Attention, CFOs: Your Capital Structure Is Just as Important as Your EBITDA!

How rock-solid balance sheets can guide you in your investments

Drawing from my previous experience as the Treasury and Corporate Finance Director of a Telecom firm, I have cultivated a natural inclination to not only analyze a company's profitability but also to delve deeper into its capital structure. Now, as a fund manager, I still prioritize certain of these key criteria when selecting stocks for investment, and so should you.

Foremost among these criteria is the strength of a company’s balance sheet and its ability to generate consistent cash flow. So, when analyzing companies, you should develop a clear preference for companies that boast a rock-solid balance sheet, characterized by minimal interest-bearing debt, asset-rich and substantial cash reserves. These factors provide a cushion of financial stability and allow companies to weather economic downturns or unforeseen circumstances effectively. Moreover, you should place significant emphasis on companies that exhibit robust cash flow generation, underpinned by solid operational profit, effective inventory- and working capital management, and that have already completed most of their significant, company-defining, investments. Such a foundation enables them to allocate resources towards growth opportunities rather than addressing financial challenges.

The emphasis on these characteristics is essential for a simple reason: even with brilliant ideas, companies cannot fulfill their potential without adequate and appropriate financing. To enable firms to operate and maximize their performance, it is crucial to ensure they have access to the necessary capital. This becomes particularly crucial for technology-driven growth companies whose value lies predominantly in the future. Evaluating the future value of such companies can be a daunting task, but it becomes less burdensome when the assessment primarily relies on factors like their technological leadership and the size and nature of their market. It is much more comfortable to make judgments based on these aspects rather than having to assess their ability to secure external financing for the next 1 to 3 years, which is subject to unpredictable financial market conditions.

In the past decade, it is evident that investors were less attentive to such criteria. With low interest rates, capital was easily accessible, and even companies of lower quality could secure funding relatively effortlessly. Especially, because most of the time the economic environment was also relatively benign with solid growth numbers. However, we find ourselves now in the midst of a rapid monetary tightening cycle, initiated by central banks. While there have been some casualties in the banking sector, the impact on corporates has been relatively contained. Many companies had proactively strengthened their balance sheets and refinanced existing loans, mitigating potential damage.

Nonetheless, with the US FED fund rate at 5.25% and the ECB deposit facility rate at 3.25% (with some additional ECB hikes in sight), the opportunity to refinance at the historically low rates of the past decade is gradually diminishing. Additionally, considering the prospect of a lower economic outlook, lenders are likely to demand a higher risk premium as delinquency rates rise. Consequently, several companies may encounter greater difficulties in securing funding for future growth projects. Therefore, it is crucial for investors to allocate the necessary importance to not only seek growth but also emphasize qualitative growth with a sound financial footing.

Managing your balance sheet is an important day-to-day task of every CFO

This brings me to you Mr. CFO. While boasting about profitability is one thing, managing your balance sheet is another. Just as investors in the last 10 years were less concerned with the strength of a company's balance sheet and its ability to generate consistent cash flow, it is not unlikely that you too were more focused on revenue and EBITDA growth. A higher inventory level facilitates sales, accepting longer payment terms makes your offer more attractive, opening a new factory demonstrates foresight, an acquisition broadens the product offering.... there will be good reasons for everything, but the changing monetary and economic environment may well mean that more reasons may also emerge not to do some of these things in order to protect the balance sheet.

As you know the Weighted Average Cost of Capital (WACC) is a financial metric used to estimate the average rate of return a company needs to earn on its investments to cover its cost of capital. It represents the blended cost of all the sources of financing used by the company, taking into account the proportion of each source in the company's capital structure. Typically, the WACC is calculated by assigning weights to the cost of each component of the company's capital structure and summing them up. In its simplest form these components are the cost of equity and the cost of debt. Following the lightning-quick interest rate increase by central banks over the past year, it now seems obvious that interest rates will fall again over the next 12 to 18 months (how much that is still a lively debate). However, let that not be a reason to neglect the focus on managing a healthy balance sheet. On the contrary, should those interest rate cuts materialize it is because economic growth needs that extra stimulus. No doubt that lower economic growth will have an impact on the risk premium demanded by the market, both on the equity and the debt component.

Some examples of companies that got the message.

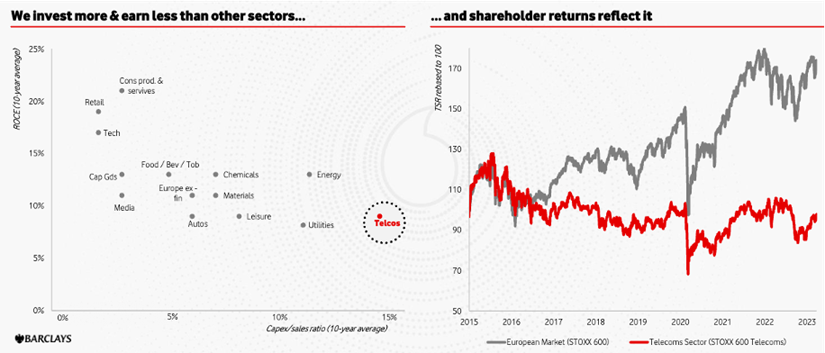

Earlier this week Vodafone, once hailed as the poster boy of the mobile telecommunication revolution, provided a blunt message: “Vodafone must change! The European telecommunication sector has amongst the lowest ROCE in Europe, alongside the highest capital investment demands. This has resulted in ROCE being below WACC for over a decade, impacting total shareholder returns…. and the comparative performance of Vodafone, which is connected to the experience of our customers”.

Another example was set by our Fiery Flash of the week: Faurecia. In August 2021, when global interest rates were near record-low levels, Faurecia announced a takeover bid on Hella. This transaction allowed Faurecia to become the 7th largest global automotive supplier and increase its exposure to some of the most promising growth areas in the automotive industry. However, as a result of this transaction, Faurecia's debt level significantly increased. Considering the share price performance since the transaction, the market suggests that the debt level may have risen too much, particularly given the rapid tightening of monetary conditions in the past 12 months. As a response, the company is now strongly focused on reducing its net debt and has committed to a 1-billion-euro asset disposal program by the end of 2023. It is not unlikely that in 2024 and beyond this will keep the company busy.