#MacroFriday: My Precious... Metals

In The Lord of the Rings, tGollum famously called the engraved golden ring “my precious”. These days, plenty of jewellery owners might catch themselves saying the same, given how sharply precious metal prices have risen. Fortunately for Gollum, this ring did not contain a natural diamond.

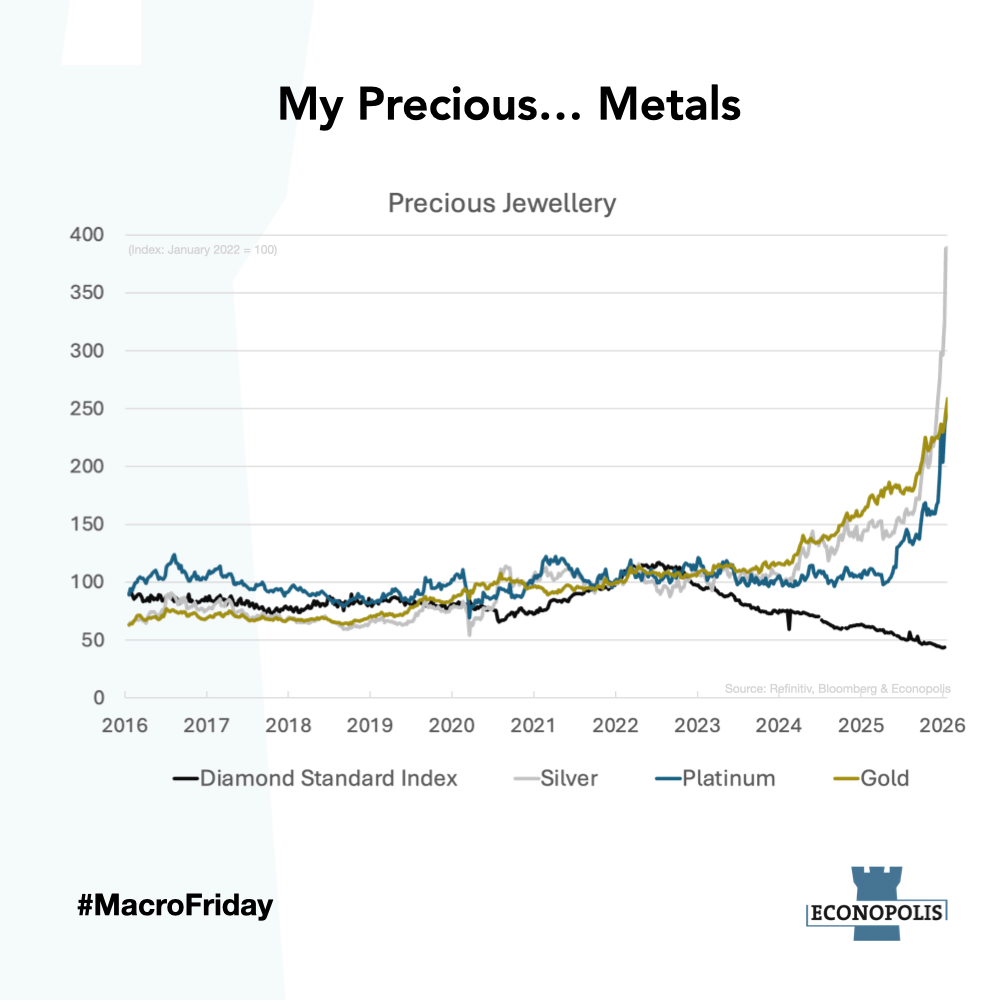

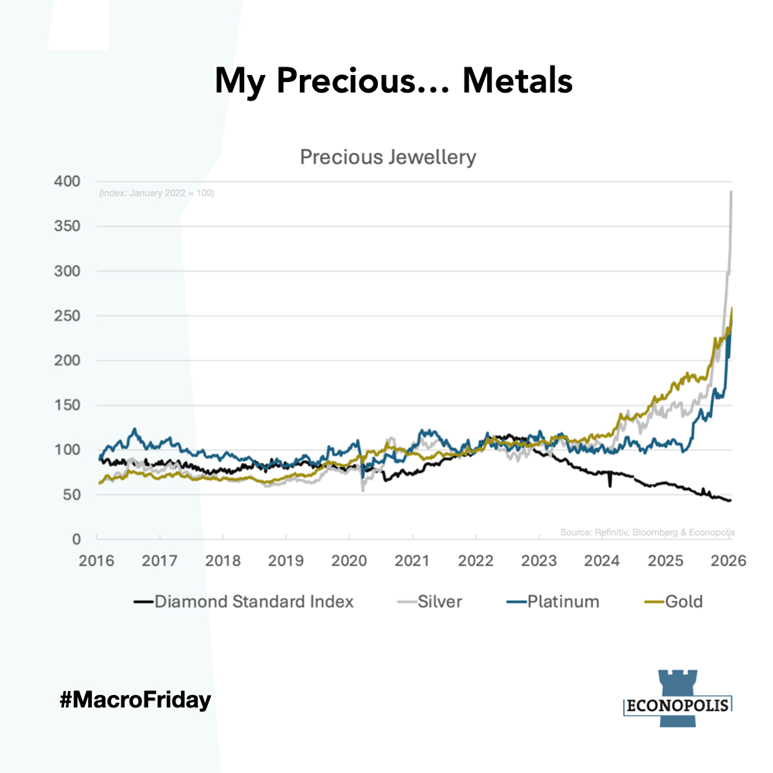

Our clients who have read our 2025 Q4 Econoviews have seen this graph recently. But an updated version is clearly needed, given the continuation of the astonishing rally in precious metal prices over the past couple of weeks. The prices of these precious metals have surged explosively in recent years. Inflation, cracks in the dollar’s dominance, and geopolitical uncertainty have prompted investors to fall back on hard, physical assets and commodities. Purchases by central banks, especially since 2022, following Western monetary sanctions against Russia, have been a catalyst and have led to the more than doubling of the gold price. Silver has shown an even more explosive price increase in recent months, as speculation has driven up demand, while platinum has caught up with gold’s price rise in barely eight months.

These precious metals are vital raw materials for jewellery, so these price increases are also pushing up jewellery prices. Weaker demand for natural diamonds, combined with the rise of lab-grown alternatives, has more than halved diamond prices in only three years. That sharp decline stands in stark contrast to the strong rise in precious metals. Diamonds may be a girl’s best friend, yet they’ve lost a bit of sparkle next to the dazzling rally in precious metals.