#MacroFriday: Japan's Policy Pivot

Japan is slowly transitioning into a new financial era.

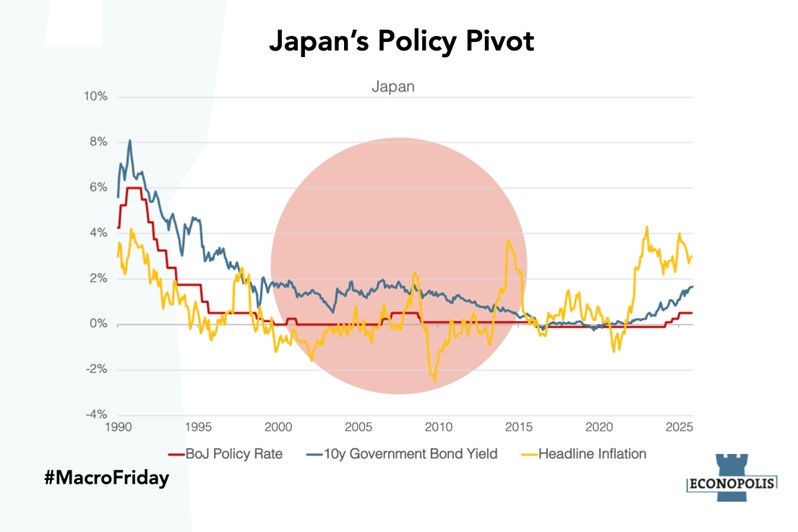

Headline inflation has remained above the Bank of Japan’s 2% target since April 2022, marking the longest period of above-target inflation in more than 35 years. While the initial surge was driven largely by higher fresh food and energy prices, underlying inflation has also firmed, albeit more gradually. During this period, the Japanese yen lost more than 20% of its value against major trading partners, fueling imported inflation. Together, these developments are reshaping Japan’s economic and financial landscape. Recall last year’s yen-driven volatility on global markets, which ultimately forced the Bank of Japan to intervene to support the currency.

Despite the weaker yen boosting Japan’s appeal as a travel destination, the economy still contracted by –0.4% in Q3 as US trade tariffs took their toll. Last week, new prime minister Sanae Takaichi unveiled the largest fiscal stimulus package since the Covid pandemic ($135 billion) to help mitigate the inflation pain and spur economic growth. Initially sparked by inflation dynamics, both expansionary budget plans, which will lead to an increased supply of government bonds, as well as tensions with China, have now driven Japanese interest rates even higher.

This revival of interest rates in Japan poses a major challenge given its public debt-to-GDP ratio of nearly 230%, even though most of it is held domestically. The Bank of Japan is estimated to hold 45% of the current outstanding Japanese government bonds, with about 40% held by domestic banks, insurance companies and pension funds. Furthermore, due to elevated inflation, the BOJ continues to tighten its monetary policy, and is on the verge of a new rate hike to 0.75%. This brings its main policy rate to the highest level since 1995. But the biggest move was in the longer end of the Japanese yield curve. While the 10-year government bond yield shifted higher to 1.8%, the yield on the 30-year bond stands at 2.6%, similar to the German equivalent and far above the Chinese 30-year government bond yield (2.16%). Meanwhile, the fall in the yen gave the Japanese Nikkei 225 equity index wings as it recaptured its 35-year-old record high and has continued its rally ever since.