Siddy holds a Master’s degree in Economics from the University of Antwerp and a Master's degree in Financial Management from the Vlerick Business School. Passionate by innovation and entrepreneurship, he also participated to an Executive Master in Venture Capital at the Berkeley Haas School of Business. Prior to joining Econopolis, he managed the Investor Relations & Treasury office at Orange Belgium, a telecom company. Siddy also held the position of Telecom, Media & Technology analyst at a large Belgian Asset Management firm. Further, he is also active in the advisory board of StartupVillage and The Beacon, a business and innovation hub in the center of Antwerp focused on Internet of Things and Artificial Intelligence in the domains of industry, logistics and smart city. At Econopolis, he is Portfolio Manager of the Econopolis Exponential Technologies Fund.

Times are Changing: the Quest for Growth is Upon us

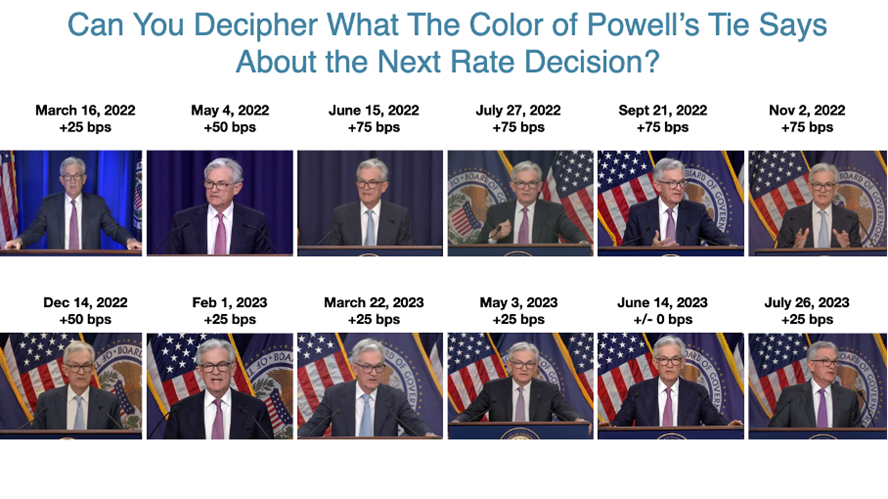

The day is 28 July 2024! Yes 2024. Approximately one year ago, the financial community put an end to its peculiar game of speculating about the color of the tie worn by Jerome Powell, the Chairman of the US Federal Reserve. For over a year, a significant number of financial market participants had been fervently analyzing each and every detail they could find, attempting to accurately predict the color of Mr. Powell's tie during his post-FOMC press presentations.

The day is 28 July 2024! Yes 2024. Approximately one year ago, the financial community put an end to its peculiar game of speculating about the color of the tie worn by Jerome Powell, the Chairman of the US Federal Reserve. For over a year, a significant number of financial market participants had been fervently analyzing each and every detail they could find, attempting to accurately predict the color of Mr. Powell's tie during his post-FOMC press presentations.

However, suddenly, these very same individuals abandoned their 'Sherlock Holmes' positions and shifted their focus away from predicting tie colors. Instead, a new obsession took center stage - the pursuit of growth. Strategists, economists, analysts, and enthusiasts all delved deep into profit & loss statements, balance sheets, and cash flow statements, in search of the new holy grail: GROWTH! This intense quest spanned across company, sector, country, and global levels, creating a thrilling rush of nervousness.

Some explorers found that the balance sheets of a number of industrial companies were not as robust as they seemed a couple of years ago. Those companies had invested too much in capacity expansion. The allure of remarkably cheap money pushed them to invest in state-of-the-art warehouses, new product categories and geographical areas garnering them attention and fame. Why worry about the customers’ needs and changing trends, the demand was there at the moment, even too much demand. They operated under the assumption that if they built it, customers would come.

The case was different for consumer discretionary companies. They proactively listened to their consumers through innovative AI-driven eavesdropping devices, gaining insight into customers' buying intentions even before the customers themselves were aware of them. This enabled these companies to optimize their supply chain management and significantly improve their working capital. Consequently, they experienced a substantial boost in free cash flow generation, enabling them to adopt a generous shareholder remuneration policy. But then, an unusual phenomenon occurred - the AI-driven eavesdropping device no longer captured the same volume of buying intentions. At first, scientists hypothesized that the device had malfunctioned or that the AI model had become ineffective. However, upon further investigation, they discovered that consumers were not spending at the same levels as before. After years of high spending, a sudden decline perplexed everyone, consumers all of a sudden stopped spending! Was it because inflation finally caught up with them, or because covid-related fiscal spending finally was depleted. Nobody knows.

In Paris, the 2024 Olympic Games had just begun. For the first time in history, the Opening Ceremony of the Olympic Games had not taken place in a stadium. On July 26, 2024, thousands of athletes had paraded in boats along the Seine, the river that flows through Paris, in front of hundreds of thousands of spectators. The opening ceremony for the Paris 2024 Summer Olympics was the largest ever held in the history of the Games. Close to 600,000 people were invited to the world's greatest celebration of sport. Well, invited is perhaps not the correct word, the invitees had to pay ticket prices of between €500 and €2,700. Most of them had bought their tickets when interest rates were still low and the economy was still growing, but since the fourth quarter of 2023 the economic landscape had shifted to the downside. Some of them regretted having spent that much money. The impact of higher rates is increasingly being felt.

Approximately two months ago, from June 6 to June 9, 2024, all Europeans had the opportunity to cast their votes in the European election. The dust from these elections is still settling, but their outcome will play a significant role in shaping the political composition of the European Parliament and influencing decision-making processes within the EU. Over the past two decades, the decisions made within the EU have increasingly impacted the lives of its citizens. However, amidst the ongoing war in Ukraine, geopolitical tensions which have drawn involvement from every continent, and the highly contentious upcoming Presidential elections in the US (scheduled for November 5, 2024), the importance of these European elections has only intensified. Understandably, such uncertainty weighs heavily on business and consumer confidence, leading to a further hampering of economic growth.

In response to these challenging economic conditions, the US central bank took action to support the US economy. On May 1, 2024, for the first time since March 16, 2020, when an emergency rate cut was implemented to address the Covid-19 pandemic, the US central bank lowered its policy rate by 25 basis points. They further cut an additional 25-basis points on June 16, 2024, with expectations of another 25-basis point cut in the coming days. These measures are aimed at reigniting economic activity in the US, given that consumer spending has declined. The ECB, who had one year ago increased its policy rate to 3.75%, seemed to have been paralyzed over most of the time, because they have not changed their policy rate since. Only on June 6, 2024, did they hold a debate regarding a potential 25 basis point rate reduction to stimulate the economy. Ultimately, they decided against the rate cut to avoid any interference with the EU elections.

So, now you understand why the color of Powell’s tie didn’t matter anymore. Central banks had tightened their monetary policy rate too much in their pursuit to combat inflation, so much that they also squashed economic growth. You now also understand, why investors across all spectrums are now seeking companies that can demonstrate not only revenue growth but also profitability and strong cash flow. Such companies serve as the driving force behind innovation, job creation, and progress.

Thankfully, the technology sector has shown resilience, especially in the last year. In 2022, the tech sector faced significant challenges, being criticized and drawing parallels to the dotcom crisis. This scrutiny arose from their inability to maintain the same exceptional growth rate experienced during the surge of digitalization amid the corona years. Furthermore, the substantial increase in central bank policy rates during that period mechanically impacted the discount rate applied to the future cash flows of these growth stocks. Rendering their future cash flows less worth at the present. However, intrinsically these companies remained fundamentally strong and robust. They continued to benefit from the long-term structural growth trend driven by exponential technologies. The core foundation of these tech companies was solid, based on the relentless advancement and adoption of transformative technologies.

In early 2023, the concept of artificial intelligence had already captured the imagination of many. However, it was not until July 2023 when technology companies began to witness a resurgence in their earnings growth, that investors started to re-appreciate the value of long-term durable growth. A notable example of this was Alphabet, which disclosed strong results on July 26, 2023. The company expressed excitement about the momentum of its products and overall business, underscoring the immense opportunities presented by AI. They reassured investors that AI was still in its early stages, leaving ample room for further development and growth. Alphabet highlighted the reacceleration of its Search and YouTube business segments, as well as the impressive momentum in its cloud business. Additionally, the company emphasized its commitment to re-engineering its cost base in a sustainable manner, signaling a shift towards profitability-focused growth. This approach had caught the attention of other tech companies as well, with many now dedicated to not only growing their topline but doing so in a profitable manner.

On the same day in July 2023, Microsoft also released its results. As a pioneer in the AI movement, Microsoft had experienced a surge in its stock price, soaring by 40% since the start of 2023. Given such high expectations, it was only natural that the stock experienced some volatility following the earnings announcement. Nevertheless, the results themselves were solid and provided clear indications of the seeds of growth that are now flourishing. 2025 even looks to become an even better year for them.

The list of tech companies that hinted in July 2023 at the emergence of a reacceleration trend was big. However, considering the press headlines at the time, it's understandable that their CEOs and CFOs remained cautious then, given that the growth resurgence was still fragile and uncertain. One notable example was the semiconductor sector, which had experienced a significant inventory destocking process between the end of the third quarter of 2022 and the start of the third quarter of 2023. This had compelled companies to temporarily curtail their production capacity in order to counter the decline in chip demand. The memory market was particularly impacted, resulting in a sharp plummet of chip prices by more than 40%. Fortunately, for companies like Micron, SK Hynix, and Samsung Electronics, the destocking phase came to an end in the third quarter of 2023. Subsequently, demand began to pick up strongly in the fourth quarter of 2023, enabling these companies to raise memory chip prices by more than 60%. This positive development signaled a much-needed turnaround in the memory chip market, which in turn benefitted most of the semiconductor equipment companies.

To conclude, by July 2024, the fascination with tie-watching had been replaced by a fervent quest for growth. A quest that hopefully doesn’t limit itself only to technology stocks, but also to several other structural growth themes. Wow, the summer of 2024 is hot! The summer of 2024 is even surpassing the record warmth of the previous year, 2023. I can only hope that the efforts to successfully guide our energy transition are picking up pace, as the urgency for sustainable solutions are intensifying every day. Well, that story is for another time.