Philippe Piessens is Senior Wealth Manager at Econopolis Wealth Management. Philippe has extensive experience in financial services, with a focus on equities. He started his career in 2001 at Lehman Brothers in London, and subsequently worked at HSBC and Kepler Cheuvreux. In addition, Philippe is active in art, as a collector and advisor, and in property, via his family business. Philippe received a BSc in International Relations at the London School of Economics.

Crypto: An Island Adrift

An Era of Speculative Capitalism Coming to an End?

In "Cosmopolis", a concise yet thought-provoking novel published in 2009 by American author Don DeLillo, the protagonist, a hedge fund manager, develops an obsession with a phrase in a Zbigniew Hebert poem: "the rat becomes a unit of currency". He believes this phrase aptly reflects an era of speculative capitalism in which "money has lost its narrative quality the way painting did once upon a time. Money is talking to itself". This sounds like nothing more than a facile generalization turned into a clever sounding literary trope. However, it almost perfectly captures the world of Cryptocurrencies, which today still stands at a market capitalization of over 1 trillion USD.

Unlike commodities, which serves as raw material for the production of goods and services, or stocks and bonds, which are used by corporations to raise capital and create economic value, cryptocurrencies serve no clear purpose. When “cash” is deployed in capital markets, it generates a real economic as well as a financial return. However, when it flows into crypto, it tends to remain idle, akin to being stored under the proverbial digital mattress. The only available return to crypto speculators is to sell to new entrants at a higher price, converting back to “fiat currency” in the process. Higher prices will be available, only if the amount of cash going in, outstrips outflows and new supply. Even though this is a zero-sum-game, price movements can be spectacular: Bitcoin soared from below 10,000 USD in the autumn of 2019 to 60,000 USD in the spring of 2021.

Today, the price of Bitcoin is just above 26,000 USD, and the collective market capitalization of all cryptocurrencies amounts to approximately 1 trillion USD. Die-hard fans see the current period as another “crypto winter”, a period of transition ahead of a new bull run that will take Bitcoin to new highs. Others call for a further correction, driven by higher interest rates, and less ample global liquidity. Below, I make the case for a third possibility, namely that independent of the “price” of Bitcoin, the crypto market increasingly resembles an isolated island that is adrift from the financial system, and that a lot of “hodlers” will find themselves trapped as the bridges to “fiat currency” are being burned. The principal reasons for this disconnection are liquidity and regulation.

Liquidity Challenges and Price Diverge

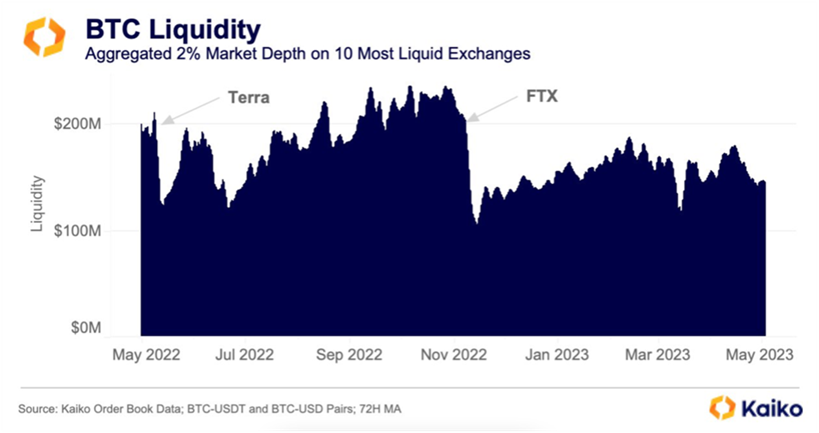

Despite experiencing a 75% year-to-date rally, Bitcoin has seen a plunge in liquidity. In other words, the price of Bitcoin has moved up, while fewer investors have been actively buying it. As the chart below shows, liquidity became more erratic in 2022, with the collapse of TerraLuna, a so-called stablecoin (more on this below). Its price dived in the autumn of that year, after the collapse of FTX, a Bahamas-based cryptocurrency exchange that displayed severe deficiencies in business ethics and risk management. With the bankruptcy of FTX, a major trading hub, liquidity provider, and counterparty disappeared. This has left US-listed Coinbase and Binance, a somewhat mysterious exchange without headquarters operated by the enigmatic Changpeng Zhao, as the main exchanges. Rather worryingly, according to a recent report by CoinDesk, Binance accounted for 92% of Bitcoin trading volume in March 2023. However, with Binance now in the crosshairs of regulators and law enforcement globally, as I will discuss below, there is a huge systemic risk to the crypto edifice.

Un-Tethered, Unveiling Risks and Red Flags

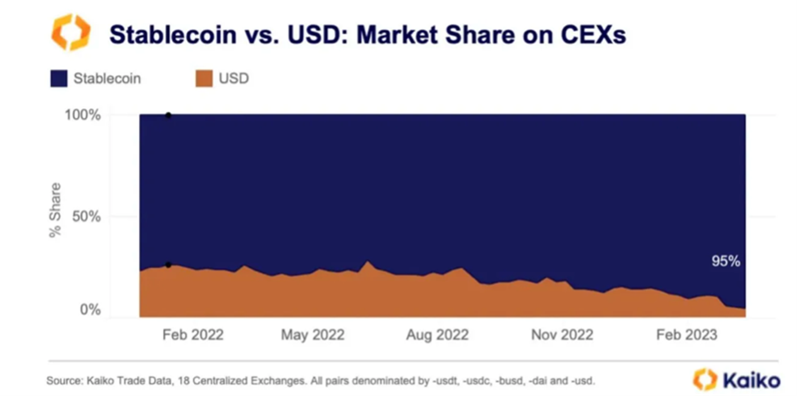

Further exacerbating the liquidity problem highlighted above, is that most of the liquidity in the market is not in USD (or EUR), but rather in Tether (UST). In fact, looking at the graph below, one is led to conclude that the price of Bitcoin is not 26,000 USD but rather 26,000 UST. Tether is a so-called stablecoin, that is pegged 1-for-1 to the USD, issued in exchange for fiat currency (like USD), and backed by ultra-safe interest-bearing instruments. There are two problems with this. Firstly, to date, IFinex, the company issuing Tether, has not been able to provide an audit trail proving it is fully backed. In fact, in 2021 it was found guilty by the Office of the New York Attorney General of misleading investors and ordered to pay 18.5 million USD in damages. Secondly, as shown in yet another bankruptcy case, that of crypto lender Celsius, Tether has also issued new stablecoins as collateralized loans to crypto market participants. Concretely, a crypto speculator could offer their Bitcoin as collateral for a loan in UST, use that UST to buy more Bitcoin (thereby driving up the price), and do the same thing all over again. And this is not to mention the multiple red flags surrounding the Tether enterprise, from the shadowy origins of its founders to the fact that it is banking with Deltec, a Bahamas-based bank previously convicted for money laundering.

Operation Chokepoint: US Agencies Intensify Efforts to Curb Crypto Excesses

If, to some, regulators and law enforcement agencies were deemed too slow in curbing the excesses of the crypto bubble, there is no doubt that in recent months, especially US agencies have moved aggressively against some of the largest actors in the space. Gary Gensler, the chair of the U.S. Securities and Exchange Commission (SEC), criticized the industry’s resistance to complying with existing regulations, had warned them as late as September 2022 of the onslaught that was coming: “Not liking the message isn’t the same thing as not receiving it."

Following the blowup of Silicon Valley Bank, lawmakers and officials at the Federal Deposit Insurance Committee (FDIC), forced the closure of Silvergate, a major counterparty for crypto businesses and investors. They also made bailouts of other banks conditional on them severing ties with the crypto market. The so called “off-ramps”, allowing crypto to be converted into fiat currency, and re-enter the “real economy” are being closed. First the Commodity Futures Trading Commission (CFTC) and then the SEC, targeted Binance, alleging numerous offenses ranging from improper controls, misappropriation of customer funds, and market manipulation. The United States Department of Justice (DOJ) has been investigating Binance since 2022, having identified it as a possible money laundering hub. Binance, remember, where most of the daily trading in Bitcoin takes place, incidentally, denominated in Tether. Then there is the Internal Revenue Service (a government agency in the United States responsible for collecting taxes and enforcing tax laws), which is targeting crypto speculators, and intends to claim its share, even in cases where customer funds were stolen or lost in bankruptcy proceedings.

This Could Be Heaven or This Could Be Hell

With liquidity dwindling in the market, and major market makers being pursued by numerous regulators and law enforcement agencies (SEC, CFTC, DOJ, FDIC, IRS), and the main denomination of the price of Bitcoin, Tether, having all characteristics of a Ponzi scheme, the question arises why there are any crypto holders (or “hodlers”, as they like to call themselves) left. Some, such as criminals, money launderers, arms dealers, or terrorists, no doubt have nowhere else to go. Assuming the majority of hodlers are none of the above, they remind me of the well-known internet meme featuring a dog behind a computer, sitting in a burning room and exclaiming: “this is fine”.

As the regulatory crackdown continues, crypto holders are likely to face growing difficulties. They may find themselves trapped, with limited options to off-ramp their crypto holdings into traditional currencies like USD or EUR. They might encounter challenges in spending their crypto and could be subjected to scrutiny by banks implementing stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. Additionally, tax authorities are targeting crypto holders, adding further pressure. In this context, the claims of crypto’s “censorship resistance”, portability, and anonymity will provide scant comfort. At least the gold bugs who did not hand in their gold when it was confiscated with the Gold Reserve Act, held on to a shiny metal used in jewelry. Bitcoin holders will have … what exactly?

They may yet be saved from financial purgatory. Regulation may open up the way for institutional adoption, which would see asset managers like Blackrock and Fidelity allocating capital to Bitcoin as “digital gold”, and banks like JP Morgan facilitating the origination and trading of digital assets. Absent this scenario, they may find themselves in the position of the protagonist of the Eagles’ Hotel California: “Last thing I remember, I was running for the door. I had to find the passage back to the place I was before. Relax, said the night man. We are programmed to receive. You can check out any time you like, but you can never leave".