Michaël De Man graduated as Master in Economics at Ghent University in 2005. Driven by a strong interest in investments, he obtained a Master in Banking and Finance at the same university. After his studies he started as a bond specialist for a large Belgian bank. In that period, he also became CFA charterholder. In the aftermath of the financial crisis, he dedicated himself to risk management. At the end of 2015, he joined the investment team of Econopolis, where he focuses on the bond strategy and leads the fund management department. Since 2021, he is also CEO of Econopolis Wealth Management NV.

Inflation-indexed bonds: One bond is not the other

In this Long Read, we turn our attention to the bond class that can actually protect investors from inflation: inflation-indexed bonds (IIB). As the name implies, inflation-indexed bonds are linked to inflation. But how exactly do they function? Unlike conventional bonds, which give investors a fixed coupon and a repayment of principal at maturity, inflation-indexed bonds will have both the coupon and the repayment at maturity variable. With these bonds, the coupons and repayment of principal are set in "real" terms. The actual amounts depend on actual realized inflation.

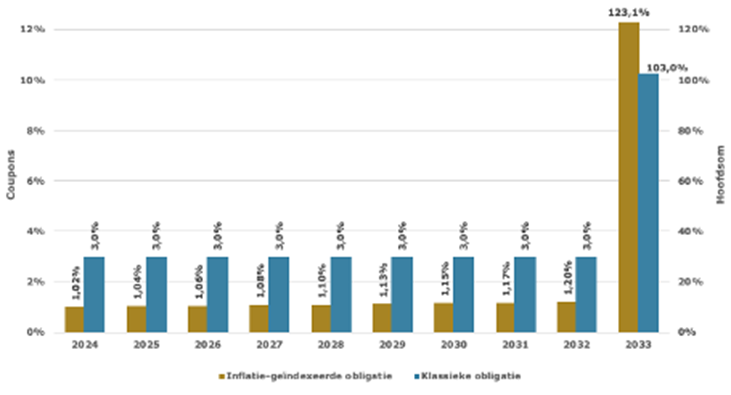

Yield of inflation-indexed bonds versus traditional bonds (in %)

Source: Econopolis

The chart illustrates the coupons of two types of bonds: a classic or standard bond with an annual coupon of 3% and an inflation-indexed bond with a real coupon of 1% and an annual inflation rate of 2%. Both bonds have a maturity of 10 years.

1. Classic bonds: The way these work is simple. They yield a fixed coupon of 3% each year. At the end of the term, investors get back 103%: this is the principal of 100% plus the final coupon of 3%.

2. Inflation-indexed bonds (IBBs): With these bonds, the real coupon remains consistent at 1%. However, the face amount is adjusted annually according to actual realized (cumulative) inflation. If inflation is consistently 2% per year, the coupon after the first year will be 1.02% - this is not simply 1% (real) + 2% (inflation). Over the life of the IGO, although the coupons are lower, this is offset by a higher payout at maturity. At that time, the principal amount is adjusted for cumulative inflation over the full term, just like the coupon. The payout then becomes 123.1% (calculated as 100%*1.02^10 + 1%*1.02^10). The expression 100%*1.02^10 is a mathematical formula that represents a certain growth over a period of time, in this case the growth of the original principal by 2% per year over 10 years.

The yield difference between inflation-indexed bonds (IBBs) and traditional bonds has been remarkably large in recent years. For investors in IGOs, these have been golden times. Thanks to inflation rates not seen in many decades, inflation-indexed bonds posted unprecedented returns compared to their regular counterparts. Let's illustrate this with a practical example.

Return on inflation-indexed bond versus regular bond (in%)

Source: Econopolis

The Spanish inflation-indexed bond (IBBs) with a maturity date at the end of 2030 posted an impressive total return of nearly 14%, including coupons. In contrast, a comparable Spanish classic bond with the same maturity date experienced a 10% decline over the same period, also including coupons. This represents a significant difference of no less than 24%! This serves as strong evidence that IBBs perform excellently in times of high inflation, unlike their classic counterparts.

Although the period of high inflation is normalizing, perhaps signaling the end of the golden period for IGOs, they remain relevant. Given expected inflation rates of between 2.0% and 2.5% in both the eurozone and the U.S., IGOs are still a useful hedge against inflation.

Inflation-indexed bonds are sometimes more complex than thought!

At first glance, the operation of IBBs seems straightforward. However, there are a number of subtle nuances and potential pitfalls in their operation that should not be overlooked. Here is a thorough overview, leaving out some minor details. We will discuss both absolute and relative returns (compared to traditional government bonds):

1. Absolute returns of inflation-indexed bonds:

- Long-term (buy and hold): Yield = Real interest rate + inflation. The higher the initial real interest rate and eventual inflation, the greater the return. Therefore, buying IGOs when real interest rates are high and inflation expectations are low is a good strategy.

- Short-term: Here the formula for return is a bit more complicated. Yield = Real interest rate + inflation - ∆ real interest rate * mod. duration. Several factors, such as changes in nominal interest rates and inflation expectations, affect this return. A longer bond duration means that changes in real interest rates will have a more significant impact. A notable detail: during periods of rising inflation, which often coincide with rising real interest rates, IGOs can exhibit negative returns. A striking example of this is the second quarter of 2022, where despite very high inflation of more than 10%, long-term IGOs showed negative returns. The increase in real interest rates more than compensated for the high inflation, resulting in negative returns.

2. Relative returns of Inflation-indexed bonds compared to traditional government bonds:

Relative returns look at the performance of IIBs compared to classic government bonds. This is where breakeven inflation (BEI) plays a key role.

- Breakeven Inflation (BEI): BEI is the difference between the nominal interest rate of conventional government bonds and the real interest rate on IGOs of the same maturity. It represents expected inflation over the bond's term. In other words, it is the inflation needed to make the yield of an IGO equal to that of a conventional bond. Therefore, the BEI is also considered a proxy for market expectations about inflation.

- Long-term (buy and hold): The excess return (or excess return over a conventional government bond) for IGOs can be calculated as the difference between actual inflation and the BEI. If actual inflation over the life of the bond is higher than the BEI at the time of purchase, then IGOs will outperform conventional bonds.

- Short-term: Here the excess return of IGOs is determined by actual inflation minus BEI, adjusted for changes in BEI and multiplied by the "modified duration" of the bond. Factors such as changes in BEI and the duration of the bond play a crucial role here. It is essential to understand that a change in BEI does not necessarily reflect a direct change in current inflation. After all, the BEI is an estimate of future inflation. Thus, even in a context of high current inflation, inflation expectations (as reflected in the BEI) may fall, as we saw in the second quarter of 2022.

All this underscores that while on the surface IGOs may seem like a simple way to provide protection against inflation, in practice they are a complex instrument that is sensitive to a range of factors, including market expectations about future inflation. Investors need to understand these nuances to make informed decisions.