Greenflation: Inflation Goes Green, But Can We Handle the Price Hikes?

When Inflation Gets a Sustainable Twist

Over the last few decades, accelerating technological growth and the widespread increase in living standards have caused a rapidly growing demand for energy resources. The potential threat of climate change is not new, although societal consciousness regarding the changing climate is. The Paris Agreement, signed in 2015, has united countries across the globe in committing to substantially reduce global greenhouse gas (GHG) emissions. Nations have set ambitious targets to reach these goals, creating a tremendous need for investment in green energy and green technologies. Alongside the prominent focus on the green transition, another major concern has dominated global debates in recent years: inflation. As the ongoing tragedy in Ukraine unfolds, soaring energy prices have pushed inflation in numerous countries, forcing us to rethink our heavy dependence on fossil fuels and increasing the urgency for renewable energies.

These two pressing issues are perhaps more intertwined than most people realise and have created a new concern called “greenflation”, a term used to describe the potential impact of the green transition on inflation rates. Seeing as the policy on interest rates is a central bank’s most important tool to tackle inflation, they now face a significant challenge in finding a balance between these two objectives. This blog post will delve into the concept of greenflation and its potential impact on monetary policy.

Understanding Greenflation

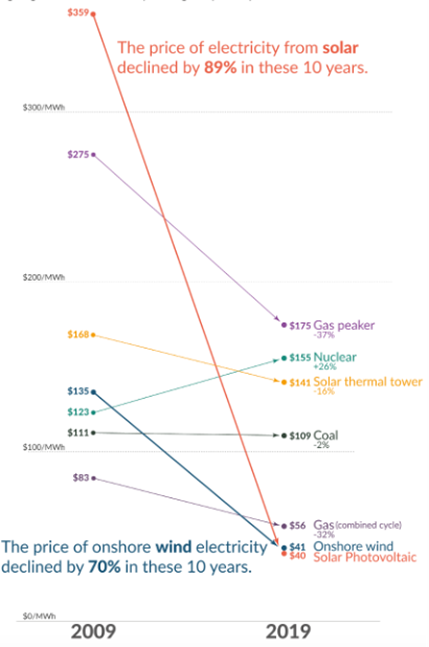

As governments worldwide commit to addressing climate change and transitioning towards more sustainable economies, significant investments are being made in renewable energy and green technologies. Today, the ‘levelised cost of energy’ (LCOE)[1] for new power plants is significantly lower than that of conventional power plants (see figure 1). Further technological advances in green technologies could mean that by 2050, the cost of renewables would be even lower than their current levels. However, the majority of energy consumption is still largely met by fossil fuels. Once the energy demand can be sufficiently met by renewables, households and industries can benefit from lower electricity prices. Nevertheless, such ambitious transformations come at a cost.

Figure 1: Source: Our World in Data

The primary factor contributing to greenflation is the substantial capital required for these eco-friendly initiatives. Governments and businesses must allocate funds for research and development, infrastructure upgrades, and the adoption of cleaner technologies. These investments exert upward pressure on prices, potentially resulting in inflationary consequences. Moreover, the scarcity of certain resources, such as rare earth metals used in certain renewable energy technologies, can further drive-up costs, impacting inflation rates.

- Three Shocks Leading to Greenflation

To fully grasp the concept of greenflation, it is necessary to distinguish between three interrelated shocks.

- Climateflation

This shock is directly related to the disastrous effects of climate change, such as droughts, severe weather events and natural disasters. Each event necessitates significant investment or leads to supply shortages, both of which contribute to inflation. For instance, droughts can result in a scarcity of food supply, particularly affecting the developing world and causing a surge in food prices that squeeze households’ disposable income.

- Fossilflation

As traditional fossil fuel-based energy sources become less favored, the current dependency on fossil fuels as an energy source can lead to higher electricity prices.

- Greenflation

The ultimate greenflation shock will mainly come from changes in supply chains, production processes and transportation systems. Businesses are being incentivised to reduce their carbon emissions, increasing the demand for green energy and technologies in the coming years. However, these technologies require a significant amount of metals and minerals, such as copper and lithium. For example, electric vehicles require nearly six times more minerals than their fossil fuel-driven counterparts (see Table 1). These changes can disrupt existing market dynamics and cause short-term price fluctuations. For instance, a sudden surge in demand for electric vehicles could strain the availability of lithium (used in batteries), leading to price hikes in the automotive industry.

Table 1: source: International Energy Agent

|

Internal combustion engine vehicle |

Hybrids |

Electric vehicles |

|

|

Copper |

20-25kg |

45-50kg |

75-80kg |

|

Nickel |

2-4kg |

5-15kg |

30-110kg |

|

PGMs |

3-6g |

4-10g |

25-35g |

Do We Need a Monetary Policy Shift?

In the face of greenflation, the role of monetary policy becomes crucial, especially considering the impact of interest rates on the adoption of renewable energies. Over the past two decades, it has become evident that the substantial upfront costs associated with capital-intensive green investments, such as windmill parks, are highly sensitive to fluctuations in the cost of capital. Historically low and declining interest rates have played a significant role in reducing the "levelised cost of electricity" (LCOE) for renewable energy sources. As a result, renewable electricity has become cheaper than conventional power plants (see Figure 1).

However, the recent surge in global interest rates poses a risk of reversing these positive developments. Unlike renewable energy projects, fossil fuel-based power plants have relatively lower upfront costs. A structural increase in the cost of capital in the coming years could have a negative impact on the green transition, as the competitiveness of renewable energies is closely linked to low interest rates. Fossil fuel plants require significantly lower up-front investment and will therefore not be impacted as much by rising interest rates.

Central banks find themselves in a challenging position as they navigate the complexities of addressing the inflationary pressures arising from the green transition. It is crucial for central banks to carefully consider the inflationary effects stemming from the green transition to avoid discouraging the significant decarbonisation efforts undertaken thus far. Balancing the need to control inflation while supporting the transition to a greener economy will be a significant and important challenge they will need to address creatively.

The European Central Bank (ECB) has already discussed two concrete proposals to address these issues, but they acknowledge these proposals come with significant shortcomings. The first proposal relates to the inflation target of close to 2%. They suggest raising the inflation target as a means to internalise the inflationary impact of the green transition and reduce the need for policy adjustments. However, there are arguments against this approach. Firstly, there is uncertainty regarding the future decline in real interest rates. The investments associated with the green transition, higher productivity growth resulting from the digitization of the economy, and the aging population may lead to higher interest rates. Secondly, a higher inflation target would increase the costs of inflation and burden the population. Lastly, changing the inflation target when it is not achieved could undermine central banks' credibility and public trust. Therefore, while inflation targets can be adjusted for valid reasons, the fight against climate change is unlikely to be one of them.

The second proposal suggests excluding volatile energy prices from measures of core inflation when setting monetary policy. However, it is important to note that headline inflation is designed to distinguish between noise and signal, and the inflation related to the green transition should not be considered as noise. Ignoring structural increases in inflation would provide a misleading indicator of underlying inflation trends.

It is evident that traditional monetary tools alone will not be sufficient to address the challenge of balancing price stability and the need for investments in the green transition to ensure a sustainable future with stable prices. To confront the challenges ahead, a more comprehensive cooperation between governments, large industries and monetary regulators will be essential.

Conclusion; Balancing the Climate and the Economy in the Interest Rate Game"

In conclusion, the concept of "greenflation" has gained increasing significance. The pursuit of renewable energy and sustainable technologies necessitates substantial investments, which can result in upward pressure on prices and potential inflationary consequences. Greenflation is influenced by three interrelated shocks: climateflation, fossilflation, and greenflation itself, which stems from climate change-related events, the rising costs of fossil fuel-based energy, and changes in supply chains and production processes.

Addressing greenflation poses a challenge for central banks and monetary policy. Low and declining interest rates have facilitated the adoption of renewable energy by reducing the upfront costs of a new project, which are typically high for such projects. However, the recent surge in global interest rates could hinder the competitiveness of renewable energies. Central banks must carefully balance the need to control inflation while supporting the green transition.

The European Central Bank has discussed potential proposals, such as adjusting the inflation target or excluding volatile energy prices from core inflation measures. However, these proposals have limitations and challenges. Traditional monetary tools alone are insufficient to ensure a sustainable future with stable prices. To overcome these challenges, effective cooperation among governments, large industries, and monetary regulators is essential. By collaborating and aligning strategies, stakeholders can develop comprehensive policies that harmonize price stability with the goals of the green transition. A more coherent approach is crucial to navigate the complexities and interdependencies of greenflation and to achieve a sustainable and resilient future.

[1] The levelised cost of energy captures the cost of building the power plant itself as well as the ongoing cots for fuel and operating the power plant over its lifetime.