Siddy holds a Master’s degree in Economics from the University of Antwerp and a Master's degree in Financial Management from the Vlerick Business School. Passionate by innovation and entrepreneurship, he also participated to an Executive Master in Venture Capital at the Berkeley Haas School of Business. Prior to joining Econopolis, he managed the Investor Relations & Treasury office at Orange Belgium, a telecom company. Siddy also held the position of Telecom, Media & Technology analyst at a large Belgian Asset Management firm. Further, he is also active in the advisory board of StartupVillage and The Beacon, a business and innovation hub in the center of Antwerp focused on Internet of Things and Artificial Intelligence in the domains of industry, logistics and smart city. At Econopolis, he is Portfolio Manager of the Econopolis Exponential Technologies Fund.

Secular Growth Is Eating Cyclical Growth’s Lunch Any Day

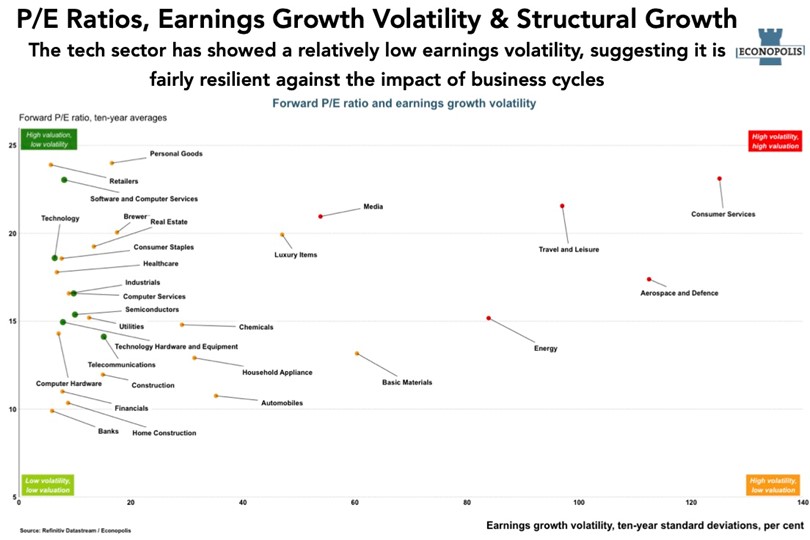

P/E Ratios, Earnings Growth Volatility, and Structural Growth Potential

Most investors are familiar with the Price-to-Earnings ratio, or P/E ratio, which is a financial metric used to assess the value of a company's stock. It is calculated by dividing the market value per share of a company by its earnings per share. Typically, a high P/E ratio suggests that investors have high expectations for the company's future earnings growth, while a low P/E ratio suggests that a company is undervalued or experiencing operational and/or financial difficulties. Currently, Nvidia trades at a 55x P/E (20-year average P/E 42x), while Renault trades at a 3.7x P/E (20-year average P/E 8.4x).

On the other hand, the concept of earnings growth volatility is less well-known. That said, it is an important measure for investors as it provides an indication of the level of risk associated with investing in a particular company. Earnings growth volatility basically refers to the degree of fluctuation in a company's earnings growth over a specific period. Companies with low earnings growth volatility exhibit stable and consistent earnings growth, whereas those with high earnings growth volatility often demonstrate unpredictable and inconsistent earnings performance. The earnings growth volatility for Apple, expressed as the 10-year standard deviation of its earnings, stands at 5.6%, while for Lanxess, this figure stands at 85.2%.

Broadly speaking, it is fair to say that business-cycle fluctuations are one of the key components of earnings volatility. However, the earnings volatility of sectors that benefit from structural growth trends, such as exponential technologies, is also influenced by this structural growth. Structural growth refers to a company's ability to grow its earnings consistently over the long term, regardless of short-term economic fluctuations. This type of growth is usually driven by elements like innovation, geographic expansion, and a dominant market presence. Companies with strong structural growth potential may offer more stable investment returns over time, as their earnings are less likely to be impacted short-term market conditions.

Identifying Sectors Vulnerable to Economic Downturns

Following the latest decisions by centrale banks such as the FED and the ECB, the narrative that excessively high interest rates are driving the economy towards recession is growing more resonant by the day. Actually, at the beginning of the year, the fear for a recession was already present in the minds of investors, and hence should somehow be reflected in the P/E ratio. Let’s consider, that the rising interest rates have increased the odds of an economic decline. In that event, it is interesting to consider which sectors are more susceptible to an economic downturn by looking at their earnings volatility.

The scatter graph (click here for an HD-version) shows on the vertical axis the 10-year average of the forward P/E-ratio, while on the horizontal axis the 10-year average earnings growth volatility (based on their standard deviation) of a large number of worldwide equity sector indices. We consider that the more to the right a sector is, the more that the earnings volatility of the sector is influenced by business-cycle fluctuations. Not surprisingly, you will find sectors such as Basic Materials (mining, chemicals, and commodity companies), Energy, Media (publishers, broadcasters, advertisers) but also Travel Leisure and Consumer Services (car rental services, delivery services). Thus, it would be prudent to closely monitor any companies from these sectors within your portfolio.

Not surprisingly, sectors with the lowest earnings volatility are Healthcare, Consumer Staples, Financials, and Food Retail. The Technology sector in general also features among the sectors with the lowest earnings volatility. We believe that the tech sector's resilience to business cycles can be attributed to a number of factors. Firstly, continuous innovation which allows it to constantly offer novel solutions. Secondly, the ongoing digital transformation across industries ensures that the demand for tech is consistently high. Lastly, the high scalability of tech companies allows them to adapt quickly to changing market dynamics. Within the Technology sector, the Software and Computer Services sector has the lowest earnings volatility, while the Semiconductor and Telecommunications sector has the highest earnings volatility with the broader technology category. In summary, it's fair to assert that over the past decade, the technology sector has showed a relatively low earnings volatility, suggesting a notable resilience against the impact of business cycles, and is capitalizing on the structural growth inherent to the tech sector.

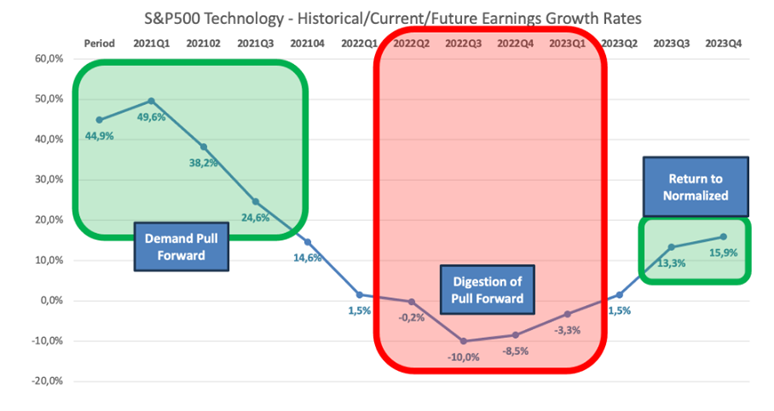

Tech Sector Rebounds: Positive Earnings Growth on the Horizon

To conclude, we wanted to also share following graph, which shows the historical, current, and future earnings growth rate of the S&P 500 Technology index. The graph clearly shows that during the covid-year 2021 growth within the sector surged, as a lot of sub-sectors within the tech sector experienced either a demand pull-forward or a strong build up in inventory throughout the supply chain. This resulted in astonishing earnings growth rates of up to 50%! That situation gradually started to turnover toward the end of 2021 and the beginning of 2022, leading to an earnings recession as of the second quarter of 2022. These negative earnings growth rates are actually quite exceptional, especially considering the positive earnings growth of the broader market. In fact, the only reason for this earnings growth is the whiplash or mirror image of the hyper growth enjoyed during 2021. Encouragingly for the technology sector, as of the second quarter of 2023, the earnings growth is beginning to turn positive, progressively approaching the double-digit earnings growth rates that are typically associated with a structurally growing sector. Actually, we don’t exclude the possibility that the tech earnings will veer up more strongly than currently expected as the amplitude of the digital covid-wave needs more time to normalize. Products with a 2 to 3-year replacement cycle, that were boosted during the covid-years, are now gradually coming up for replacement.

As an overall summary, the low earnings volatility of the tech sector seems to suggest that the tech sector is resilient for business cycles, while the structural earnings growth of the sector clearly is a supporting factor. As such, if the central bank-induced global recession would materialize in the coming months, it is likely to have a more limited impact on the broader technology sector compared to other sectors. Moreover, the covid-digitalization is most-likely turning positive again as of this quarter, which clearly be a supporting factor for the valuations of technology companies in the coming 12 to 18 months.