Bernard Thant graduated as master in Commercial Sciences at EHSAL (now known as Hogeschool-Universiteit Brussel). Afterwards he completed a one-year postgraduate in Finance and Investment Management. After his studies he joined Société Générale Private Banking Belgium (previously Bank De Maertelaere) where he worked for most of his career as a financial analyst. During that time, he also acted as portfolio manager equities at the same company for a number of years. Bernard joined the Econopolis Wealth Management team in September 2014 as an equity analyst.

AholdDelhaize and the eternal feast of retail resilience

Food retail and the case for AholdDelhaize

"People always need to eat," said Bill McCanless, a former CEO of the food retailer Delhaize America (now part of AholdDelhaize), in an interview around the turn of the century. His statement, though seemingly obvious, underscores a perpetual market for supermarket operators. The frequency of restaurant visits and other forms of eating out may fluctuate over time due to changing consumer lifestyles (e.g. increased working from home post-COVID), variations in disposable income, and other factors. However, people will consistently prepare meals at home, ensuring a steady demand for food retailers worldwide.

The quiet power of local focus and a sound strategy

For a supermarket group, size is important, but being active in multiple countries is not a necessity. What truly matters is the local market share. Supermarket groups such as Colruyt and Kesko (K-Market) have demonstrated significant success while primarily operating in a single market (Belgium and Finland, respectively). Size may not be as crucial for purchasing power as some might assume, since smaller supermarket groups often form international alliances to secure favorable purchasing prices.

Comparing a supermarket group to an oil tanker provides a useful analogy. Once the tanker begins moving, it requires time to decelerate and changing its course is challenging. Similarly, for a supermarket group, establishing a sound strategy means that little can go awry in the short term.

Looking beyond profit margins: understanding the importance of free cash flows in food Retail

When examining profit margins, the food retail sector might not seem particularly lucrative at first glance. The operating profit margins for food retailers often fall into the low single-digit percentage range. This modest margin is understandable given that supermarkets generally do not significantly enhance the value of the food and other consumer products they sell. Moreover, the presence of competitors offering the same or similar products contributes to margin pressure. However, profit margins may not be the most insightful indicator for investors, as they do not reflect the capital investments involved, which are comparatively low in the supermarket industry. Thus, investors should instead concentrate on free cash flow, a metric where food retailers often perform better. It's also important to note that food retailers typically receive immediate payment from their customers, whereas they may extend payment terms to their suppliers for weeks or longer.

How supermarkets stay competitive in a changing retail landscape

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change" a famous quote attributed to Charles Darwin, aptly describes the evolving landscape of the supermarket industry. Despite the existence of supermarkets, such as self-service grocery stores, for over a century—with Piggly Wiggly, considered the first supermarket, opening its doors in Memphis in 1916—operators cannot afford complacency. The rise of dollar stores, club stores, Walmart supercenters, and online food retailers in recent decades signifies a competitive push for a share of the grocery market. Yet, this heightened competition does not spell doom for supermarket groups. Walmart, known as the 'Big Bad Wolf of Bentonville' for its formidable market presence, may have vast resources, but Food Lion—AholdDelhaize's largest supermarket chain in the US—has been successfully competing against it for years. AholdDelhaize's US stores generally price their products only slightly above Walmart's, distinguishing themselves through convenience and fresh food offerings.

The acquisition of Whole Foods by Amazon in 2017 caused a momentary panic among investors, leading to a sell-off of US food retailer shares. However, the initial fear was overstated, as Amazon has not posed a significant threat to US supermarkets since the acquisition.

AholdDelhaize: more than a Benelux champion.

With approximately 7,659 stores and annual sales of around 88 billion euros, AholdDelhaize stands as a dominant force in the food retail industry. A significant 96% of its sales are generated from markets where the company holds either the number 1 or number 2 position.

Its subsidiary, Albert Heijn, reigns as the leading supermarket in the Netherlands, boasting a market share of about 37%. This formidable position, coupled with stellar management, enables its Dutch operations to achieve margins surpassing the group average.

In Belgium, Delhaize has experienced a decline in market share in recent years but still maintains control of nearly a quarter of the market. However, the profitability of its Belgian operations remains weak. To address this, the company is in the process of transitioning all of its owned stores, which generally underperform, to franchisees.

In the broader Benelux market, the group operates bol.com, akin to a local Amazon counterpart but without the cloud business (AWS). Originally an online bookstore, bol.com now offers a wide range of products online. It serves not only as a direct retailer to consumers but also as a platform for third-party retailers wishing to sell online. AholdDelhaize had plans to take bol.com public in 2022, but this was postponed as the e-commerce sector began to experience a significant slowdown in growth post-COVID.

Beyond Belgium and the Netherlands, AholdDelhaize is a significant player in the Czech Republic, Greece, Romania, and Serbia. The company continues to express interest in expanding its presence, as evidenced by the recent acquisition of the Romanian supermarket group Profi Rom Food for 1.3 billion euros last October.

Though AholdDelhaize is widely recognized for its European operations, the majority of its sales (over 60%) and profits (around 65%) come from the US. Here, the group is a leading entity along the East Coast, operating approximately 2,050 stores under banners such as Food Lion, Stop & Shop, Hannaford, Giant, and the Giant Company, all of which hold strong positions in their respective local markets. Looking ahead, there is speculation that AholdDelhaize may eventually separate into European and US units, as there are minimal synergies between the two divisions beyond 'best practices.'

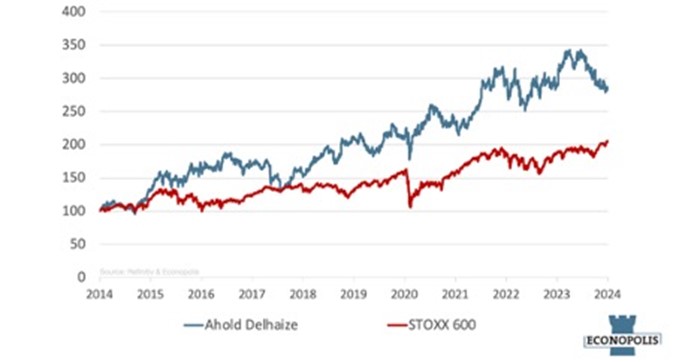

Over the past 10 years, AholdDelhaize shares have proven to be a solid investment. The group offers an attractive dividend yield, projected at approximately 4.4% for 2024, and consistently conducts share repurchases, totaling 1 billion euros each year over the last three years. Taking these factors into account, the stock has delivered an annual return of around 11.4% over the past decade, outperforming the broader European stock market (STOXX Europe 600), which saw returns of about 7.8%.

Total return comparison AholdDelhaize and the STOXX Europe 600 over 10 years

Source: Econopolis, LSEG Datastream

Supermarkets like AholdDelhaize thrived during the COVID-19 pandemic as consumers shifted to home consumption. Post-pandemic, the industry benefited from high food price inflation. However, 2023 posed challenges, with a slight decline in profits, and 2024 is expected to see limited growth due to weak sales volumes and a challenging pricing environment. Looking ahead, AholdDelhaize shares appear to be supported by the group's strong market positions, appealing valuation, and sound strategy.