Green transition in developing countries severely impacted by rising capital costs

Constructing large-scale renewable energy projects necessitates substantial capital, often leading to the need for loans. While essential, these loans introduce additional costs to the capital. Such added expenses can significantly affect projects like wind or solar parks, or grid expansions. Consequently, these costs from loans influence the overall cost of electricity. This effect is particularly pronounced in developing countries, where the higher costs impede both socio-economic progress and their transition to green energy.

LCOE or Levelized Cost of Electricity: The price of different energy sources

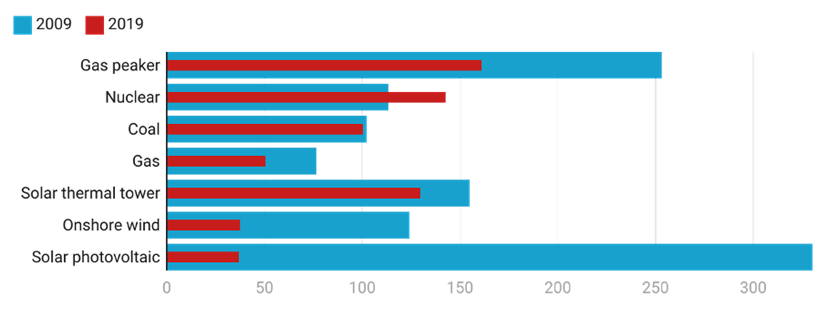

When assessing renewable energy projects, a key factor in determining their economic feasibility is universal across all types of energy production: the cost-effectiveness of electricity production. The Levelized Cost of Electricity (LCOE) serves as a standard metric, offering insights into the cost per megawatt-hour (MWh) produced. This enables comparison between different forms of energy production. In 2009, for example, solar electricity generated from renewable sources was more expensive than traditional fossil fuels. Fortunately, recent advancements in the green energy transition have significantly reduced the cost of renewable energy, making it more competitive with non-renewable sources.

Comparison of LCOE (€/MWh) for different energy sources in 2009 compared to 2019

Figure: Econopolis Strategy, Source: Our World in Data

If the LCOE for green energy is lower or equal to that of non-renewable energy, investing in renewables becomes both sustainable and economically viable. However, challenges emerge when considering the financing costs of renewable energy projects.

Cost of capital: the defining factor in the economic viability of the green transition

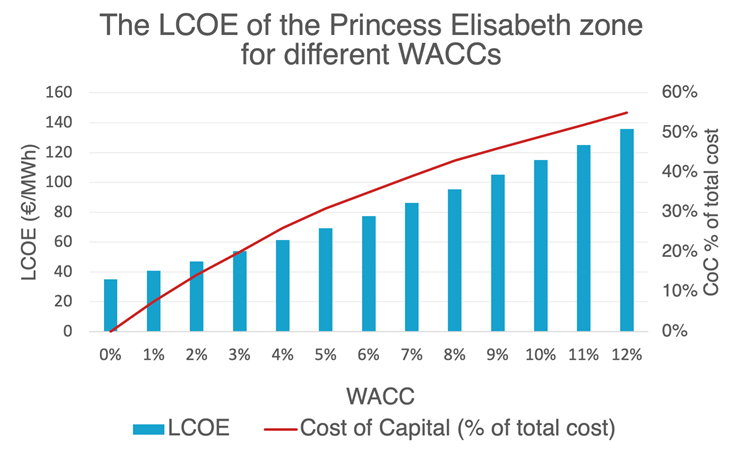

Developing a wind park in the midst of the North Sea represents a significant investment for any nation. Multibillion-euro projects like these require borrowed capital, as it's nearly impossible to cover such substantial amounts upfront. The adage 'borrowing money costs money' holds especially true for these ventures, with an impact greater than one might initially anticipate. The Weighted Average Cost of Capital (WACC) is a metric utilized by developers and investors to understand the costs associated with borrowing a certain amount for a project. This borrowing expense is known as the ‘cost of capital’ (CoC), and the WACC indicates the percentage of the total capital that is added as an additional cost each year until the debt is fully repaid. The WACC fluctuates from one country to another, influenced by varying interest rates, risk premiums, and the nature of the project, among other factors. Even slight differences in these percentages can lead to considerable variances in the Levelized Cost of Electricity for a project.

To give more insight into the influence of the WACC on the eventual price of electricity, the team of Econopolis Strategy calculated the LCOE for the new 2.1 GW wind park in Belgium in the Princess Elisabeth Zone with varying WACC. For a WACC of 12%, almost half the cost of the project is due to borrowing the money, clearly highlighting the crucial importance of this factor.

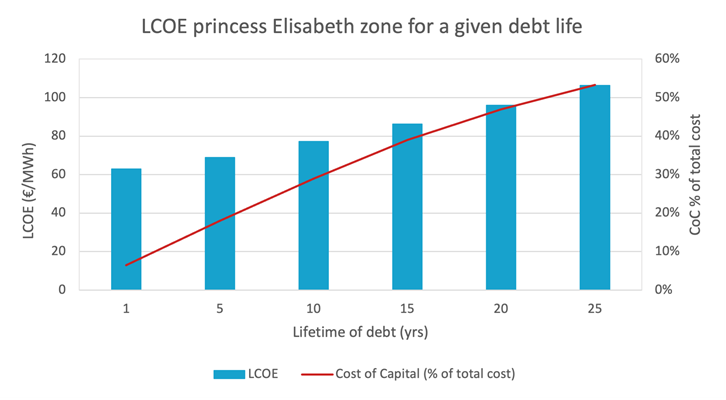

In our calculations, we assumed an optimistic timeline for debt repayment, minimizing the total number of years the capital is borrowed. As illustrated in the graph below, an extended borrowing period results in a higher Cost of Capital (CoC) and Levelized Cost of Electricity (LCOE).

High WACC: the barrier to affordable renewable energy in developing countries

In stable and developed nations, the Weighted Average Cost of Capital (WACC) for renewable energy projects was relatively low, around 5% in 2021. This low WACC facilitates the production of affordable electricity. Conversely, in developing countries, where GDP levels are much lower and the need for inexpensive electricity is greater, the WACC tends to soar due to heightened investment risks, leading to increased Levelized Costs of Electricity (LCOE). This presents a significant obstacle to the green transition in these regions. For instance, Belgium, with a WACC of 7%, can construct a wind park in the Princess Elisabeth Zone at an LCOE of €86.28/MWh. However, constructing an identical wind park in Africa, with a WACC of 12%, would raise the LCOE to €135.84/MWh, making the electricity produced 57% more expensive. Consequently, even though renewable energy might be less costly in terms of operations and maintenance, the elevated cost of capital in developing countries undermines these advantages, compelling them to rely on established non-renewable energy sources.

Strategies for lowering WACC to drive renewable investments in developing countries

A reliable method to reduce the WACC is to mitigate uncertainty, essentially minimizing the risk that an investor faces across as many variables as possible. For instance, governments can enact green policies that assure investors of a secure future. Moreover, it's crucial to have access to detailed data from established projects to make accurate future WACC estimations. This is vital even for developed countries, where imprecise WACC calculations can result in ill-informed investments and policies, subsequently raising the WACC for subsequent projects. In developing countries, where data from existing projects are scarce, WACCs are typically high. However, after an initial investment yields profitable results, as observed with solar investments in Morocco and South Africa, WACC tends to stabilize, paving the way for further investment. Thus, the significance of a 'first renewable project' cannot be overstated. Development banks can significantly aid developing countries in initiating their green transition and fostering a robust business climate. Furthermore, smaller projects could yield a more favorable Levelized Cost of Electricity since the timeframe for debt repayment is shorter. A collection of small, successful projects may be the optimal approach for developing countries to leverage their vast renewable energy potential.