Kristof graduated as a Master of Business Engineering at the University of Antwerp in 2018 (major in Corporate Finance and Financial engineering). In his master thesis, he examined the profitability of a momentum strategy on various government bond markets. Kristof joined the team of Econopolis as a Business Analyst in September 2018, focusing on data management and the follow-up of the latest wealth management technologies. Since 2020 Kristof, became Senior Consultant within Econopolis Consulting, a strategic advisory services with a focus on climate and energy transition.

Electric Vehicle Recycling: A Growing Market with Potential?

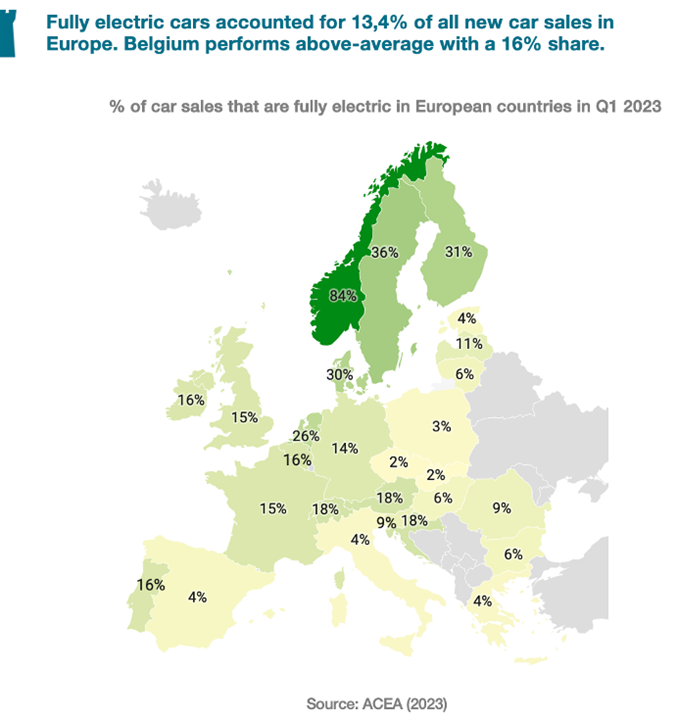

The presence of electric vehicles on our roads is becoming ever more pronounced. In the first quarter of 2023, fully electric cars accounted for 13.4% of all new car sales in Europe. Scandinavia has traditionally been at the vanguard of this movement. Norway leads the way with an impressive 84%, followed by Sweden at 36.2% and Finland at 31.4%. The Netherlands comes in a close fourth with a 26% share, while Belgium also posts above-average numbers at 16%. The map below provides a detailed overview of the percentage of passenger car sales that were full electric in each European country during the first quarter of 2023.

Electric vehicles are poised to become the mainstay of the automotive industry in the upcoming decades. Presently, Belgium holds a stock of nearly 8 million vehicles, and when combined with the Netherlands, the total approaches a staggering 18 million vehicles[1]. By 2050, an increasing number of diesel and gasoline vehicles will be replaced by electric vehicles. Consequently, a substantial volume of batteries will be in circulation, with many reaching the end of their life cycle after 10 to 15 years. While automotive batteries have stringent requirements, such as high power output and capacity, once they're no longer fit for vehicles, they can still provide several more years of service in less demanding applications such as home energy storage.

What Should We Do with All the Battery Waste?

As the prevalence of electric vehicles grows, so does the impending question: What do we do with batteries that are no longer suitable for reuse, or those that have reached the end of their life post-reuse? The answer lies in recycling. By doing so, we can extract and repurpose the raw materials within these batteries, such as lithium, cobalt, and aluminum. This approach offers a range of important benefits:

- Resource Conservation: Recycling mitigates the strain on primary raw material reserves.

- Geopolitical Resilience: By satisfying a significant portion of our raw material needs through recycling, we lessen our dependency on foreign nations for the supply of primary raw materials.

- Climate Impact: Primary raw materials extraction has a higher carbon footprint compared to recycling, making the latter a more environmentally friendly option.

- Environmental Preservation: Instead of allowing end-of-life batteries to degrade our environment as waste are valorized instead of ending up in our environment as waste.

- Economic Opportunities: The burgeoning recycling sector offers many economic opportunities. We’ll delve deeper into this aspect shortly.

While the promise of circular or secondary resources is tantalizing, it's essential to temper our expectations about the transition's speed. We will still need primary raw materials for a very long time while we transition – perhaps well beyond 2050. Here’s why:

- Delay effect: Let's hypothesize that by 2035, all cars sold are electric. Given a battery’s average lifespan of 15 years, it means that we can only have an ample supply of end-of-life batteries for recycling by 2050. This would provide the recycled raw materials needed for that year’s new car production.

- Inefficiencies and Losses: The recycling process, no matter how advanced, will not achieve a perfect 100% efficiency. Losses are inevitable at various stages, necessitating the continued input of primary resources.

- Global Growth: As emerging economies develop, global vehicle sales will rise. The increasing demand may outpace the supply of circular feedstock in the coming decades. However, growth in this case is not only related to more vehicle sales, but can also be due to larger batteries in the future. Again, additional primary input is needed.

Nevertheless, this doesn’t hinder our climate ambitions for 2050. Climate neutrality in 2050 is perfectly possible in a world in which we cannot yet use everything in a circular manner. In the long term, we must of course continue to strive for this.

Market Potential of Battery Recycling

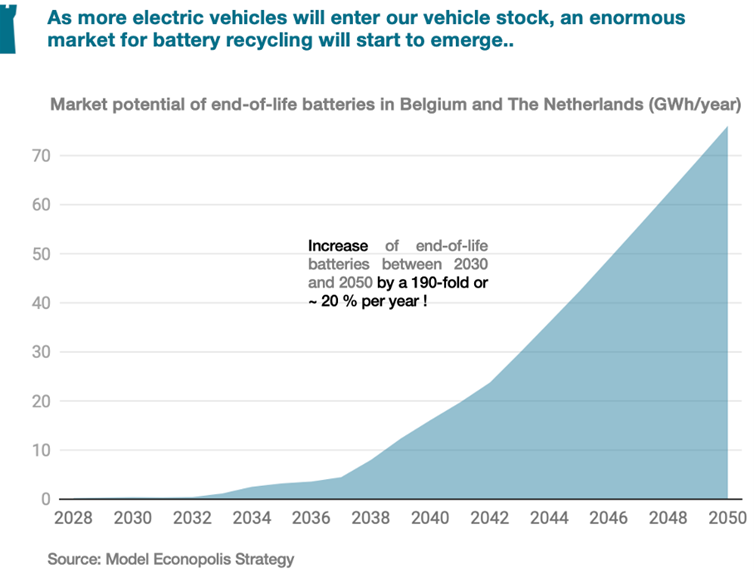

In order to gain insight in the market potential of battery recycling, Econopolis has made a stock-flow model. This model projects the number of batteries anticipated to reach their end-of-life stage per year up to 2050, for both Belgium and The Netherlands. It not only takes passenger cars into account, but also other vehicle types such as buses or trucks. Of course, such models are always subject to numerous assumptions, but the main trend remains consistent.

What Can We Learn from This Figure?

The figure from the above graph, shows that:

- Within 10 to 20 years a huge volume of batteries will become end-of-life.

- Recycling car batteries will become an important economic activity, with a huge market potential.

But will we not just send all discarded batteries to countries like China? Well, this will probably not be the case for battery recycling. Batteries are heavy and subject to dangerous goods regulations, making them extremely expensive to transport. Since the transport costs are a major factor, local recycling hubs are more likely to develop close to the waste sources.

This specific activity is a good example of how we should increasingly see climate transition as a source of numerous economic opportunities instead of a threat. Battery recycling can become a great new sector for our economy. Even though high volumes are still 10 to 20 years, we should already consider how to organize the value chain and evaluate in which knowledge domains we want to position ourselves as a region. We can be even more ambitious: battery recycling can have important spill-over effects on activities higher up in the economic chain: it can for example work as a magnet to attract high-value production activities for battery cells!

_____________________________________

[1] When discussing vehicles, it encompasses not only passenger cars but all vehicle types (buses, trucks, delivery vans, …)