‘Tech Leadership’ Continues the Dance

'Follow the leader, leader, leader'

It's highly likely that you're familiar with the 1998s song 'Follow the Leader' by the Dutch group The Soca Boys. The lyrics are straightforward and go something like this: 'Follow the leader, leader, leader / Follow the leader / ...' Be cautious because once this song gets into your mind, its catchy tune will get stuck in your head, and you'll find yourself continuously repeating it uncontrollably.

In 1998, Microsoft was 23, Apple was 22, Amazon was 4-year-old, Google was just founded, and Meta (formerly known as Facebook) did not even exist, as it was only founded in 2004. This band of five dominated the stock market during the longest bull market in this century. This bull market started in March 2009 (at a moment the US was in a deep recession, the unemployment rate was rising to 10% and the FED was scrambling all efforts to stimulate the economy) and ended in February 2020 with the onset of the COVID-19 pandemic. It was fueled by a combination of factors, including low interest rates, economic growth, and corporate profits. Tech leadership, or the outperformance of technology companies in the stock market, was also a key trend during this period. Driven by the growing importance of technology in the global economy, as well as investors' confidence in the future growth potential of the tech industry. The companies leading the way in tech innovation, from smartphones to cloud computing, were also leading the way in stock market performance. With the increasing use of exponential technologies in everyday life, it is not surprising that the technology sector has become a key driver of overall market performance.

The streak of 11 years continued quickly after the initial doom-and-gloom of COVID-19, leading to stellar tech leadership in 2020 and 2021. However, somewhere around November 2021 tech stocks turned suddenly in the anti-hero. The ultra-sonic speed at which central banks increased policy interest rates pummeled the status of tech leadership, causing a sudden downturn in the market, and ending their leadership period.

(Cash) Earnings are the most important factor for long-term value creation

While rising interest rates are often cited as the main reason for the deep fall in tech stock prices in 2022, it is also true that the earnings of tech stocks peaked in the fourth quarter of 2021. Much of the demand for tech products and services, such as computers, laptops, flat-screen TVs, and e-commerce, was pulled forward from previous periods, leading to a drop in demand in the first half of 2022. This, coupled with companies lowering their inventories back to normal levels, had a significant impact on the earnings growth of most, if not all, technology companies, including the band of five that had previously led the tech leadership movement.

As of now, the market is expecting the Federal Reserve to announce one more rate hike at its upcoming meeting next Wednesday, followed by a pause and even potential rate cuts in the following meetings. Even if this scenario does not play out as expected, any further rate decisions are likely to be less impactful than the earth-shaking blitz rate hikes of 2022. Therefore, it is the relative earnings power of technology stocks versus other sectors that will determine whether they can regain their leadership position in the market. In particular, as the effect of the covid-induced demand pull forward, is progressively unwinding.

So, let’s have a closer look at the recent earnings report and financial performance of the ‘leaders of the tech leadership’ movement, to look for evidence that they can again rise to the crown they previously held.

***

Microsoft reported revenues of $52.9 billion for the third quarter of its fiscal year 2023, a 7% increase from the same quarter last year. Revenue growth re-accelerated compared to the meager 2% year-on-year growth in the previous quarter. Microsoft's Azure, the company's workhorse, grew by 31% and is becoming a larger portion of the overall revenue. Microsoft Azure has a worldwide market share of about 21%, and the company aims to increase that share, not least due to the new workloads brought by Microsoft's artificial intelligence initiatives. It is interesting to note that the CFO indicated that the cloud optimization of its customers is nearly complete, as the start of these optimization processes is reaching its first-year anniversary. Overall, the company expects the improving trends seen in the past quarter to continue in the coming quarters. Microsoft's share price jumped 11% following its earnings release.

***

Alphabet reported revenues of $69.8 billion for the first quarter of 2023, an increase of 2.6%. Although this figure pales in comparison to the nearly 20% revenue growth the company achieved before the 2020 COVID period, it is an acceleration from the previous quarter. Alphabet faced a challenging environment due to the worsening advertising landscape over the past year. However, this may provide a silver lining in the coming quarters, as it will be increasingly easier to achieve better year-over-year results for the remainder of 2023. In other words, while the current advertising climate may pose difficulties for Alphabet in the short term, it could create favorable conditions for the company to outperform its previous year's results in the future. Furthermore, the company indicated that its cloud segment grew a healthy 28% to $7.5 billion. Google's worldwide cloud market share is only about 11%, making it the third cloud player. While total revenues seem to have bottomed, this cannot be said of its operational profit, which came out well below the peak realized in the fourth quarter of 2021 and is still on a declining path. The cost management initiatives that were announced earlier this year are expected to gradually contribute to an improvement in the cost structure in the coming quarters. The company's CFO, Ruth Porat, repeatedly stated that they want to ensure expense growth does not outpace revenue growth. Thus, it appears that the profit inflection point is near. Alphabet's share price increased by 4% following its earnings release.

***

Meta Platforms reported revenues of $28.6 billion, an increase of 3%. For the first time in four quarters, the company is reporting positive revenue growth. The company highlighted its growing customer base and vastly improved engagement across its different platforms, thanks to the smart usage of artificial intelligence (partly neutralizing the negative effect of Apple's stronger privacy rules, which render Facebook's targeted advertising less effective). The total number of ad impressions served across their various platforms increased by 26% year-on-year, but the average price per ad experienced a significant decrease of 17%. The company indicated that overall pricing remains under pressure, though they anticipate ongoing improvements in ad targeting and measurement, which should enhance overall platform monetization. The first quarter operating income was $7.2 billion, representing a 25% operating margin. However, this marks the sixth consecutive quarter that the company is reporting negative operational profit growth, albeit with a smaller decline than in previous quarters. The company emphasized an increased focus on operating efficiency going forward. Therefore, if all goes according to plan, the company's operational profit should start benefiting from cost-cutting measures, while at the same time, its ad revenue growth should begin to reaccelerate. Meta's share price increased by 14% following its earnings release.

***

On Thursday, Amazon became the fourth member of the "Gang of Five" to publish its quarterly results. The e-commerce and cloud giant reported revenues of $127.4 billion, an increase of 9.4% year-on-year, in line with sales growth achieved in 2022. Although Amazon's AWS cloud segment (17% of total revenues) demonstrated a healthy increase of 16%, this marks the lowest growth pace on record for the cloud leader. The company's worldwide market share hovers around 34%, but its closest competitors are growing faster. Overall, Amazon's revenues are subject to the law of large numbers, making it more challenging for them to maintain the same growth pace. Achieving 20%+ growth becomes harder at $500 billion (2022 revenues) than it is at $100 billion (2015 revenues). Amazon's US e-commerce business (~60% of total revenues) grew 11% year-on-year, while its international e-commerce business (~23% of total revenues) only grew 1%. However, excluding the unfavorable impact from year-over-year changes in foreign exchange rates, the international business would have grown by 9%. Overall, it's clear that achieving top-line growth is becoming more difficult for Amazon.

Fortunately, the company should gradually see the intensity of investments in operational expenses level off, boosting their operational efficiency. For example, the international business is still loss-making as the company invests in new markets. The past quarter could be the first proof that improvement in operational profitability is feasible, as the company reported an operational profit of $4.8 billion, a 30% increase year-on-year. This marks a significant reversal of the year-over-year declines seen in previous quarters. The company believes its profitability trajectory will continue to improve over the coming years. Together with Meta Platforms, Amazon is likely the Big Tech company par excellence that needs to prove itself over the coming years.

***

The last company of the group of five, and certainly not the least, is Apple. They are expected to publish their results next Thursday, May 4. Consensus expectations point to a 4.4% decline in revenue and a 9.5% decline in operational profitability. In previous earnings publications, Apple's CEO Tim Cook explained that the company's revenues were impacted by foreign exchange headwinds, supply issues of iPhone 14 Pro and iPhone 14 Pro Max related to the COVID-lockdown issues at the end of 2022, and a challenging macroeconomic environment. The company then said it expects its March quarter year-over-year revenue performance to be similar to the December quarter. Since then, the exchange and supply headwinds have eased significantly.

***

While Apple has yet to report its quarterly results, it is fair to say that the overall earnings profile of the Big Tech companies is improving. First and foremost, they are benefiting from the structural growth inherent to their innovation and technological prowess. Furthermore, they are moving past the demand pull-forward impact, while simultaneously reaping the rewards of their cost improvement efforts. In one or two quarters from now, we may well be looking back at this quarter as the inflection point in terms of profitability. It is even possible that new all-time high earnings could be within reach in the next 1 to 6 quarters.

Tech leadership needs to be bigger than the big five.

Although the big tech companies will undoubtedly steer tech leadership, a broad-based recapture of overall market leadership requires other tech companies to follow their big brothers' examples. When we broaden the scope to encompass all technology companies, we observe a similar pattern of improving profitability. Let's examine the earnings growth evolution of the S&P 500 and its various subsectors, with a particular focus on the tech sector.

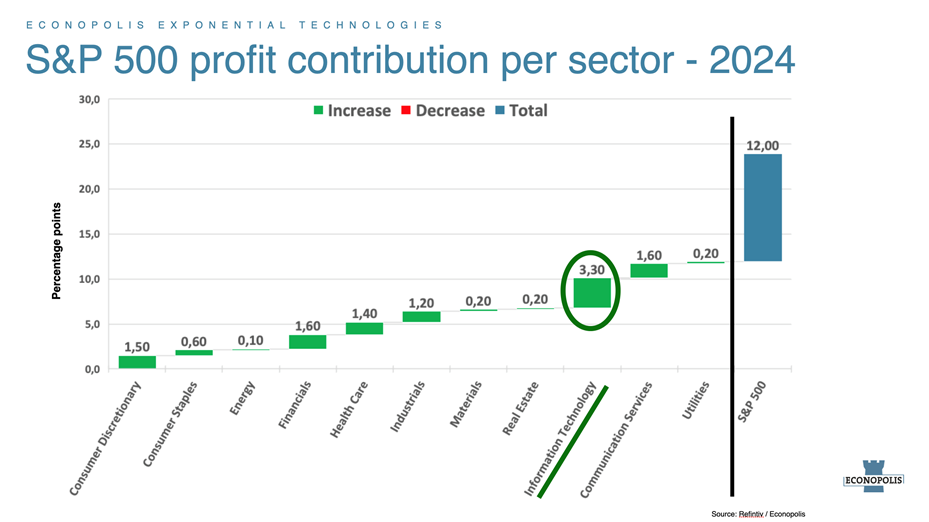

In 2022, the overall earnings growth for the S&P 500 was 4.82%, with the majority of growth stemming from the energy sector and no contribution from the tech sector to the overall growth. The reasons for this lackluster contribution have been discussed earlier. To understand this graph, one should first examine the overall growth figure on the right. This figure is then broken down by different sectors, with each sector either contributing to or detracting from the overall figure.

In 2023, the overall earnings growth expectation for the S&P 500 is projected to decrease to a mere 0.9%. This decline partly reflects the increasing number of indicators suggesting an upcoming economic recession. While the energy sector was a strong contributor to earnings growth in 2022, it is expected to be a detractor in 2023. Other sectors, such as consumer discretionary, financials, and communication services, are anticipated to contribute positively. However, the tech sector is predicted to be a detractor, with a negative earnings growth of 0.2% in 2023. In this regard, it is difficult to argue that the tech sector is poised to reclaim its leadership.

However, if we examine the different quarters of 2023 more closely, the signs of improvement gradually become evident in these earnings expectations. While the tech sector (-2.5%), along with the healthcare sector (-3.4%), are the biggest detractors for earnings growth in the first quarter, pulling the overall growth figure into negative territory (-3.2%), the earnings profile seems to improve throughout the year. In the second quarter, the tech sector is expected to be a detractor with -1%, but by the third quarter, its contribution should turn slightly positive with +0.1%, eventually reaching a positive contribution of +2.5% in the fourth quarter of 2023.

This positive trend continues into 2024, with the overall earnings growth for the S&P 500 projected at 12%, and the technology sector's positive contribution clearly standing out. In this scenario, the tech sector will be taking the first step towards regaining its overall leadership.

In the event of a deep recession, the overall earnings growth might prove too optimistic. However, one can argue that a considerable amount of pessimism is already reflected in the earnings forecast, especially for 2023. That said, the relative strength of the tech sector should hold up in both scenarios. Many end markets are moving past the COVID pull-forward demand. The PC and mobile markets are expected to gradually recover in the second half of 2023, amid projections that inventory levels have declined, and demand is anticipated to improve. The data center, automotive, and industrial end markets remain quite buoyant. So, even if there is an economic recession, the underlying current of the tech sector is shifting in a positive direction.

The earnings results of the big tech companies have set the tone. 2023 will determine if they can regain their position as leaders of the market. We are at least optimistic on the potential for the tech sector to reclaim its leadership in the market.