Philippe Piessens is Senior Wealth Manager at Econopolis Wealth Management. Philippe has extensive experience in financial services, with a focus on equities. He started his career in 2001 at Lehman Brothers in London, and subsequently worked at HSBC and Kepler Cheuvreux. In addition, Philippe is active in art, as a collector and advisor, and in property, via his family business. Philippe received a BSc in International Relations at the London School of Economics.

Indulgence vs. Essentials: navigating brand loyalty and market dynamics in the food industry

Food for thought:

While driving through downtown Omaha with a CEO friend in 2009, Warren Buffett posed a question: 'Do you know what the best-selling candy bar was in 1962?'. When the friend said he wasn’t sure, Buffett told him it was Snickers. Then, he told him what the best-selling candy bar was now: Snickers.

When it comes to food, it appears that brands can have enormous and long-lasting value, as well as a global reach. To put it in Buffett's parlance, they have a strong 'moat'—an ability to maintain a competitive advantage over rival products, thereby protecting profits and securing a dominant market share. However, our research indicates that not all food brands are alike. Looking back over twenty years, we discovered that the share prices of companies whose revenues come predominantly from 'snacks' have shown substantial outperformance compared to those mainly active in 'packaged foods' (i.e. canned vegetables and fruits, breakfast cereals, microwaveable frozen meals, and packaged bread). We will present our findings and discuss what could be behind these trends.

Methodology and key findings

We categorized the 'food' sector into two distinct baskets. The first group includes companies primarily focused on 'Snacks,' encompassing items such as candy bars, cookies, and crisps. This group comprises Mondelez, PepsiCo, Coca-Cola, Lindt, Hershey's, and Lotus Bakeries. The second group consists of companies generally classified under 'Staples,' predominantly selling packaged food. This group includes Unilever, Danone, Nestlé, Campbell's, and Kraft Heinz.

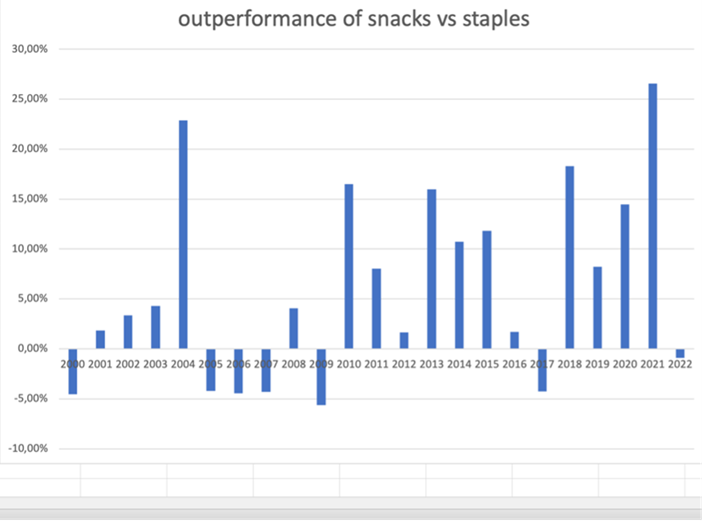

Firstly, when examining the share price performance over a 20-year period, we observe a notable outperformance of the Snacks sector compared to the Staples sector, especially pronounced in the last decade. In the past ten years, the Snacks category has surpassed the Staples by an average annualized outperformance of 9.47%. The average outperformance over the past five years is even higher at 13.33%. Intriguingly, this trend persists even during challenging years, such as 2020, marked by COVID-19, and 2022, characterized by inflation concerns.

Source: Econopolis, Bloomberg.

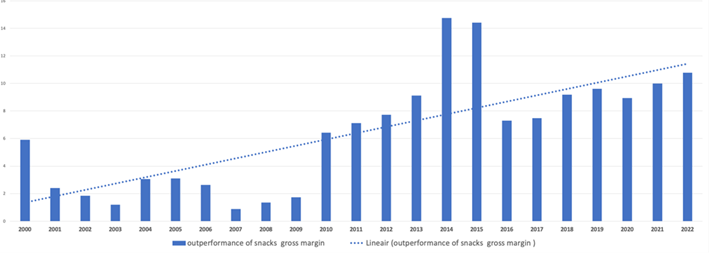

Secondly, a closer examination of the fundamentals of both categories reveals that the Snacks sector consistently outperforms the Staples sector. Over the past twenty years, sellers of Snacks have demonstrated either growth or better protection of their gross margins compared to their Staples counterparts. Moreover, in terms of top-line growth over the same period, the Snacks sector has achieved a robust annualized outperformance of 3.32% compared to the Staples sector.

Comparative analysis of gross margins: Snacks vs. Staples

Source: Econopolis, Bloomberg.

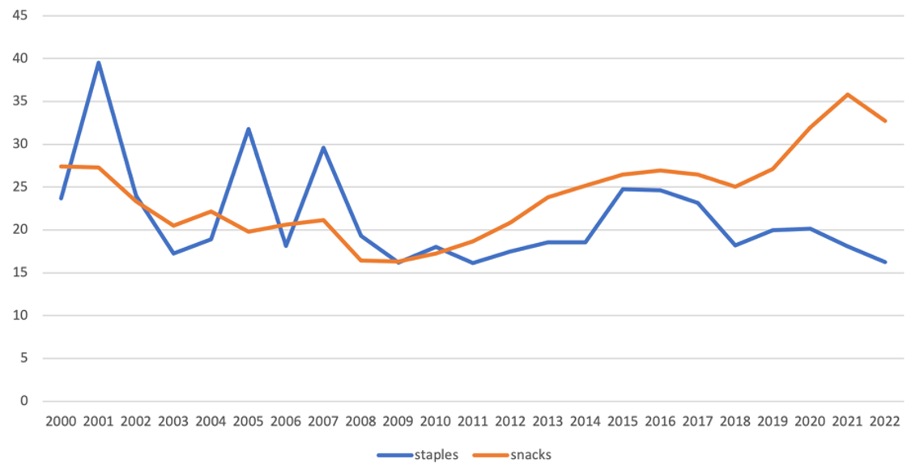

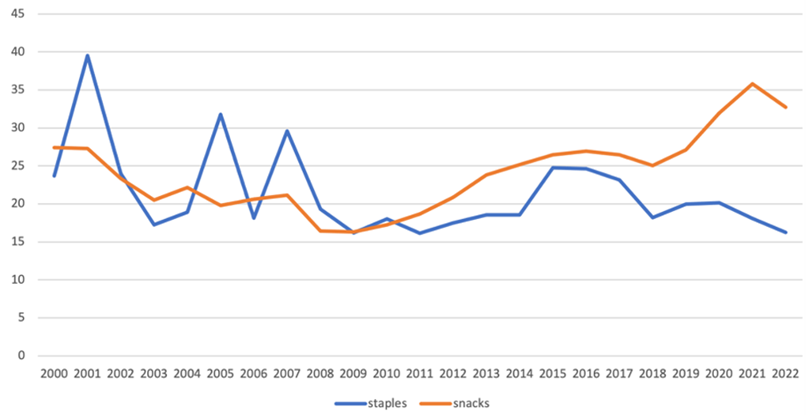

Third, an analysis of the multiples investors are willing to pay for companies in both categories clearly shows that the market is rewarding Snack companies for their robust fundamentals. Currently, these companies command an average P/E (Price-to-Earnings) ratio of 32.70 times their projected 2023 earnings, compared to the Staples sector, which trades at 17.46 times. Notably, this differential in multiples has widened significantly over the past decade.

Comparative analysis of valuation multiples: Snacks vs. Staples

Source: Econopolis, Bloomberg.

The evolution of Lotus Bakeries exemplifies this trend perfectly. Over the past decade, the maker of the iconic Biscoff cookie (also known as Speculoos) has achieved double-digit annualized growth in its top line and increased its gross margins to 65%, frequently surpassing market expectations. Consequently, its P/E multiple expanded significantly, rising from 20 times to 50 times earnings per share (EPS).

Staples: facing more trouble than in the last 100 years?

In one of his final interviews before his passing, Warren Buffett's colleague and fellow investment legend, Charlie Munger, commented on the challenges confronting major brands in the Staples sector. He observed, I think that there are forces -- in fact, now they're going to make it harder for the people that control the big brands because these house brands like Costco has and the other house brands and the success of places like Aldi and so forth, I just think that there's more trouble coming to big brands than they've had in the last 100 years.'

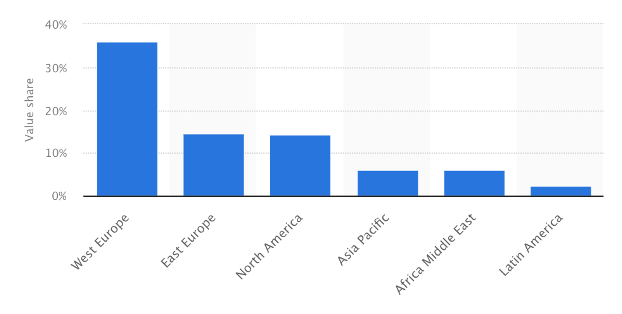

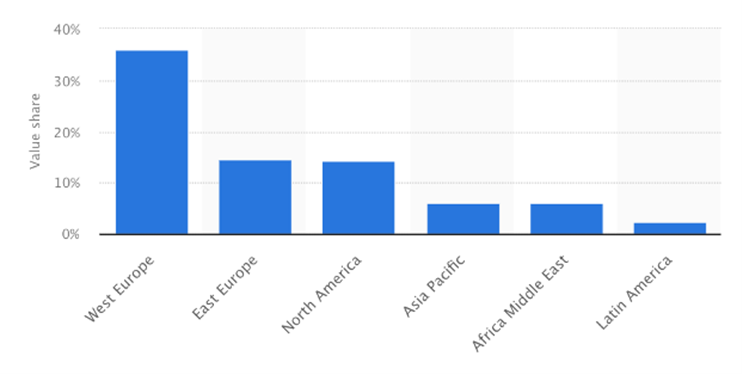

Private label value share of fast-moving consumer goods (FMCG) – Worldwide in Q2 2022, by region

Source: Econopolis, Statista.

Munger highlighted the increasing popularity of 'private labels,' which are supermarkets' own brands in food, drinks, and other consumer staples. These products, being more affordable than well-known brands, appeal to consumers who are facing financial constraints. Retailers benefit as well, enjoying profit margins that are, on average, up to 10% higher. This strategy also enables retailers to regain control over their product offerings. Importantly, consumers often find that these private label products offer good value without a significant compromise in quality. Currently, in Europe, private labels account for nearly 40% of supermarket sales. In the U.S., although the market share of private labels is considerably lower at around 12%, it is rapidly growing, bolstered by large-scale retailers like Walmart and Costco boosting their private label offering.

The surge in private labels is particularly notable in the Staples category. A wide array of products, from sauces and pasta to yogurts and coffee capsules, are increasingly being dominated by retailers' own brands in supermarket aisles. A prime example is Nestlé's prestigious Nespresso brand. What was once a unique, patent-protected product now contends with over 400 competitors. Adding to the challenges faced by major staples companies, private label products are frequently outperforming their branded counterparts in taste tests conducted by polling organizations. This situation calls to mind the old adage: 'Just because you're paranoid doesn't mean they're not out to get you’.

Snacks: life is made up of small pleasures

While Snacks too are challenged by private label competitors, our data shows that they have been able to hold their ground. As Dirk Van de Put, the Chairman and CEO of Mondelez, owner of brands such as Cadbury, Oreo and Ritz, put it in the November 2023 earnings call: “Consumers continue to prefer our widely loved brands over private label alternatives. This is particularly clear in emerging markets, where consumer confidence remains strong, and we continue to see resilient underlying demand”. Michelle Buck, CEO of chocolate manufacturer Hershey, echoed this sentiment during last year's Q1 earnings call, stating, 'Chocolate and salty snacks rank as two of the top three resilient treats that consumers are not willing to forgo’.

Responding on CNBC to Elon Musk’s Twitter jibe that “moats are overrated”, Warren Buffett shared a similar perspective. He explained, ‘If you go into a drugstore and say, "I would like a Snickers," and the owner offers to sell you a different candy bar for 10 cents less, you'll go across the street and get a Snickers’. In essence, when it comes to treats, consumers seem less influenced by mere economic considerations. Echoing this, Hershey's CEO Michelle Buck, specifically referring to chocolate, stated, ‘ Chocolate moments are such a heavily integrated part of consumers’ weekly routines, from rewarding moments to stress relief to self-care, and everything in between, that they indicate they would rather cut back on other expenses to make room for chocolate because they love it so much and it’s affordable.’

The future: a smaller pie for everyone, or shrinkflation to the rescue?

The recent rise of 'weight loss' or GLP-1 drugs, such as Novo Nordisk's Ozempic, has sparked concern among Wall Street analysts covering the Food & Beverages sector. These drugs function as appetite suppressants, and there is a growing apprehension that their widespread use could significantly reduce food consumption, thereby impacting sales volumes. The seriousness of this issue was highlighted by comments from Walmart CEO John Furner in October last year. Speaking to Bloomberg, Furner noted, We definitely do see a slight change compared to the total population, we do see a slight pullback in overall basket …“Just less units, slightly less calories”.' This statement was a contributing factor to one of the worst trading sessions in history for Food & Beverages stocks.

It remains uncertain what effect GLP-1 drugs will have on the Food & Beverages sector's stocks. In the latest quarterly reports, none of the companies in the Snacks category have made observations similar to those from Walmart. While companies in the Staples category have noted a slowdown in volume, it appears to be primarily associated with private label products, not weight-loss trends.

The long-term impact of Snacks' volume outperformance in a world increasingly focused on healthier waistlines is yet to be determined. However, a recent development offers a hint of optimism for the sector. In September 2022, Meriam Webster announced the inclusion of a new word in its eponymous dictionary: ‘Ever bought a candy bar that seemed somehow smaller than you remembered but that still cost the same? It's no illusion; it’s shrinkflation’. In order to pass on rising input costs to consumers, so it emerges, companies have been selling them smaller portions at the same price. Consumers’ response to this has been muted, and they have happily continued to gobble up their favorite snacks in smaller sizes.

A remembrance of times past

While it's commonly understood that food serves purposes beyond mere sustenance, packaged food often seems to be perceived as just that—fuel. Consequently, companies in the Staples sector face challenges from both private label competitors and the allure of fresh food for those with culinary inclinations. As a result, their shareholders have experienced diminishing returns. Snacks, in contrast, evoke the indulgent spirit of one of history's most famous connoisseurs, Marcel Proust. In his seminal work, 'À la recherche du temps perdu,' he eloquently muses over a madeleine: 'No sooner had the warm liquid mixed with the crumbs touched my palate than a shudder ran through me and I stopped, intent upon the extraordinary thing that was happening to me. An exquisite pleasure had invaded my senses, something isolated, detached, with no suggestion of its origin. And at once the vicissitudes of life had become indifferent to me, its disasters innocuous, its brevity illusory’. It seems, then, that Snacks provide not only emotional comfort but also solid investment returns.