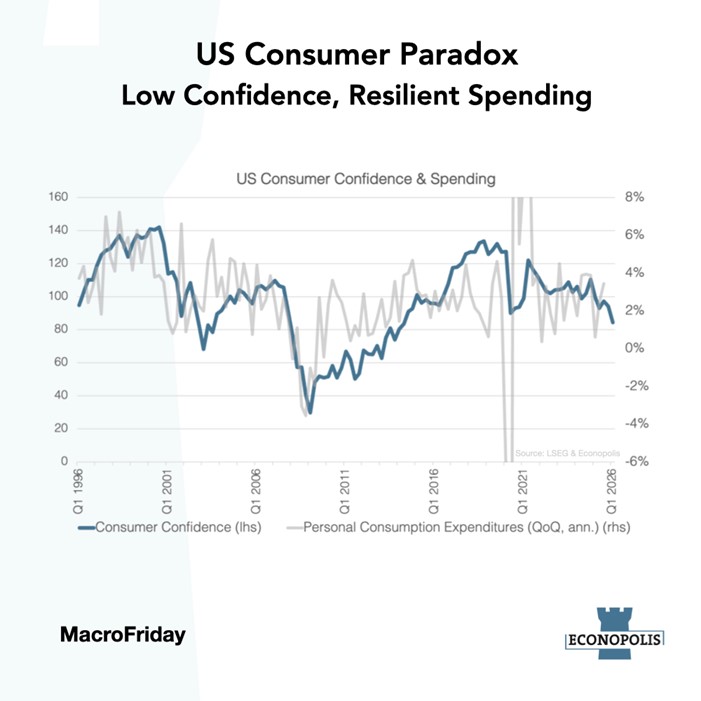

#MacroFriday: US Consumer Paradox Low Confidence, Resilient Spending

The Conference Board’s consumer confidence indicator fell to its lowest level since 2014 in January. Meanwhile, consumer spending has been quite resilient. This paradox reflects another K-shape in the US economy.

US consumer confidence has deteriorated markedly in recent months, with the Conference Board’s measure sliding to its weakest level in more than 12 years. This reflects a sour mix of elevated price levels and unease about the labor market outlook. The expectations measure also collapsed in January, well below the threshold of 80 that usually signals a recession ahead. Meanwhile, recent consumer expenditure releases still show household outlays holding up better than the mood suggests, with consumption growth remaining broadly resilient rather than collapsing alongside confidence. Yes, December’s retail sales stalled unexpectedly, but they remained strong in previous months and quarters.

Previously, we discussed the K-shape in different aspects of the economy. This K-shape emerges in consumer confidence and spending data too. There is a notable difference in sentiment between higher-income households and median- or lower-income households. Supported by gains in asset prices and strong financial markets, which are more likely to benefit higher-income households, these high earners continue to spend from a position of strength, while lower-income households feel the squeeze. The Federal Reserve Bank of Dallas calculated that the highest quintile of earners accounted for 57% of overall consumption on average from 2020 through the second quarter of 2025. This highlights the importance of high-income households in ‘hard’ consumption data.

For US growth, solid spending data can keep near-term GDP supported as long as upper-income households remain willing and able to spend. But this dynamic also makes the expansion more vulnerable: if labor-market cooling broadens to higher incomes or asset prices wobble, the support from spending could weaken quickly.