Leona Tan Siew Hoon graduated from Indiana University Bloomington, US, majored in Finance and International Business. She started her career as an analyst in a financial-data company in the US. Upon her return to Singapore, she spent a few years in corporate finance before dedicating herself to working as an equity analyst at a brokerage firm in 2004. She joined a large Singaporean asset manager in 2007 and was involved in various roles such as portfolio manager for global and China-India equities funds. She joined Econopolis Singapore Pte Ltd in April 2017 and was responsible for stock selection in the emerging markets funds until 2023. Since then, she has been advising Econopolis on emerging market equity markets as an associate of Sunline (Singapore).

Why investors shouldn’t overreact to China’s market rout

There has been a series of regulatory changes in China since 2019, mainly taking place in new economy sectors, first with gaming, then fintech, and now private education. On July 23, Beijing announced new rules barring for-profit tutoring in core school subjects to ease financial pressure on families.

Under the new rules, all institutions offering tutoring on the school curriculum will be registered as non-profit organizations, and no new licenses will be granted, according to an official document.

This triggered a massive sell-off in China’s education stocks (including US-listed New Oriental Education & Technology Group, TAL Education Group, Gaotu Techedu, Koolearn Technology and Youdao), of which we have no exposure to within our investment strategies.

These regulatory measures have had a major impact on the equity market especially for the affected industries, though the short-term macro impact has remained limited.

Regulatory crackdown in China has always been a key risk to contend with. At high levels, regulatory clampdown is related to the long-term development agenda that benefits the long-term macro of the world’s second-largest economy. Overall, regulatory risk has always been present since the past decade which began initially with anti-corruption campaigns, followed by the new cybersecurity law, then the anti-competitive and antitrust practices, and currently the most extreme clampdown in the private education sector that regulators blame for exacerbating inequality.

However, not all regulatory changes are risks, noting that Chinese authorities have in some ways made it easier for companies and investors to access capital markets in recent years through the capital market developments. Thus, the importance of tracking the Chinese government’s shifting priorities is crucial for investment, as China’s long-term agenda is to develop into a modernized socialist economy and achieve the nation’s rejuvenation by the middle of this century.

Strong fundamentals

Despite the string of regulatory changes and clampdown in China during the past decade, the MSCI China Index 10-year annualized return has been 7.9%.

Relative to equity markets in other regions, there is no doubt that Chinese equity markets are on a much better footing presently. Growth remains strong and valuations are attractive. The World Bank forecasts China’s GDP to grow 8.5% in 2021, leading world economic recovery. China has so far achieved better control of COVID-19 (even as the Delta variant has prompted a new wave in early April this year) than many other economies. China’s economy grew by 7.9% in the second quarter of this year compared with a year earlier to post a 12.7% growth in the first half of the year. This is fueled by consistent domestic demand and a mature digital economy.

China has roughly 940 million internet users, nearly all of whom own smartphones. This has led to China’s digital economy making up nearly 40% of the country’s GDP in 2020, up 2.4 percentage points from 2019. This segment of the economy includes electronics manufacturing, telecommunications, internet and software services, as well as the value-added from the application of digital technologies in traditional businesses which amounted to 39.2 trillion yuan (US$6 trillion) last year, an increase of 3.3 trillion yuan from 2019, according to a source published by the China Academy of Information and Communication Technology (CAICT).

For this reason, global investors should definitely consider the opportunities relating to China, in particular in areas such as high-tech innovation. A so-called fourth industrial revolution is presently under way in areas like artificial intelligence (AI), big data, fifth-generation telecommunications networking (5G), nanotechnology, biotechnology, robotics, the Internet of Things (IoT), and quantum computing. One of Beijing’s objectives is to raise the domestic content of core components and materials in high-tech manufacturing to 70% by 2025. In addition, China is the world leader in patent applications with 40% of the global total, a share more than two times larger than that of the US and four times larger than that of Japan. Although there are risks brought on by uncertainties caused by the regulation, Beijing’s push to become a leader in tech, is undeniable. In tandem with this initiative, Chinese tech giants and start-ups have demonstrated they can be leading innovators both globally and domestically. Overall, authorities in Beijing are unlikely to undermine some of the country’s biggest corporate success stories if its long-term agenda receives higher priority. They will be 1) common prosperity, 2) innovations and independence in key and foundational technologies and 3) green development. On one hand, Beijing is concerned about four pillars of stability, namely 1) banking, 2) anti-trust regulation, 3) data security and 4) social equality.

Investors should also take notice of the increasing investment in the long-term growth of decarbonization-related sectors such as electric vehicles and renewable energy in China as major supportive policies were announced by Beijing last year after it set an ambitious 2060 carbon neutrality target.

In addition, COVID-19 has sped up the adoption of digital technologies by several years as well as sharpened the focus on climate change in China- and many of these changes could be here for the long haul.

Impact on Emerging Markets (EM) and on Econopolis’ EM strategy

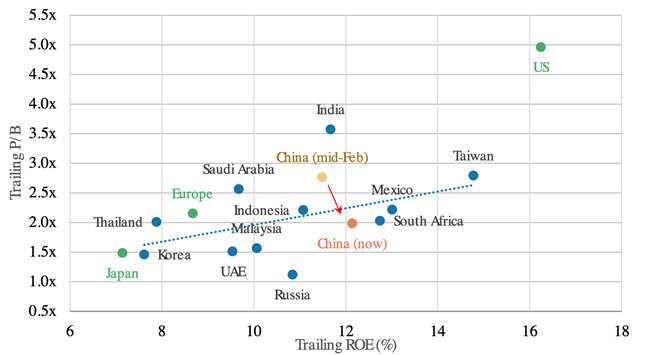

The MSCI China Index as the gauge has dropped more than 25% from this year’s peak and is now trading at about 1.3 times book value, the biggest valuation discount on record relative to global peers (see below graph).

Including the market rout in previous weeks, the MSCI China Index is down almost 10% YTD in EUR, while the MSCI Emerging Markets Index is still up since the beginning of the year.

At Econopolis, we have a relatively high-conviction, bottom-up stockpicking approach in our Emerging Market strategy, but we also have a top-down layer on top of it to determine in which regions and countries to invest or not. Today the preference is clearly tilted towards Asia. The vast majority of the stocks we hold are considered high-quality blue-chip investments that have a strong competitive position and high market share (i.e. semiconductor companies in South Korea and Taiwan). Our EM strategy also focusses on a handful of stocks that have been hand-picked to ride the rise of emerging markets’ middle class in areas such as digital lifestyle which includes commerce and gaming, healthcare & beauty, and sportswear. Therefore, we do have some diversification across Latin American and EMEA regions as well. In addition, the strategy is geared towards a long-term growth theme in high-tech (5G, AI, IoT), disruptive innovation (EV supply chain) and sustainable development (renewable energy).