Is the Sun Shining for Solar Energy?

The world is constantly changing. Examples such as Artificial Intelligence (AI), e-commerce, and shifting demographics clearly demonstrate this fact. Innovation is a good thing as productivity growth is essential for economic expansion.

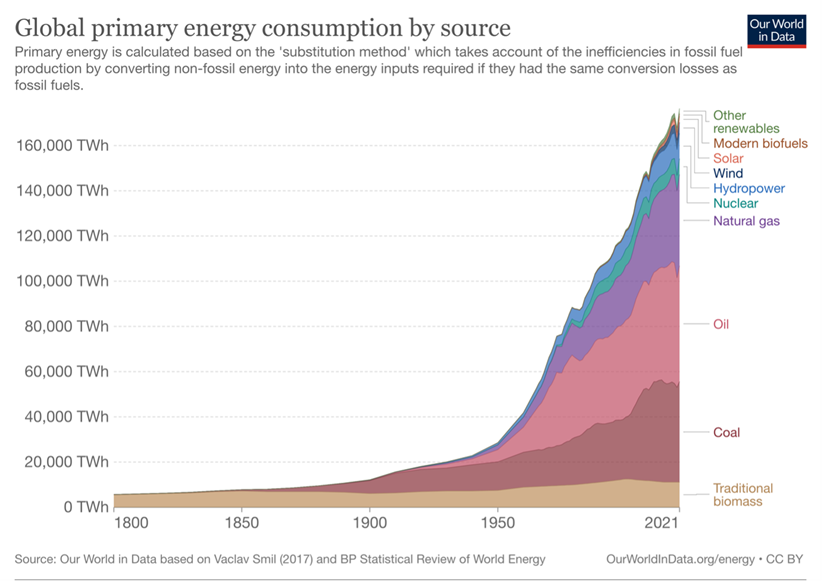

Another area undergoing rapid change is our source of energy consumption. Since the 19th century, there have been three major energy revolutions:

- The first energy revolution involved a shift from biomass to coal, beginning in the mid-19th century;

- The second energy revolution occurred in the 20th century when the world transitioned to a wider range of sources, primarily oil, gas, and hydropower. It wasn't until 1960 that nuclear power was added to the mix;

- The third energy revolution, starting in 1980, has seen a move towards renewable energy sources.

Source: OurWorldInData.org

The most important conclusion that can be drawn from 200 years of global energy consumption? Energy transitions have historically been slow. It has often taken several decades for a new energy source to become dominant.

This underscores the immense challenges we face. The shift to renewable energy needs to happen much faster than any other energy revolution in human history. The International Energy Agency (IEA) projects that by 2050, renewables should generate 90% (!) of our electricity to achieve climate neutrality. Goldman Sachs estimates that an annual investment of $3 trillion is necessary to reach Net Zero by 2050. Meanwhile, JP Morgan recently suggested that Net Zero could require energy investments of up to $9 trillion per year, amounting to almost 9% (!) of global GDP.

Solar Energy as Dominant Renewable Energy Source

Is there good news? Indeed, a study by BNEF has found that renewable energy is now the cheapest source of electricity in several countries, which together account for 85% of global GDP.

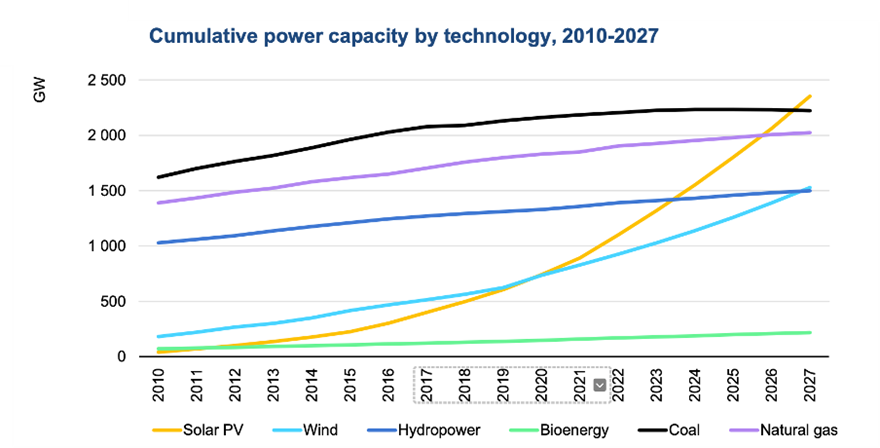

In June, the International Energy Agency (IEA) published its Renewable Energy Market Update. In their base case scenario, they forecast a 440 Gigawatt (GW) increase in global renewable energy across all technologies by 2023. This is up 107 GW, or 32% compared to last year. To put these numbers into perspective: a typical nuclear reactor produces 1 GW of electricity, and 1 GW can power approximately 750,000 homes (Source: CNET).

In 2022, solar PV and wind accounted for 92% of renewable power additions. 348 GW of renewable power capacity was added in 2022, up 13% from 306 GW in 2021. Today, renewables cover 30% of global electricity generation, with solar PV and wind power contributing 12%.

Even though the global wind market is projected to add a record-breaking 107 GW in 2023, solar energy appears to have more potential than wind in the years to come. The IEA remains cautious on its wind outlook, predicting a 5% year-on-year decline in 2024 due to permitting delays slowing installations. Solar energy on the other hand should be able to continue to grow at attractive rates. The IEA estimates 287 GW of solar additions during 2023 while BNEF estimates 344 GW. 344 GW in solar additions would imply a year-on-year growth of 36%. Research provider CLSA estimates that the market for solar energy will grow at a Compound Annual Growth Rate (CAGR) of 20% until 2030.

Source: International Energy Agency (IEA) based on World Energy Outlook 2022

From Polysilicon to Solar Modules

Now that we understand energy transitions typically occur over extended periods, and that solar energy holds the most potential among renewable sources in the short to medium term, let's shift our focus. We'll transition from the macro perspective to a more micro-level examination.

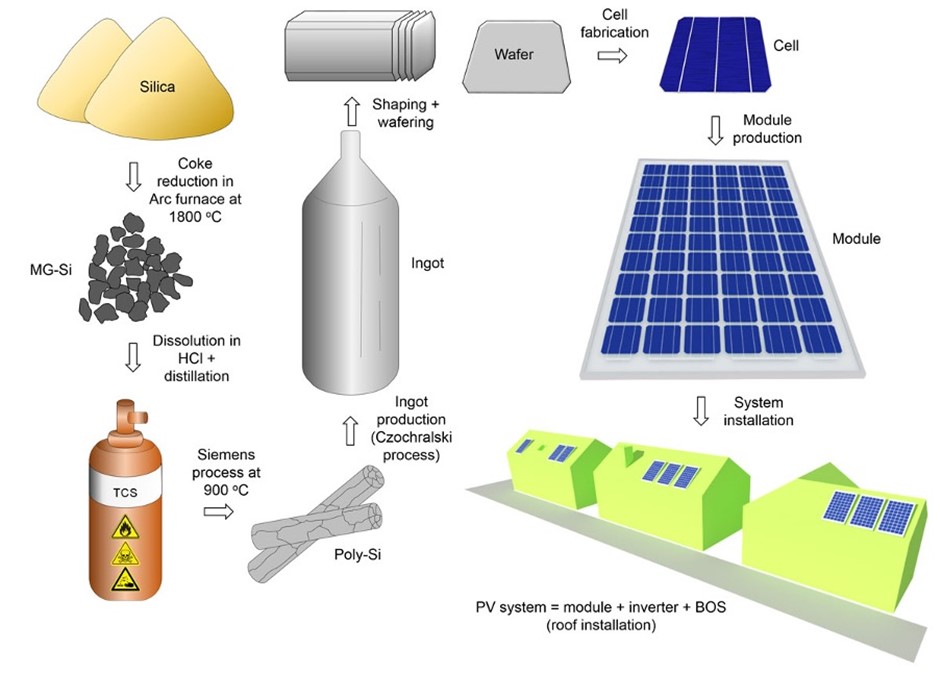

First, we’ll take a look at how solar modules are produced. The different steps needed to produce a solar module can be visualized as follows:

Source: Cheetah – European Energy Research Alliance

Polysilicon, a pure variant of silicon, plays a crucial role as a primary material in the supply chain of solar photovoltaic (PV) systems. Polysilicon is a high purity polycrystalline form of silicon used as a raw material by the PV industry. Polysilicon can be manufactured with different technologies. At this point in time, the Siemens process is the most used one. This particular process includes the distillation of silicon compounds that are volatile, followed by their decomposition into silicon under high temperatures. Major polysilicon companies are among others Wacker Chemie and OCI.

After polysilicon undergoes a high temperature melting process, ingots are created. A silicon ingot represents the solid and bulk form of crystalline silicon before being thinly divided into wafers. Using diamond blades on a high-speed wire saw, the ingot is sliced into circular wafers with a thickness ranging from 300 to 1000 microns (a human hair strand is approximately 70 microns) and a diameter between 25 mm and 300 mm. These wafers find application in solar cells. The thickness of the wafer is determined by the strength of the material, which is influenced by the process of melting silicon to form the ingot and the inclusion of other materials. If the wafer is sliced too thinly, it becomes prone to cracking and lacks the necessary structural stability to be utilized in solar panels or electronic circuits. Major companies active in ingots/wafers are among others Siltronic, GlobalWafers and SK Siltron.

The conventional procedure for manufacturing solar cells using silicon wafers involves a sequence of nine steps, starting with an initial quality assessment of the silicon wafers and concluding with the final testing of the completed solar cell.

The process can be summarized as follows:

To give the solar cell practical value, solar modules are needed. A single PV Module is a unit comprising interconnected solar cells that capture sunlight as an energy source to generate electricity. To achieve the desired current and voltage, a collection of PV modules is needed, these are interconnected and wired together to form a larger arrangement referred to as a PV array.

Last but not least, it is crucial to maintain a balance between various components, a concept known as the Electrical Balance of System (EBOS), in a photovoltaic system. Inverters are an important part of the EBOS. They enable the use of standard AC-powered equipment by converting the direct current (DC) electricity generated by the solar panels into alternating current (AC) electricity. This conversion makes the electricity compatible with common household or commercial appliances and electrical systems. By incorporating an inverter, the photovoltaic system becomes capable of seamlessly integrating with and powering regular AC-powered devices. SolarEdge, SMA Solar and Enphase Energy are two dominant companies active in the inverter market.

The Solar Value Chain: Chinese Dominance in a Competitive Market

The solar value chain is very broad and there are multiple interesting companies across the entire value chain.

It is noteworthy to underline the geopolitical risk within the solar value chain. Solar PV production remains heavily concentrated in China. Currently roughly 80% of all modules, 85% of all cells, 95% of all Ingots PV, 98% of all wafers and 75% of all polysilicon are produced in China. Low-cost Chinese solar companies are gaining market share in the United States as well as in Europe, resulting in lower margins for the entire industry. Political initiatives such as the American and European Inflation Reduction Act try to make the US and the European Union more self-sufficient, but this is going to be a big challenge.

In general, the solar industry is a difficult sector to invest in. Chinese low-cost producers are pushing down margins and results are often very volatile as they are dependent on several input prices. That’s exactly why it can be very difficult for individual investors to see the forest for the trees when selecting solar stocks. It is therefore recommended to seek professional advice.