Too Big to Fail Comes to the Rescue

The First Banking Crisis Induced by the US Central Bank

The echoes of the 2008 financial crisis reverberate loudly these days. Some of the biggest bank bailouts are taking place right now: following Silicon Valley Bank (SVB) and Signature Bank, it was now First Republic Bank (FRB) that had to be saved. SVB and FRB were among the top 20 banks in the United States according to the size of their balance sheets, roughly comparable to KBC. These smaller - though not small - banks encountered problems due to a typical bank run. Underlying this situation are several factors, including poor risk management. However, this banking crisis can also be attributed to the monetary policy over the last 15 years, ever since the great financial crisis.

Firstly, the loose monetary policy fueled asset inflation, and a strong rise of credit demand. As this policy was aggressively reversed over the past 18 months, stress built up in asset prices (also in so-called riskless US Treasury bonds). Furthermore, TINA (there is no alternative) faded away silently, and as a results deposits shifted to term accounts and better-yielding short-term bonds. Banks were whiplashed between fleeing deposits, lower asset values, and crippling credit demand.

This is probably the first banking crisis induced by the US central bank, whose role is to maintain financial stability. The US Federal Reserve organized a bailout with the help of the largest US banks, in a manner very similar to the rescue of Crédit Suisse by UBS. While the lesson of the 2008 financial crisis was that “Too Big to Fail” should be avoided, “Too Big to Fail” has now come to the rescue of the financial system itself.

JP Morgan Created the Federal Reserve

The Federal Reserve, the US central bank, was created in 1913 as an initiative of… JP Morgan. Yes, indeed. JP Morgan had rescued banks, the stock market, and New York City from financial ruin in 1907. The “bank panics” became chronic, and congress passed the Federal Reserve Act, which put the government, and not JP Morgan, in charge of managing financial crises. More than a century later, it seems that history is repeating itself, only this time the FED and JP Morgan are acting in tandem. The result is nevertheless worrisome.

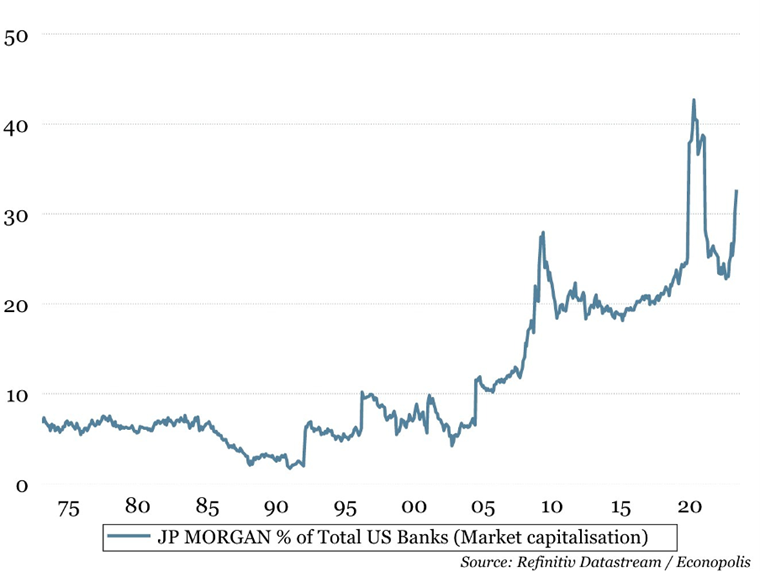

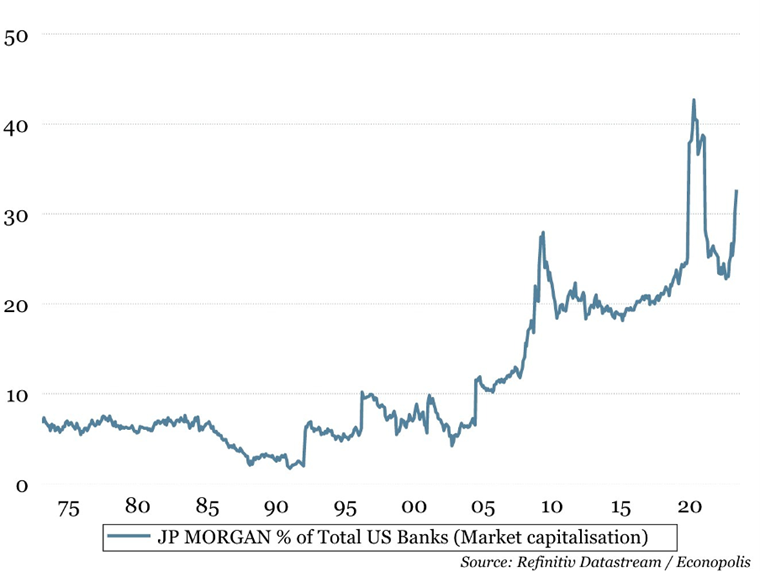

JP Morgan now accounts for more than 30% of the total market capitalization of US banks. Federal regulations typically prevent a bank from acquiring another bank if the combined entity would hold more than 10% of total deposits. However, this has not been the case in the present crisis. This is unprecedented, and against all rules.

The US banking crisis has not yet ended, and the biggest risk is that the credibility of central banks could be questioned. This skepticism could also spread to Europe, where the ECB has yet to be confronted with the lagging effects of its tightening policy on assets, sovereign debt financing, and various financial constructions in sectors such as real estate and private equity. This situation is still unfolding, and its consequences remain to be seen.

About the author

Geert Noels

Geert Noels is Group CEO and Chief Economist of Econopolis, an independent asset manager and economic consultancy firm. He is best known to the general public through his columns in various newspapers and his presence on TV and radio programs as economic expert. His advice is regularly requested by various organizations and authorities, who appreciate his creative thinking and completely independent macroeconomic vision. He is the author of Econoshock (2008), which deals with the six shocks that are currently changing our economy, society and daily life. Econoshock also forms the basis and guideline for Econopolis' strategies.

In 2019 his second book Gigantism was published. Gigantism is a strong plea against companies and organizations that are getting bigger and more powerful. It kills healthy competition, leads to unsustainable growth and oppresses people. In Gigantism, Geert proposes ten solutions that adjust the economic rules, tame the giants and give people and the environment a place in the global economy again.

In December 2022, Geert Noels' last book "The Climate Shock - 20 solutions for governments, companies and citizens in Belgium" was published, written with colleagues Kristof Eggermont and Yanaika Denoyelle. The book describes how we can tackle this urgent crisis and use it to make Belgium more prosperous and paints a realistic picture of a bright future.