Maxim Gilis obtained a Master in Applied Economics at the University of Antwerp in 2015. His master thesis examined the diversification of stocks in emerging markets. Next he obtained an additional Master of Finance at the Antwerp Management School, where he researched sustainable responsible investing for a European asset management company. He joined Econopolis in the summer of 2016.

Opportunities in Bonds Arise After 2022, A Painful Year for Most But Not All Bond Investors

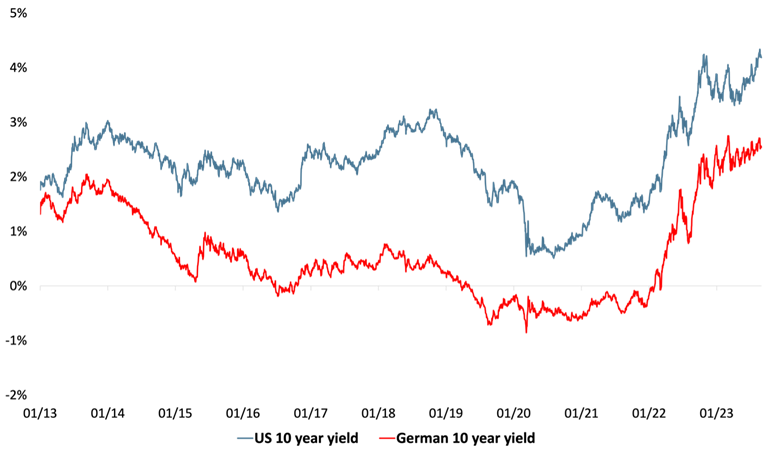

The past two years have provided bond investors with several lessons. The foremost lesson is that inflation hasn’t disappeared indefinitely. Consequently, the era of ultra-low interest rates isn’t everlasting either, especially as central banks have begun raising interest rates to fight inflation. This trend is illustrated in the graph below. Interest rates in both the US and Europe have surged to levels not witnessed in over a decade.

Source: Bloomberg, Econopolis

Indeed, the current environment presents enticing opportunities for bond investors after years of ultra-low interest rates. However, there’s a catch: the substantial losses some faced in 2022. Global (Western) bond indices declined by more than 10% last year. In some extreme cases, such as the 100-year bond of Austria (a high-quality country), losses exceeded 50% due to the influence of surging interest rates on long-duration bonds. As such, many investors have a picture in mind that 2022 was a terrible year for all bonds. This perception leads us to another lesson from recent bond market behavior: bonds do not always operate as a unified market with all instruments moving synchronously up or down. One segment that bucked the trend in 2022 (and continuous to do so this year) is the emerging market bonds, which even delivered positive returns for bond investors. Several factors contributed to their superior performance. Primarily, central banks in emerging markets took the initiative to raise interest rates ahead of 2022, having observed rising inflation. This action fortified their currencies. With a rich history of navigating high inflation, emerging market countries perhaps smartly leveraged their experience to manage the situation adeptly. Additionally, some emerging market countries benefited from higher commodity prices.

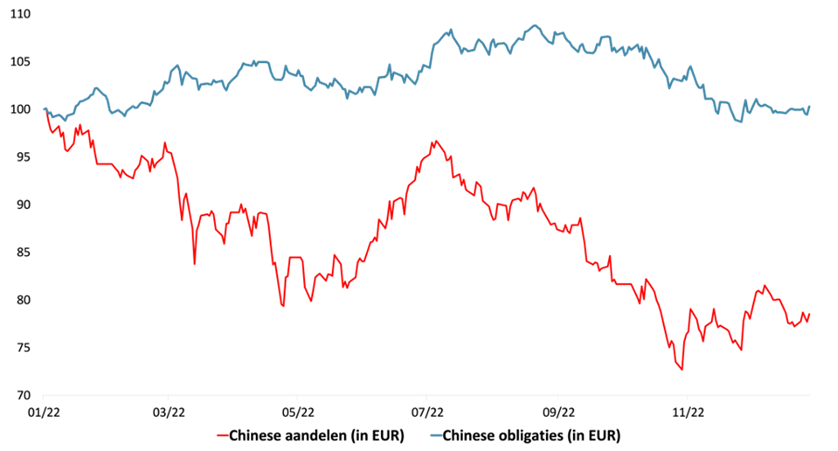

This leads us to the third lesson: emerging markets are not monolithic, and their bonds do not mirror the behavior of their equities. This distinction underscores the rational for investors to diversify portfolios with both emerging market bonds and equities. The previous two years posed challenges for emerging market equities, with Chinese equities facing the brunt of adversities – ranging from the harsh Covid-19 lockdowns and economic slowdown to the government’s crackdown on the technology sector and the bursting of the real estate bubble). As China is a key country in the emerging market equity universe with a weight of more than 30% in the prominent MSCI EM index, these challenges inevitably dragged down the performance of emerging market equities. However, China plays a different role in the universe of emerging market bonds. First and foremost, China (and Asia as a whole in fact) is of much less importance in terms of weight in the emerging market bond universe, where regions such as Latin America or Eastern Europe are in relative terms much more important. Furthermore, the performance dynamics of Chinese bonds differ markedly from their equity counterparts, as illustrated in the graph below.

Performance evolution of Chinese equities and bonds in 2022

Source: Bloomberg, Econopolis

Emerging market bonds are perhaps a bit of an unknown to many investors. To demystify this often-misunderstood asset class, let’s conclude this article by highlighting some key insights about emerging market bonds.

While there isn’t a universally accepted definition of an ‘emerging market’, organizations like the World Bank and MSCI offer categorizations. MSCI, for instance, classifies countries into Developed Markets (e.g., US, Germany, Belgium…), Emerging Markets (e.g., Brazil, India, China…) and Frontier Markets (e.g., Vietnam, Tunisia…). Typically, the emerging market bond universe comprises bonds issued by governments from the latter two categories. However, some investment funds draw clear distinctions between investments in emerging and frontier markets.

However, the emerging market bond universe does not only exist of government-issued bonds. Corporates active in emerging markets also issue bonds, as do several supranational agencies. The latter, institutions created by the governments of several countries, merit perhaps some extra explanation. Entities like the International Finance Corporation (IFC), the European Investment Bank (EIB), the European Bank for Reconstruction and Development (EBRD) fall under this category. They are often linked to the World Bank and issue bonds in a wide range of currencies to fund development projects in (mainly) emerging markets. For example, the IFC issues bonds denominated in currencies such as the Brazilian real, Mexican peso, Indian rupee, Indonesian rupiah, Colombian peso, and Chinese renminbi. A key advantage of these supranational bonds in emerging currencies is the exceptional creditworthiness of the issuing agencies, largely attributed to their robust capitalization and strong funding. However, there’s a trade-off: the yields on these bonds are often somewhat lower than on government bonds of the same currencies (though not always), and they are a bit less liquid.

Emerging market bonds can be broadly categorized into two types based on currency: local currency bonds and hard currency bonds.

- Local Currency Bonds: These bonds are denominated in the issuing country’s local currencies, such as the Brazilian real, Mexican peso, Czech koruna, or Indian rupee.

- Hard Currency Bonds: These are bonds issued not in the nation’s local currency, but in so-called hard currencies, primarily the US dollar, though the euro is also used.

Emerging countries often issue both local and hard currency bonds to diversify their financing sources. Investors in local currency bonds look at the prospects of the local currency and thus also local inflation, growth, and interest rate dynamics. Investors in hard currency bonds look rather at the creditworthiness and the spread over benchmarks, such as US treasuries or German bunds. While hard currency bonds are often perceived as less risky for investors due to the absence of currency risk, it is important to note that their credit quality, especially at the index level, can be inferior. Smaller, more risky emerging countries are often not able to successfully attract investors to their local currency bonds and in return thus try to take the currency risk off the table by offering hard currency bonds.

The past couple of years have been rather eventful for bond investors, which culminated in a painful 2022. However, the pain was not spread equally. There were even some pockets, such as emerging market bonds, that offered positive returns. As we look ahead, the global bond landscape is ripe with opportunities, given that interest rates in both developed and developing markets have reached levels not seen in a long period.