#MacroFriday: Made In America

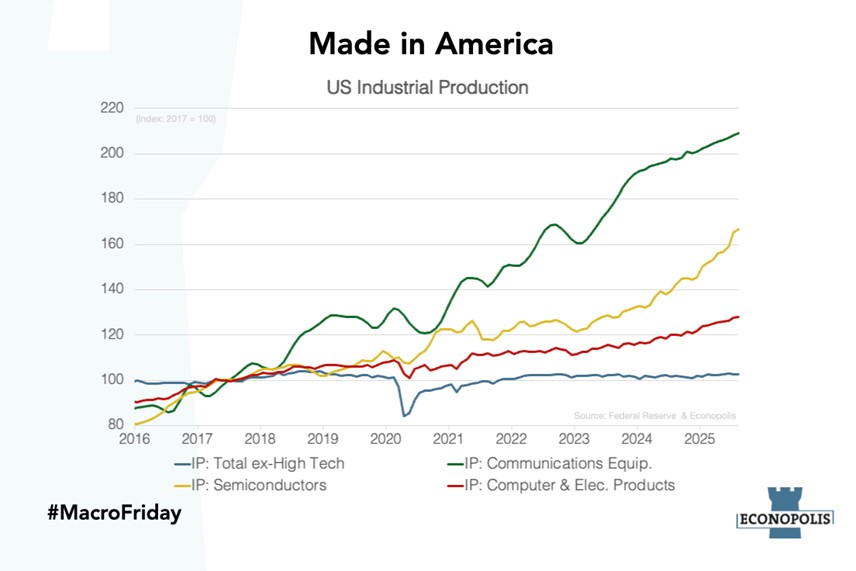

Industrial Production in the US has barely risen since 2017, especially excluding high-tech. The blue line suggests little output growth in the broader manufacturing base once high-tech components are excluded. While consumer spending has clearly grown since then, this suggest the continued offshoring of industrial production, something the current US administration is actively trying to tackle.

US industrial output growth is no longer broad-based, it’s concentrated in advanced technology industries. Production in Computer & Electronic Products, Semiconductors, and Communications Equipment reveal an enormous expansion. This is a clear sign of a real economic impact of digitalization, automation, AI & network infrastructure infrastructure investments on the US economy. Together, these high-tech subsectors have driven nearly all aggregate industrial production growth in the US since 2017.

This graph highlights the results of last week’s MacroFriday, showing the incredible construction spending boom in electronics since the supportive government acts in 2022. Economist and Harvard professor Jason Furman recently calculated that the US economy grew at an annualized +0,1% in the first half of 2025 when excluding information processing equipment and software from the GDP growth calculations. The American growth story is running on chips.