Philippe Piessens is Senior Wealth Manager at Econopolis Wealth Management. Philippe has extensive experience in financial services, with a focus on equities. He started his career in 2001 at Lehman Brothers in London, and subsequently worked at HSBC and Kepler Cheuvreux. In addition, Philippe is active in art, as a collector and advisor, and in property, via his family business. Philippe received a BSc in International Relations at the London School of Economics.

The Breton Pulley: Buyer Beware

A "Breton Pulley" may sound like an instrument of torture used during the French Revolution. However, Breton pulley systems were used in the past to effortlessly lift heavy loads. These systems relied on a complex network of ropes and pulleys to achieve their purpose. The system was designed by the Breton people, who were known for their ingenuity and resourcefulness. The ropes were carefully woven, and the pulleys were precisely crafted to ensure maximum efficiency and durability.

Today, a Breton Pulley is a system of financial engineering that is key to understanding some of Europe’s largest business empires. Conceived by the legendary Lazard banker Antoine Bernheim, the system operates by creating a cascade of holding companies, each employing financial leverage, enabling maximum control of a company with minimal capital. In 1980s Europe, with its shallow capital markets, it proved to be an elegant solution for ambitious entrepreneurs, from Vincent Bolloré, François Pinault, Bernard Arnault and Charles Naouri in France to the Agnellis in Italy. Capitalism without the capital, as it were. The trajectory of two of France’s most swashbuckling entrepreneurs, Bernard Arnault and Charles Naouri, illustrates the opportunities and pitfalls of the “Breton Pulley”, confirms that leverage is a two-edged sword.

In a 2011 interview with Capital magazine, Antoine Bernheim mused that when he first met Bernard Arnault, he had “three francs six sous”. At the time, Arnault was running a small family property business called Ferret-Savinel, Arnault. With Bernheim’s help, Arnault embarked on a series of deals that allowed him to gain control of Christian Dior – then a dormant part of the Boussac Saint-Freres retail group. Utilizing the Breton Pulley, he subsequently used Dior as a vehicle to go on a buying spree, financed by debt. Today, Arnault controls the LVMH group, a business empire with an annual revenue of 80 billion euro, encompassing the world’s most successful luxury brands across Leather Goods, Wine, Jewelry, and Fashion. With a controlling stake in Europe’s largest listed company and estimated net worth of 240 billion euro, Bernard Arnault is currently the world’s richest man.

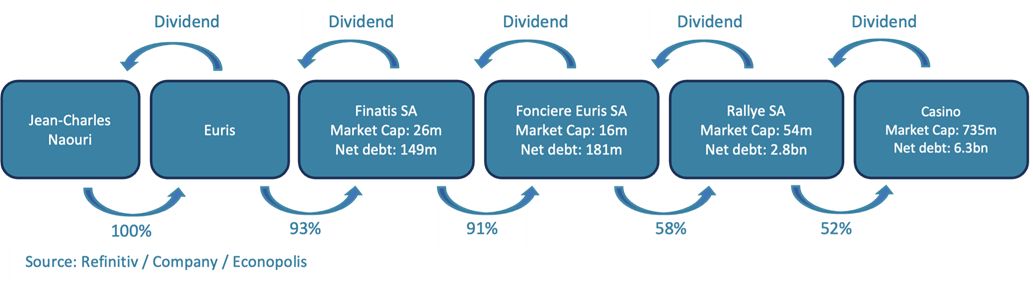

The fate of Jean-Charles Naouri, another proponent of the Breton Pulley, stands in stark contrast to that of Bernard Arnault and brings to mind the well-known Hemingway quote: “How did you go bankrupt? Gradually then suddenly”. Starting in the late 1980s, Naouri, a former civil servant and Rothschild banker, began by acquiring the struggling retailer Rallye. He then utilized a series of debt-laden holding companies to gain control of Groupe Casino, one of France’s leading convenience store chains. Through a stake of just 100 million euro in the top layer, Naouri controlled a retailer that, at its peak, had a market cap of 4 billion euro. Initially, business was prosperous. Casino’s convenience store format gained popularity in affluent urban areas, and its discount operations under the Monoprix brand conquered the suburbs. Dividends streamed upwards in the chain of holding companies. However, starting in the mid-2000s, Groupe Casino faced insurmountable operational challenges due to the relentless price competition of privately held Leclerc, the entry of Aldi and Lidl and the growth of e-commerce. A vicious cycle ensued as declining cashflows, dividend pressures, share price declines, and rising indebtedness reinforced each other. This ultimately led to a first default in 2019. In the past week and days, the saga seems to be reaching its climax, as trading in Rallye debt and Casino stock has been suspended in anticipation of a restructuring.

These two very contrasting sagas illustrate that while financial engineering can play an instrumental in building an empire, how it is utilized and the assets it is used for are crucial in determining the fate of that empire. Two lessons emerge from these stories. First, it is important to pay down debt when you can. Arnault understood this and used the cashflow of his portfolio companies to do so, while Naouri, on the other hand, expanded into Brazil and took on additional debt. Second, and more importantly, leverage should only be employed to acquire high-quality assets. The luxury goods industry comprises companies with a wide “moat”: a hard-to-replicate heritage, high barriers to entry, high margins, and strong pricing power. In contrast, the food and general retail industry is characterized by fierce competition, low profit margins, and wildly fluctuating cash flow.

Bernard Arnault’s prudent use of debt enabled him to acquire a diverse range of unique assets and consolidate them into a group with high synergies. In contrast, Naouri’s excessive debt exacerbated the declining operational performance across disparate assets. Alas for Naouri, the dictum that “the only way to win in a casino is to own one” does not apply to a French retailer that goes by that name.