Senior Economic Consultant at Ortelius

Beyond the North Sea Summit: A Roadmap to Affordable Energy for Europe

At the North Sea Summit in Hamburg, European leaders sent a strong and necessary signal. By announcing a €1 trillion investment trajectory in offshore wind, grids and related infrastructure across the North Sea, Europe is betting on scale, cooperation and predictability to deliver clean and affordable energy.

This matters. The North Sea Summit is not just about climate ambition; it is about competitiveness. In a world where energy prices increasingly determine where industry invests, this commitment lays the groundwork for structurally lower electricity prices in the coming decade.

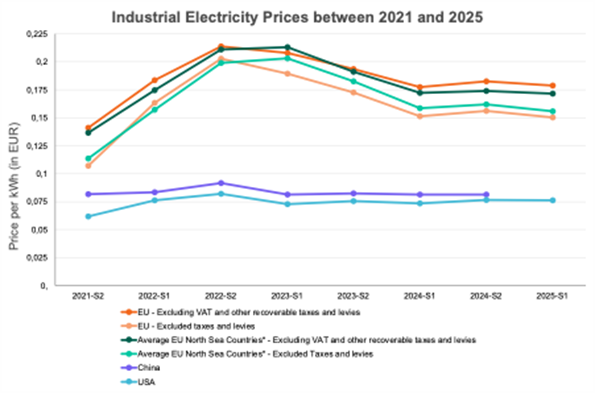

Yet Europe’s energy price problem is not a future risk, it is a present reality. European companies still face electricity prices that are higher and more volatile than those in the United States and China. Without complementary action in the short and long term, the promise of the North Sea risks arriving too late for parts of Europe’s industrial base.

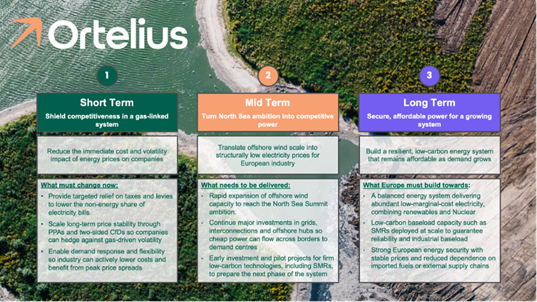

Short term: reduce the cost impact of a gas-linked power system

Europe has successfully reduced its dependence on Russian gas since the war in Ukraine. But this has not fundamentally reduced gas usage in the energy system. Instead, Russian pipeline gas has largely been replaced by imported LNG, much of it from the United States.

Because gas-fired power plants still play a pivotal role in balancing electricity systems, they frequently remain the marginal units that set power prices. As a result, electricity prices remain strongly coupled to imported gas prices, exposing European companies to volatility and uncertainty that their competitors in the US and China largely do not face.

This structural dependency cannot be removed overnight. In the short term, the focus should therefore be pragmatic: reduce avoidable cost components and give companies the tools to actively manage their own price exposure.

Beyond this, the biggest gains come from structural market solutions that improve price stability.

For industries with relatively inflexible consumption profiles, long-term contracting mechanisms such as Power Purchase Agreements and two-sided Contracts for Difference are essential. These instruments allow companies to secure predictable prices over 10–15 years and reduce their dependence on volatile spot markets. To make them work at scale, barriers must be lowered: contracts need to be standardised, smaller and mid-sized firms need better access to credit guarantees, and regulatory uncertainty around accounting and state-aid rules must be minimised. Without this, only large multinationals can benefit, while much of Europe’s industrial base remains exposed.

For industries that can adapt their processes, demand response and flexibility offer an equally powerful lever. Load shifting, on-site storage, and smart energy management can significantly reduce exposure to peak prices and even create new revenue streams. Yet today participation in flexibility markets is often complex, fragmented across TSOs and DSOs, and insufficiently remunerated. Simplifying prequalification rules, enabling aggregation, and properly valuing flexibility services would allow companies to actively monetise their flexibility while lowering overall system costs.

Crucially, these reforms cannot wait for the next decade. If Europe wants to safeguard industrial competitiveness, long-term contracting and flexibility markets must become mainstream before 2030, when many investment and relocation decisions for energy-intensive industries will already have been made. The short-term agenda is therefore not primarily about subsidies, but about making markets work better now: enabling price certainty where demand is inflexible, and rewarding flexibility where demand can adapt.

Mid term: make the North Sea work for Europe’s industry

The North Sea Summit is where Europe’s mid-term solution takes shape. Offshore wind in the North Sea has the potential to deliver some of the cheapest large-scale electricity in the world. By committing to large-scale deployment and coordinated investment, European governments are sending a clear signal that clean energy should also mean affordable energy.

The ambition is explicit: to reduce offshore wind energy costs by around 30% by 2040 and increase offshore wind capacity to 300 gigawatts by 2050. At that scale, offshore wind is not only a climate project, but a competitiveness strategy. Structurally cheaper electricity is one of the strongest levers Europe has to keep industry, investment and innovation on the continent.

That investment signal therefore matters beyond generation capacity alone. Long-term visibility and predictable demand give developers, investors and industrial consumers the confidence to commit capital in Europe rather than elsewhere. Without that certainty, both energy projects and industrial activity risk moving to regions with lower and more stable energy costs.

But building cheap generation is only half the story. Europe will only benefit if that low-cost power can reach demand.

Grid integration and a more unified electricity market are therefore essential complements to offshore expansion. Cross-border interconnections, hybrid offshore hubs and deeper market coupling ensure that wind power flows across Europe, instead of remaining concentrated in coastal regions. Without stronger connections, Europe risks building vast renewable capacity without fully capturing the price benefits.