Cédric Van Hooydonk graduated from the University of Antwerp in June 2022 with a Master's degree in Business Engineering. In his final academic year, Cédric joined the Econopolis team as an interim analyst. He combined his internship with a thesis dealing with the dynamic correlation between equity and bond yields. Cédric is a Portfolio Analyst and also a member of the Risk Committee.

New year, new IPO market?

In financial markets, the Initial Public Offering (IPO) market stands as a barometer of economic vitality and investor sentiment. An IPO marks the transition of a privately held company into a publicly traded entity, opening its doors to a broader investor base and entering a new chapter of growth and visibility.

As companies embark on the IPO journey, the market's response becomes a reflection of broader economic conditions. IPO activity and investors’ reaction shed light on the prevailing mood and confidence levels that resonate throughout the financial system. Thus, the IPO market stands not just as a mechanism for capital infusion but as a mirror reflecting the interplay between economic forces and investor perceptions.

This blogpost explores the IPO landscape by first reviewing the 2023 IPO market and then delving into the key factors that shape the 2024 outlook. We conclude by summarising some potential upcoming IPOs to watch in 2024.

IPO activity disconnected from upbeat equity markets in 2023

IPO activity is positively correlated to financial market performance and negatively correlated to market volatility. In addition, the macro-economic environment plays a significant role in shaping the landscape for IPOs. Companies carefully assess economic conditions before deciding to go public, while investors weigh the macro-economic climate in evaluating the risk and potential return of IPO investments.

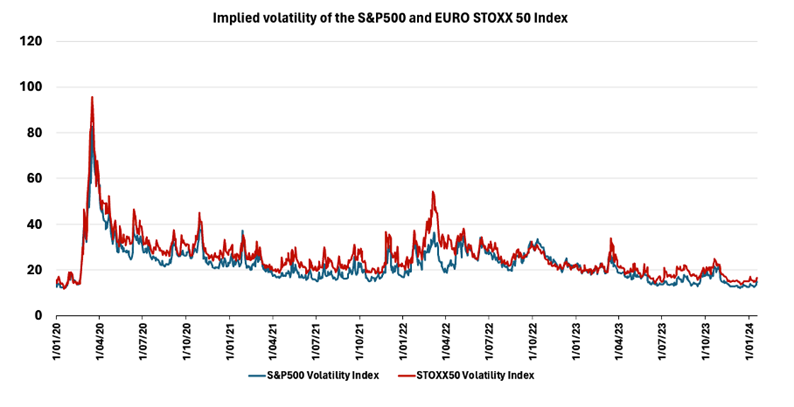

Despite the robust performance of major stock indices and relatively low volatility, the IPO market in the Americas and Europe regions struggled to gain momentum. The dominant success of a few mega-cap technology stocks in driving index performance overshadowed the overall market dynamics. Risk-averse investors, seeking stability amid macroeconomic uncertainty, favored established mega-cap companies, reducing interest in new IPOs.

Various factors, such as geopolitical events, bank failures, rising interest rates, and inflation, contributed to the macro-economic uncertainty and thus the overall slowdown in IPOs in 2023. The persistent high-interest rates set by central banks increased demand for bonds, resulting in lower liquidity in equity markets. With investors displaying a reduced appetite for riskier assets, the timing for companies to go public became less opportune. The combined impact of these factors created a challenging environment for IPOs, reflecting a cautious and risk-averse investor sentiment.

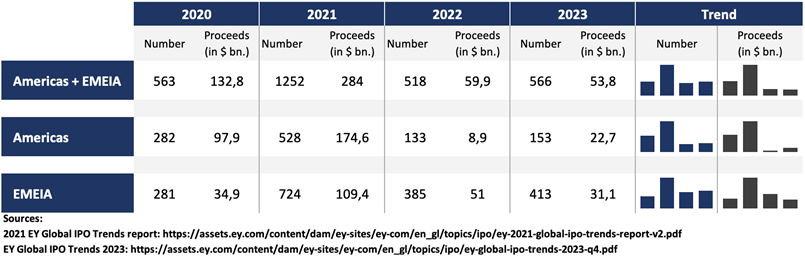

Data given in table 1 shows the impact of the above mentioned contributing factors to a muted IPO market in the Americas and EMEIA. While the year-over-year total number of IPOs increased slightly in 2023, proceeds from these IPO were down 10%. The driver being the sharp decrease in IPO proceeds in Europe, the Middle East, India and Africa (EMEIA).

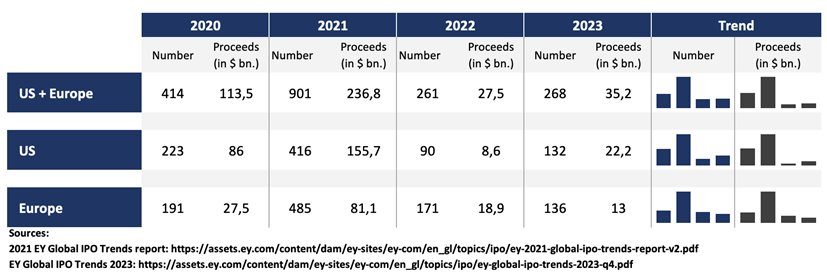

Isolating the US in table 2 indicates that IPO proceeds were up 158% compared to the annus horribilis of 2022. This increase was fueled by three billion dollar deals: chip giant Arm ($5.2 bn.), consumer products carve-out Kenvue ($4.4 bn.) and sandal maker Birkenstock ($1.5 bn.). Smaller IPOs maintained their dominance on US exchanges, with nearly 70% of IPOs raising less than $25 mln. This trend remained consistent with 2022 and marked a substantial increase compared to an average of approximately 10% in the preceding decade. Notably, there were seven deals in 2023 that raised more than US$500 million, surpassing the four such deals in 2022 (source: EY Global IPO Trends 2023).

In Europe, IPO proceeds, as presented in table 2, witnessed a 39% decline compared to the figures recorded in 2022. Unlike the United States, where the Technology sector dominated IPO proceeds, Europe experienced a different trend. The Energy sector emerged as the most sought-after, generating $3.5 billion in IPO proceeds, followed closely by Industrials at $3.3 billion, and Technology at $1.5 billion. Notably, only two deals surpassed the $1 billion mark in proceeds: Hidroelectrica SA with $2 billion and SCHOTT Pharma AG with $1 billion (source: EY Global IPO Trends 2023).

Catalysts and headwind in the 2024 IPO market

The outlook for initial public offerings in 2024 is cautiously reserved, largely influenced by the complex macroeconomic landscape. While the global IPO market in 2023 lacked excitement, there are some signals of improvement as deal activity gained momentum in the fourth quarter of 2023, accompanied by the anticipation of several high-profile deals in the pipeline.

Some catalysts and headwinds in the 2024 IPO market might include:

- Economic conditions:

While there is optimism that the interest rate hike cycle has concluded due to a significant decrease in inflation, the present scenario involves elevated interest rates in both Europe and the United States, coupled with a slowdown in Chinese economic growth and a cloudy outlook for the US economy. The increased interest rates also bring forth the prospect of higher returns from debt. Investors recently rushed to bonds to lock in attractive yields, introducing competition and alternative investment options outside of the equity market. In addition, elevated interest rates increase the cost of borrowing for private companies, which could potentially impede corporate expansions and investments. These are pivotal considerations for companies considering an IPO.

However, potential interest rate cuts in 2024 could entice investors back into IPOs by enhancing liquidity and improving the overall outlook for returns.

- Equity risk levels:

The risk levels in the equity market are favorable as the VIX (14,8%), VSTOX (16,4%) and VDAX (16,2%) indexes are maintaining volatility levels significantly below the 'IPO-critical' benchmark of 20.

- Geopolitical uncertainty:

Persistent geopolitical tensions arising from ongoing wars, trade sanctions, and the strained relations between the United States and China have the potential to erode investor risk appetite. This may lead to investors redirecting their focus towards capital preservation rather than actively engaging in new ventures.

- Pent-up demand:

Given the disappointments of both 2022 and 2023, a considerable number of postponed deals and companies ready to execute an IPO is waiting on the sidelines. Should circumstances unfold favorably, 2024 is anticipated to be a busy IPO year.

- Past IPO-performance:

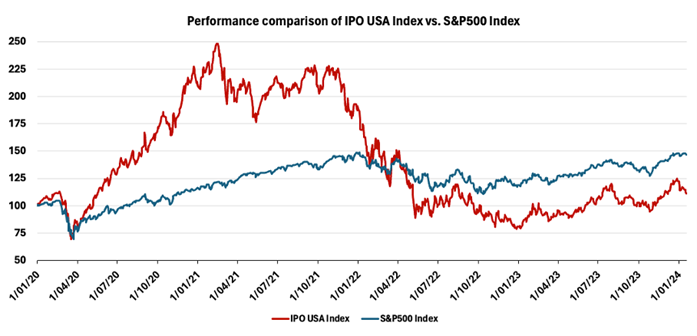

If previous IPOs have shown strong post-listing performance, with share prices increasing or at least maintaining stability, investor confidence increases. Positive experiences create a favorable perception of IPOs as an investment opportunity, encouraging more investors to participate in upcoming offerings. Unfortunately, several companies which went public this year have had uninspiring beginnings, trading just around or below their offering prices. The graph given below shows the performance of the IPO USA Index in comparison to the S&P500 Index. While 2020 and 2021 were great years for IPO stocks, the index is down a whopping 55 percent since its high in February 2021, lacking the S&P500 performance.

Potential Upcoming IPO events in 2024 in the US

|

The social discussion platform Reddit has been planning to go public for several years, yet turbulent market conditions led to the postponement of its IPO plans. On the 18th of January, the company announced it has drawn up detailed plans to launch its IPO in March. In a private funding round in 2021, the company was valued at $10 bn. The company had postponed its IPO plans multiple times due to unfavorable IPO market conditions. In addition, the firm waited to reach profitability to reach a higher valuation.

|

Stripe Stripe specializes in providing payment software services and solutions. The company offers a payments platform designed to streamline the complexity of payment infrastructure. Additionally, Stripe provides a range of ancillary services and financial products, including fraud management, analytics, and lending solutions for small and medium-sized businesses . While primarily serving customers in the United States, Stripe's offerings aim to simplify payment processes and enhance financial capabilities. The firm has been vocal about its IPO plans. The company announced in early 2023 that it had plans to go public and already hired JPMorgan Chase and Goldman Sachs as advisors. |

|

Rubik Rubik, known for the iconic Rubik’s Cube, is also making strides toward an IPO in 2024. The company initiated the hiring of banks for the process as early as June 2023. While initially aiming for a valuation around $4 billion a couple of years ago, current indications suggest the potential for a higher valuation at launch. billion.

|

Ola Electric Ola Electric is set to create history as the first Indian electric vehicle manufacturer to go public, marking the first IPO by an auto manufacturer in India in two decades. With plans to debut by the end of 2024, the company targets a valuation between $7 billion and $8 billion. |

Potential Upcoming IPO events in 2024 in Europe

|

Klarna Klarna is a Swedish fintech giant that has gained prominence for its “buy now, pay later” service, allowing consumers to make online purchases with the option to pay in installments. Founded in 2005, Klarna has become a major player in the e-commerce space, offering a range of payment solutions to enhance the shopping experience for millions of users globally. The company has initiated a process for a legal entity restructuring to set up a holding company in the United Kingdom “as an important early step” in its plans for an initial public offering.

|

Vinted The secondhand clothes marketplace, valued at $4.1 billion, frequently emerges in discussions about potential IPO candidates in Europe. In a 2023 interview, the CEO mentioned that the company was "technically IPO-ready" but refrained from divulging specific timelines. Subsequently, the Financial Times reported that the company was collaborating with Morgan Stanley to assess its capital structure in preparation for a potential IPO.

|

|

Northvolt Since its inception in 2016, the Swedish battery manufacturer has attracted $7.7 billion in investments and is contemplating a potential entry into the public markets within the next two years. In February 2023, the company's CFO informed Sifted (a leading media brand for the European startup community) that Northvolt had been actively preparing for an IPO and were awaiting favorable market conditions. The Financial Times reported that the company was inclining towards a listing in Stockholm, potentially marking one of the largest IPOs in the climate tech sector.

|

Volocopter The German air taxi startup faced setbacks in its plans to introduce helicopter-like flying vehicles during the Paris Olympics following opposition from the city's councillors last year. However, the company aims to initiate commercial flights later this year. According to statements provided to Sifted, Volocopter acknowledges that considering an IPO is an ongoing consideration, but it deemed the market as "especially difficult" in 2023. Since its establishment in 2011, the company has secured $769 million from investors, as reported by Dealroom. Despite not yet launching commercial flights, achieving profitability is likely a goal that remains some distance away. |

The IPO Dance: anticipating a vibrant future on the market stage?

With so many interesting companies waiting on the sidelines, the promising horizon of the IPO market in the quite near future resembles a still empty dancefloor, pulsating with anticipation. In our perspective, the question isn't merely "if" some of these aforementioned firms will make their public debut, but rather "when" they will step into the spotlight. As interest rates potentially decline in 2024 and investors embrace a higher risk appetite, the stage might be set for a blockbuster company to break the ice and kick off the festivities. As things stand at the time of writing, it looks like Reddit's legs are itching and they might kick off the danceparty in March 2024. Robust post-listing performance would crank up the volume, creating a dynamic rhythm for many others to enthusiastically join in and follow suit.

The question also extends to whether Belgian companies will partake in the IPO Dance. Notably, 2023 saw no Belgian company making its debut on a stock exchange. Benoît Van Hove, CEO of Euronext, anticipates a potential resurgence in IPOs on the Euronext, particularly in 2025 or 2026. Euronext's IPO Ready program, consisting of five sessions, has gathered significant interest. Fourteen companies signed up, two of which have a market value exceeding €1 billion. Additionally, Van Hove hints at the possibility of the Belgian Government divesting some of its financial participations to the public, with one potential candidate being the Belgian bank Belfius, currently under 100% government ownership.