates and tight spreads, equities would be the place investors go looking for yields. We foresee finished goods prices accelerating in 2021 due to higher commodity prices in the second half of 2020 as the global economy rebounds and remaining supply-chain disruptions slowly get resolved. Attention from investors and policymakers are likely to shift from COVID-19 towards environment-related issues in 2021. An important trend to note is the rise in ESG (Environmental, Social and Corporate Governance) and Climate policy. Emphasis on ESG and Climate will exacerbate the financing difficulties of energy and some commodity producers. Technology lies at the heart of those attempts to prevent, or even reverse, global warming as intelligent products, new applications of existing technology or even entirely new business models are emerging to increase energy efficiency, reduce overall energy consumption or expand the use of renewable energies.

All in all, it appears likely to be a welcoming year of the Metal Ox for investors, we are hopeful that the Ox will lead us steadfastly on a path to recovery. In any case, we hope the worst is behind us and wish for a good harvest at the end of the Lunar year. With the Chinese New Year of Ox arriving next week, Econopolis wishes all of you a prosperous, joyful and healthy new year!!