The Maritime Shipping Sector Vital component in addressing climate change

Addressing climate change has become an urgent global priority. As the global maritime shipping industry is transporting an impressive 11 billion tons of merchandise annually with the help of nearly 100,000 commercial vessels, this makes it not only a vital component of the global supply chain (scope 3 emissions), but also a vital component in addressing climate change.

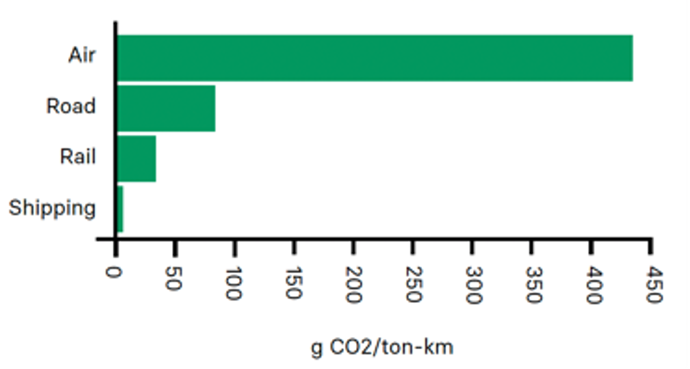

Today, the industry accounts for approximately 3% of global CO2 emissions, but it is also linked with pollution from methane and some other common greenhouse gases, which together with CO2 pose a significant environmental challenge. The CO2 emission intensity of shipping per unit of freight is quite low1. Emissions are well below those from air and road transport and only a fraction of long-haul aircraft. However given the sheer size in the mix of global trade volume (80%), the total emission footprint runs quite high.

While a lot of other industries have already adopted zero-emission technologies that are commercially available, maritime transportation solutions are less developed.

Shipping companies are already using both technical and operational measures that help them to reduce fuel consumption with some relatively easy to implement solutions. Just think about slower steaming, better hydrodynamic hull designs, and more efficient combustion engines. In the longer run, advances in energy efficiency will come into play. Consider the digitalization of fleets and the creation of machine-learning models that are capable of enhancing both the planning of itineraries and the scheduling of preventative maintenance.

Their implementation alone will however not be sufficient to reach the goals outlined in the Paris Agreement, which aims to limit global warming to 1.5 degrees Celsius or well below 2 degrees Celsius. Especially as economic growth continues to drive increased demand for shipping services, emissions from this sector are projected to surge by 40% by 2050.

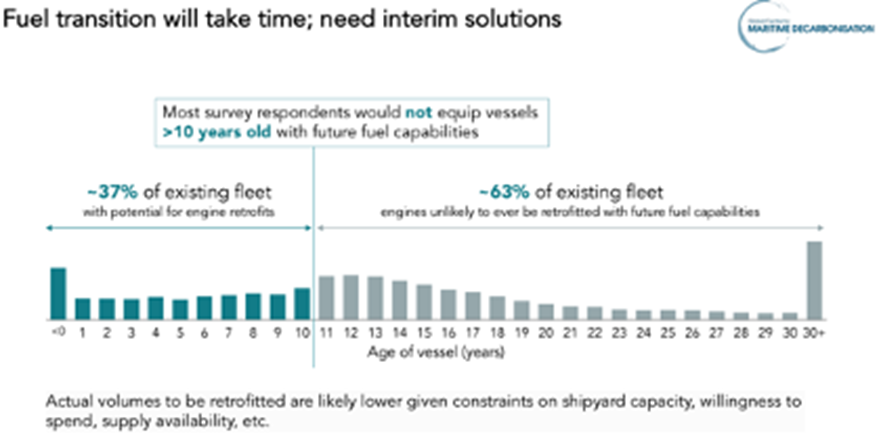

In order to make significant progress in reducing carbon emissions, it is essential to include low- and zero-carbon fuels in the array of available solutions. While these fuels are not yet widely accessible, they are in various stages of development. Some can be integrated seamlessly with existing vessels, while others require engine or vessel modifications. However a recent study done by the Boston Consulting Group (BCG) in partnership with The Global Centre for Maritime Decarbonisation (GCMD) found that of the 130 shipowners and operators surveyed, most answered that they would not retrofit vessels that are >10 years old for future fuels. This means that about 63% of the existing fleet will never use any kind of future fuel.

As the economical lifetime of a vessel is 25 - 30 years (can be stretched up to 40 years with correct operation and maintenance), this also suggest that newbuild vessels today need to be designed with optionality for future fuels, even if these fuels are not widely available today.

It also indicates that we need to make use of various kinds of measures. Shipboard carbon capture, and so on are only some of the options available.

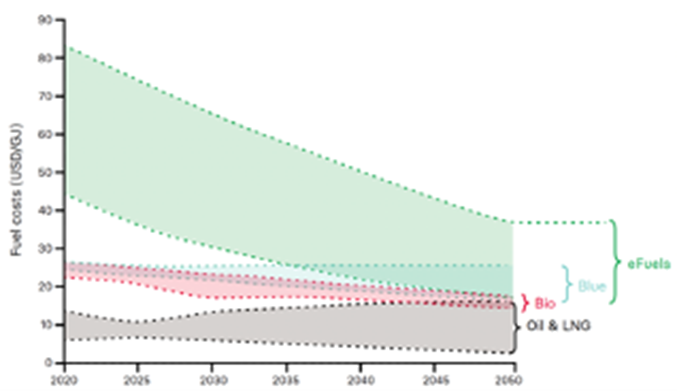

Projections indicate that alternative fuel costs will decrease significantly in the coming years but are expected3 to remain 2-5x costlier than traditional fossil marine fuels used today and to require a substantially larger storage space. As the fuels are costlier, engine fuel efficiency becomes increasingly critical too.

Given that fuel remains the most critical factor in vessel operation, the price difference between traditional and renewable fuels must be reduced. This can be achieved by carbon taxes, worldwide regulations, or business model innovations that alter the value drivers for seaborne shipping. The role of the International Maritime Organization, a specialized agency of the United Nations, is quite important in this respect.

More low- and zero-carbon fuels needed to achieve same level of travel

Basically, different applications will need different fuel types, and every type of fuel has its own challenges and opportunities.

Technically the production of green ammonia necessitates investment in renewable energy sources, specifically through the utilization of hydrogen derived from water electrolysis and nitrogen extracted from the atmosphere. Conversely, methane can be produced either from waste biomass or from green hydrogen. Methanol exhibits a more efficient utilization of tank space compared to ammonia, despite the fact that both fuels are expected to possess comparable costs relative to heavy fuel oil, around 25 times higher.

More importantly though is that the widespread adoption of these eco-friendly fuels requires a fundamental transformation of the entire global supply chain, from energy producers on one end to new bunkering facilities and innovative engine designs on the other.

This could mean that there will be a need for more storage tanks and bunkering barges with larger capacities given the lower energy density for example of methanol and ammonia in comparison to that of conventional fuel oil (respectively 2.5-2.8 times lower). So more of these fuels will be needed to achieve the same level of travel.

But it could also result in the requirement for additional ports, port infrastructure, and port-related services. In the same joint study from Boston Consulting Group (BCG) and The Global Centre for Maritime Decarbonisation (GCMD), the majority of shipowners and operators said they prefer to bunker more frequently instead of installing larger fuel tanks and give up cargo space as a result of this lower energy density of future fuels.

Insights from an established player: Wärtsilä

One of the companies that is active in the engineering of engines as well as fuel systems is Finnish company Wärtsilä. They recently hosted a R&D call focused on marine fuel transition.

Wärtsilä currently observes best progress in the utilization of methanol, for which it possesses an established engine and fuel system offering. The interest in ammonia is primarily regional (Norway and Japan), where it expects its first engine deliveries to commence in 2024.

Wärtsilä conducted mix and pre-H2 testing in the hydrogen sector throughout the year 2015-2021, and anticipates the development of a finalized technological concept by the year 2025. The engines powered by 100% H2 are primarily suitable for stationary power plants, as the storage of hydrogen necessitates a significantly larger space compared to that required for heavy fuel oil. Specifically, the fuel tank in the vessel would need to be 20 times larger when using hydrogen.

Conclusion

In conclusion, maritime shipping is a cornerstone of the global economy, but it also presents significant environmental challenges due to its greenhouse gas emissions. Achieving zero-carbon shipping by 2050 is a complex task, but it's essential for addressing climate change and it provides ample investment opportunities throughout the entire global supply chain. Ambitions are high, but we are still early in the journey. We see evidence of the sector’s energy transition accelerating, with 5% of the energy for shipping expected to come from carbon-neutral fuels by 2030, but there is still a long way to go before reaching zero-carbon shipping.

______________________

Sources:

1 IEA Tracking Transportation 2021

2 Clarksons Shipping Review and Outlook as of 2022 for # of vessels

GCMD-BCG Industry Survey on Maritime Decarbonisation (N = 128), BCG analysis

3 Maersk Mc-Kinney Møller Center for Zero Carbon Shipping – Industry transition strategy 2021, Wärtsilä-DNV collaboration