Maxim Gilis obtained a Master in Applied Economics at the University of Antwerp in 2015. His master thesis examined the diversification of stocks in emerging markets. Next he obtained an additional Master of Finance at the Antwerp Management School, where he researched sustainable responsible investing for a European asset management company. He joined Econopolis in the summer of 2016.

Contrary To Popular Belief, "Buy And Hold" Isn't A One-Size-Fits-All Investment Strategy.

The appeal of buy and hold investing is simplicity. Buy and hold requires little intelligence, skill, or serious effort, and it completely ignores the essential investment concept of managing risk. Buy and hold's allure is as old as eternity - get rich with little or no effort. Just mindlessly make your monthly deposits, don't blink when the market tanks, and eventually you will emerge rich.

The preachers of the buy and hold gospel are supported by several well documented, academic studies showing that a diversified portfolio of stocks never lost money when bought and held for twenty years or more. They also teach the idea that buy and hold stocks outperforms other investments such as bonds, real estate or cash equivalents over the long-term. That much is true. And if you take what they say at face value then the case for buy and hold may seem compelling. Unfortunately, it's not what they tell you that's the problem - it's what they don't tell you about buy and hold that will cost you money.

Below are some of the inherent flaws in buy and hold logic that will hopefully make you think twice about this sacred cow of investment strategy and investigate deeper with an open mind:

- Buy and hold makes no sense because it implies the risk of assets is always justified by the reward. The idea that every year is a good year to own stock is patently false. The facts are well researched and proven that the risk of buying and holding securities is not justified by the reward under certain conditions (and these conditions are completely knowable without the benefit of hindsight).

- Buy and hold implies that prices don't matter because the strategy requires you to buy and hold at all times regardless of price or valuation. Is there any other buying decision in your life where price doesn't matter? Of course not, so why should investing be any different?

- Buy and hold uses dynamically composed investment indexes (MSCI World, S&P 500, etc.) to support the case for a static investment strategy (buy and hold).The truth is more stocks have vanished or gone to zero than have survived to this day. That is why the very indexes used to support the research for buy and hold do just the opposite - they sell and replace stocks regularly. Why would you do any different?

- There exists a mathematically implied optimum holding period for securities based on transaction costs and volatility, so how can a "no transaction" strategy like buy and hold make sense? It implies zero transaction activity is optimal which is mathematically false.

- Buy and hold is a purely offensive investment strategy that ignores the defensive half of your investment portfolio. It implies risk is something to be accepted rather than controlled. How can buy and hold make sense when it is only one-half of a complete investment strategy?

- Buy and hold is passive. If the passive approach isn't an effective strategy for advancing your career, developing satisfying relationships, raising productive children, maintaining health or any other important aspect of your life, what makes you think it is an effective approach for investing?

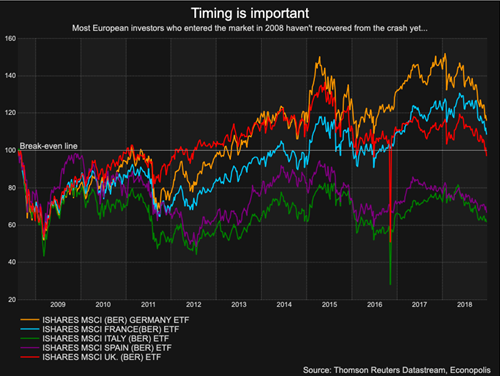

- The case for agility is supported by the fact that it can often take very long (several years) for investors to recover from a major crash in the market. After the dot-com bubble in 2000, it took 5 years for the average US equity investor to offset his losses and 2 years after the financial crisis of 2008. In Europe, most equity investors haven't even recovered yet from the financial crisis of 2008 (see graph below). By timing time investing in stocks, we try to avoid the risk of buying at the top of the market. A study shows that an investor fully invested in the US stock market (S&P 500) from 1998 to 2012 achieved an average annual return of 7.2%. If this investor missed the 40 best days of these 14 years, he would have achieved a return of -2.8% per year. Many people use this argument to show that it is important to be in the market at all times. However, what many investors look over is that, in these 14 years, if the 40 worst days would have been avoided, an annual return of 19.1% would have been achieved. This shows that it is more important to miss the worst days than to miss the best days and thus makes the case for a pro-active, agile investment strategy.

In summary, we at Econopolis do not oppose the buy and hold investment strategy. We just oppose how it is marketed as an all-weather, all-condition investment solution when the research supports it as a special case investment strategy that should only be used when conditions are appropriate. At Econopolis, we promote an active and agile investment strategy (buy the dip sell the rally). After all, that's what professional asset management is all about.