#MacroFriday: De-Dollarization: US Dollar Dominance Fades Slowly

De-dollarization is less new and less outspoken than headlines make you believe

On Wednesday, our founder and Chief Economist Geert Noels appeared on Terzake to discuss the continued decline of the US dollar and the concept of De-dollarization. This means a structural shift in the reserve currency status of the US dollar and its fading dominance in global transactions and trade.

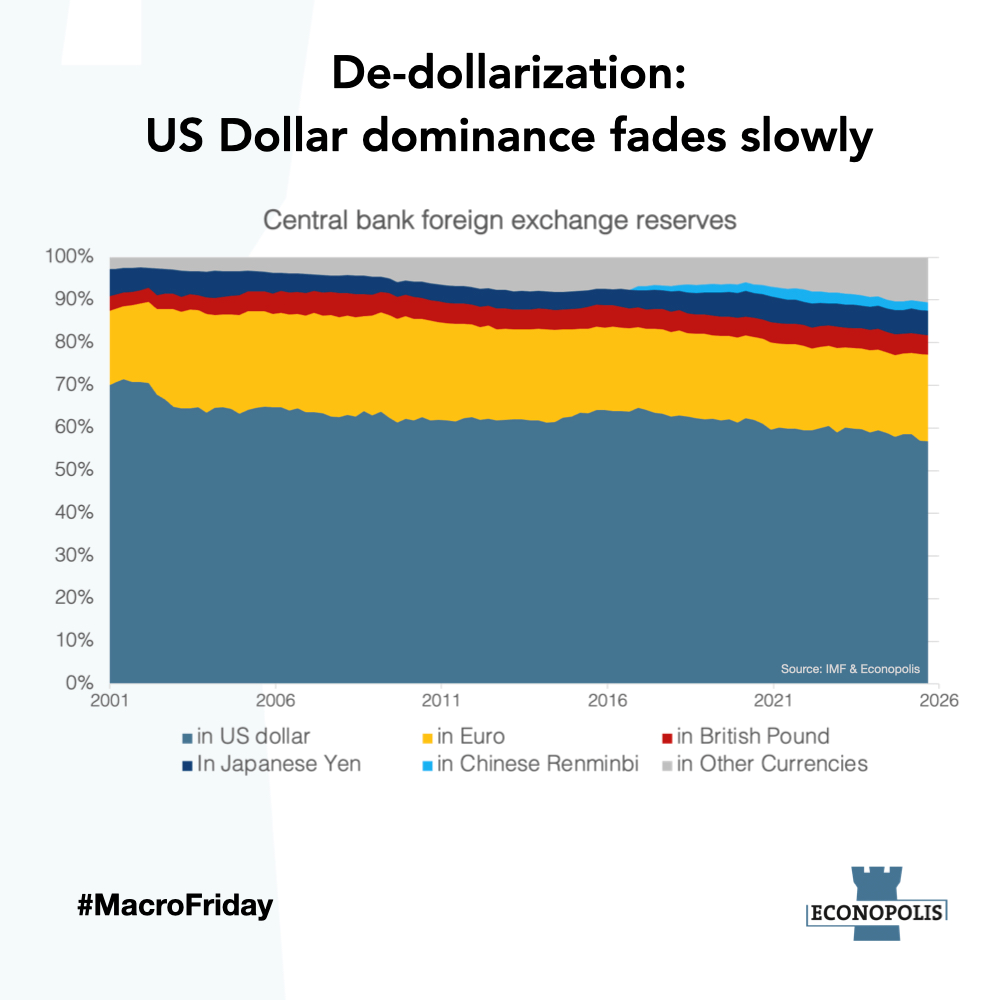

Still, we have to be careful interpreting this concept, as the US dollar remains by far the most dominant currency in global trade and forex transactions, appearing one of the sides of transaction. Of course, as some economies have grown faster than the US economy in recent decades, their currencies have gained influence, but no other currency comes close. To assess reserve currency status, we look at central bank foreign exchange reserves. Global central bank foreign exchange reserves are currently held for 77% in two (Western) currencies, the US dollar and the euro. Again, the weigth of the US dollar is heavily dominant at 56,9%. While the share of the euro has remained quite stable over the years at around 20%, the US dollar’s weight in the reserves has been slowly decreasing. This was particularly visible in the first three quarters of 2025, when the share of the USD in global central bank foreign exchange reserves fell by 1,5%. The drop in the USD exchange rate likely played its role. However, the absolute value of the US dollar in these reserves still continued to rise, even in 2025, from $ 7.215 billion to $ 7.414 billion in Q3.

Let’s bring last week’s topic back to this table. The weaponization of Western currencies in 2022, as sanctions prevented Russia to change its rubles to USD or EUR or vice versa, made the alarm bells ring at central banks holding most of their reserves in these two currencies. It is no surprise that gold kicked off its rally back then, and it clearly impacted central bank reserves holdings, both in volumes through above-trend gold buying by central banks and in value through rising prices. If we take the indicative central bank gold holdings in Q3 and revalue at today’s price, gold now accounts for 31% of the central bank reserves. This was only 18% in the beginning of 2025 and 12% at the start of 2022. Over this period, the importance of the US dollar fell from 52% to 39%. Gold overtook the euro as its second most important reserve asset in 2024, and is now starting to challenge the USD.