Bernard Thant graduated as master in Commercial Sciences at EHSAL (now known as Hogeschool-Universiteit Brussel). Afterwards he completed a one-year postgraduate in Finance and Investment Management. After his studies he joined Société Générale Private Banking Belgium (previously Bank De Maertelaere) where he worked for most of his career as a financial analyst. During that time, he also acted as portfolio manager equities at the same company for a number of years. Bernard joined the Econopolis Wealth Management team in September 2014 as an equity analyst.

Hearing Aids: Appealing Long Term Market Potential

The hearing aids industry is attractive given secular growth drivers. Although the market environment is challenging in the short term, the market should eventually return to its historical growth pattern. There are several investment options for investors looking to get exposure to the theme.

Megatrends …

Ageing populations, more active seniors, reduced stigma, improved access, consumerisation of healthcare and health beyond hearing (hearing aids helping to threat other medical conditions) are all megatrends piloting the hearing aids industry. Today, people live around 34 years longer than four generations ago. In 2023-2030, the number of people over 65 years is expected to grow by 21% in North America, by 14% in Europe and 27% in China. There is significant penetration potential in mild and moderate hearing loss population and high growth in developing markets.

… supporting a resilient market

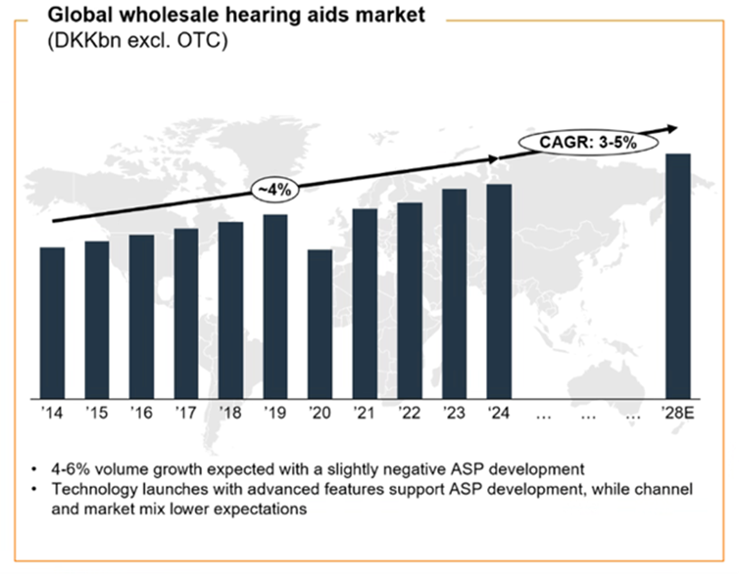

Over the past decade the global hearing aids market excluding the OTC segment (over the counter, i.e. where no audiologist intervenes, for low to mild hearing loss only) grew by an average compounded rate of around 4% in value. In the period 2024-2028, the market is expected to grow by 3-5% p.a. on average in value (4-6% volume growth with a slightly negative price impact). In the short term however, the hearing aids market is tracking below the long term average due to the increasingly challenging macroeconomic and geopolitical context.

Source: GN Group

The big five in the hearing aids space

The global market for prescription hearing aids is dominated by 5 players: Sonova (~25% market share), Demant (market share in the low twenties), GN Group (~17% market share), WS Audiology (~27% market share, private company) and Starkey Hearing Technologies (market share between 5 and 10%, private company). These players combined control over 90% of the market. A further consolidation towards 4 players cannot be ruled out, but is not the basic scenario. Never say never, but there is no Chinese competition on the horizon at the moment. One of the biggest hurdles for challengers to enter the industry is that hearing aids – unlike many other consumer products – are entirely (from design to assembly) made by the manufacturers. This requires a lot of knowhow. Focusing on innovation is the best protection to maintain one’s position in the market.

Swiss and Danish precision technology rules the listed market

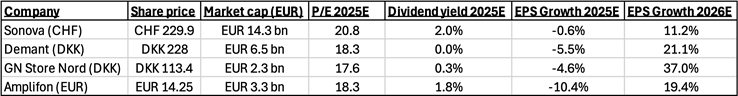

Swiss company Sonova was founded nearly 80 years ago. It is active in personal audio devices and wireless communication systems to audiological care services, hearing aids and cochlear implants. It operates through four businesses – Hearing Instruments, Audiological Care, Consumer Hearing and Cochlear Implants. Sonova has a leading position with brands such as Phonak, Unitron and Hansaton. In consumer hearing it has the Sennheiser brand (under license) and in Cochlear implants it owns Advanced Bionics. Sonova has an advanced vertically integrated business model with a focus on innovation.

The group’s products are sold in over 100 countries. In 2024 the company realized sales of CHF 3.9 bn. The group boasts a strong balance sheet (net debt/EBITDA of 1.2) and sound margins (EBITA margin 20.9% in 2024).

Demant has a history that goes back to 1904. It has a multibrand strategy (Philips, Oticon, Audika, …), is present in 130 countries and employs some 22,000 people. Around 45% of its sales stem from hearing aids, 40% from hearing care, 11% from diagnostics and 4% from communications. In 2024, the company realised sales of DKK 22.4 bn wit an EBIT margin of 19.6%. Demant has a fairly decent balance sheet (net debt/EBITDA of 2.8). The majority of Demant is controlled by the William Demant Foundation.

GN Group is the oldest listed Danish company (over 150 years old). It started as a telegraph lines company. Today the group derives 40% from hearing (brands: a.o. ReSound, Jabra), 40% from enterprise (headset, communication tools, brands: Jabra and blueparrott) and 20% from gaming. In 2024, GN Group realized sales of DKK 17.4 bn in and an EBITA-margin of 12%. The company is relatively highly indebted (net debt/EBITDA of 4.1), but is in the process of deleveraging its balance sheet.

Next to the 3 listed hearing aids manufacturers, Amplifon may also interest investors. This Italian company is the largest hearing aids retailer in the world with operations in 26 countries with some 10,000 stores (direct stores, shops in franchise and shop-in-shops combined), over 5 mln customers and a global market share of 13%. The company boasts a strong market position in Central and Southern Europe, North America and APAC. In 2024, Amplifon recorded sales of EUR 2.4 bn. 42% of the shares (68.38% of the voting rights) is held by the founding Holland family. The company recently launched its Fit4Growth plan that aims to improve profitability through focus, simplification and efficiency. It should result in 150 to 200 bp improvement in the adjusted EBITDA margin by 2027. Amplifon has a solid balance sheet (net debt/EBITDA of 1.9).

Source: Econopolis, LSEG Datastream

2025 a difficult year

2025 is a more difficult year after a soft 2024 as weak consumer confidence leads to longer replacement cycles. The purchase of a hearing aid can be postponed by 12-18 months. Price sensitivity is limited, it’s rather a decision to buy or not. Given the secular growth drivers for the market, there is no reason not to see a return to historical growth rates. The timing of the recovery (2026? 2027?) is however hard to predict.

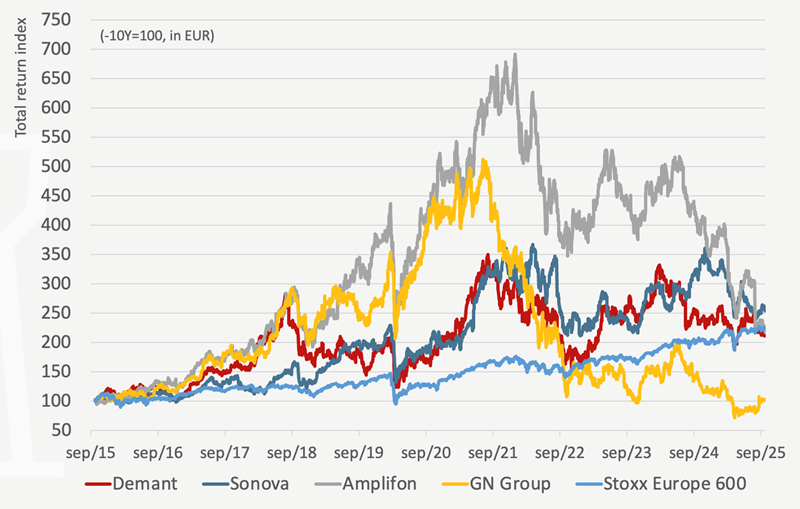

The difficult market circumstances lead to some pressure on earnings and (very) poor stock performances year to date as a consequence. Despite this, over a 10 year time frame, except for GN Group, all hearing aids stocks still perform at least in line with the broad stock market (STOXX Europe 600).

Source: Bloomberg

Conclusion

Hearing aids companies operate in a consolidated market with high barriers to enter. 2025 is a difficult year for the industry, but structural growth drivers should help the market to return to its historical growth pattern. If such a scenario proves correct, the share prices of the players within the industry could recover.