Siddy holds a Master’s degree in Economics from the University of Antwerp and a Master's degree in Financial Management from the Vlerick Business School. Passionate by innovation and entrepreneurship, he also participated to an Executive Master in Venture Capital at the Berkeley Haas School of Business. Prior to joining Econopolis, he managed the Investor Relations & Treasury office at Orange Belgium, a telecom company. Siddy also held the position of Telecom, Media & Technology analyst at a large Belgian Asset Management firm. Further, he is also active in the advisory board of StartupVillage and The Beacon, a business and innovation hub in the center of Antwerp focused on Internet of Things and Artificial Intelligence in the domains of industry, logistics and smart city. At Econopolis, he is Portfolio Manager of the Econopolis Exponential Technologies Fund.

Beauty is in the eye of the beholder

Big Tech's earnings power and their pivotal role in S&P's gains

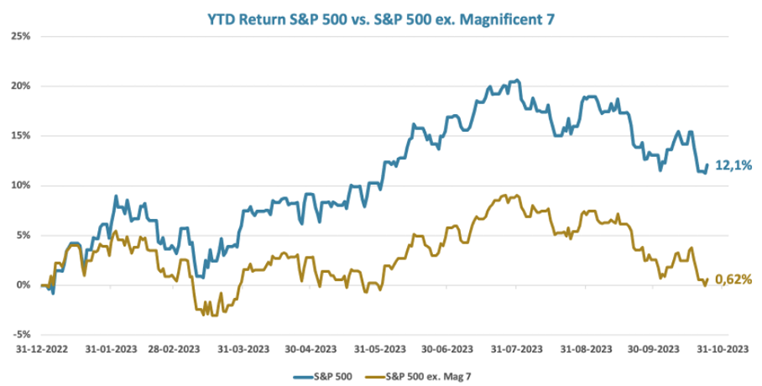

In the last ten days, five out of the seven leading big tech firms have released their earnings reports. Considering the significant market attention these results have attracted, it's clear that such quarterly earnings disclosures are tremendously important. Indeed, they hold considerable significance, especially considering the substantial impact these companies have on the year-to-date performance of equity markets. Their contributions are so pivotal that, without them, the S&P 500 would have scarcely advanced, rounding up to a mere 1% increase.

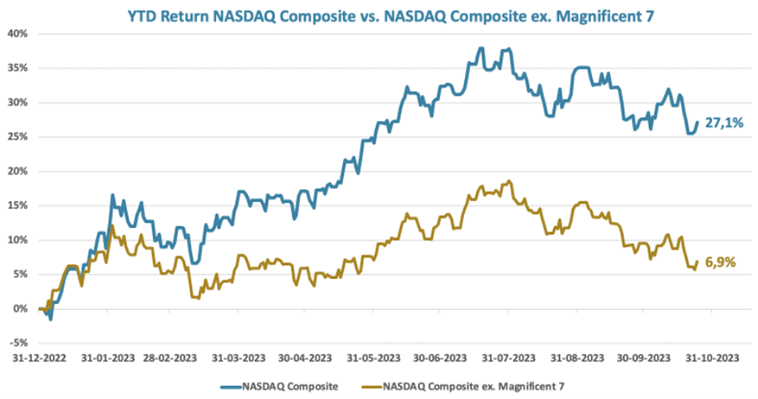

Similarly, the NASDAQ Composite owes much of its progress to these tech giants. Absent their influential contributions, the index would have posted a modest 6.9% gain year-to-date. This figure accentuates big tech’s integral role as a pillar of strength for US indexes.

This explains why the earnings results of these tech giants command such intense scrutiny. However, it's also crucial to maintain perspective and not be swept up in the frenzy of the moment. For investors, navigating the equilibrium between short-term indicators and long-term trends is always a nuanced endeavor, as the relationship between these two elements isn't always distinctly delineated. Sometimes, this necessitates a very thorough analysis of quarterly operational performances, entailing a comparison of various metrics such as KPIs, revenue, operational profit, EPS, cash flow generation, the balance sheet, and growth rates with both estimates and historical data. At other times, a more holistic, future-oriented view is imperative, focusing on long-term potential. This approach involves making informed decisions regarding a company's enduring viability, considering its ability to innovate, strategies for global expansion, and positioning in relation to emerging products or technological advancements.

The overarching narrative for the #BigTech companies is their advantageous position, driven by robust structural growth trends resulting from society's increasing digitalization, particularly when coupled with their status as leaders in their respective categories. These factors are poised to offer substantial support for investors operating on a 3 to 5-year horizon, provided that the fundamental investment thesis remains intact and resistant to potential contradictions posed by, for example, periodic financial disclosures. While short-term data from quarterly reports are informative, they should not be allowed to overshadow the long-term prospects unless they indicate a fundamental shift in the company's outlook or market conditions. Therefore, a discerning approach that balances immediate data with future expectations is crucial for making sound investment decisions.

Big tech's earnings momentum is re-confirming our thesis of earnings re-acceleration

Let’s now consider the results of the Magnificent 7 companies that have already reported so far, i.e. Microsoft, Alphabet, Meta Platforms, Amazon and Tesla. For each of these names we can say that the fundamental investment thesis remains intact:

- Microsoft is the champion of productivity software and cloud services

- Alphabet is the champion of search engines and online advertising,

- Meta Platforms is the champion of social networking, virtual communities and online advertising

- Amazon is the champion of e-commerce, online retail and cloud services

- Tesla is the champion of electric vehicles and innovation in sustainable energy

Moreover, four out of these five companies have not introduced any new information that could cast doubt on their long-term growth potential; on the contrary, they have provided additional confirmation of their robust prospects. Only Tesla has delivered a tempered statement regarding its growth trajectory. Previously, Tesla aimed for a long-term delivery CAGR of 50% for its electric vehicles, anticipating its production capacity would reach 20 million by 2030. However, Elon Musk casually revisited this ambitious goal during the conference call. He noted, that maintaining a compound growth rate of 50% indefinitely is impractical, as it would eventually exceed all bounds of feasibility, even humorously suggesting it would surpass the mass of the known universe. The company indicated it is navigating through a period of economic uncertainty, higher interest rates and shifting consumer sentiment. The current sell-side consensus estimates that Tesla will deliver 2.3 million vehicles in 2024, marking a 28% increase from the 1.8 million vehicles projected for 2023. Based on this 28% CAGR, the company’s 2030 production figures are estimated to be around 10 million, falling significantly short of the initial 20 million target. However, considering that Mercedes sold over 2 million vehicles in 2022, reaching 10 million would still represent a remarkable achievement for Tesla. Elon Musk also stated that if the macroeconomic conditions are stormy, even the best ship is still going to have tough times. The weaker ships will sink, but Tesla will not sink.

Entering this quarterly earnings season, our market thesis was anchored on the expectation that earnings from technology stocks, especially those of #BigTech firms, would re-accelerate. From the third quarter of 2022 until the first quarter of 2023, technology stocks had exhibited a downtrend in earnings. We regard this trend as an anomaly, largely attributable to the pull-forward of demand experienced during the COVID-19 pandemic. This surge in demand had to be assimilated and adjusted for throughout 2022 and into the initial months of 2023. This period of negative earnings, we believe, was a sector-wide recalibration following the unprecedented market conditions created by the pandemic.

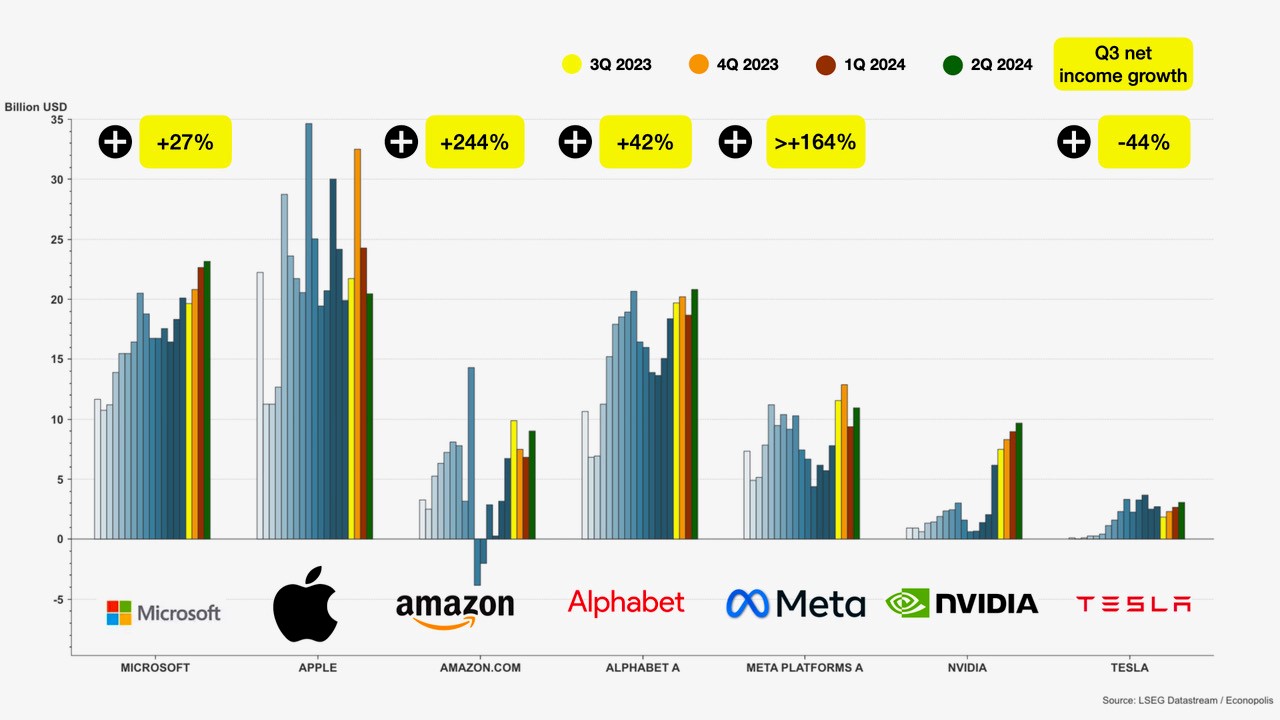

Upon reviewing the recent earnings releases of the five major tech companies, it's clear that, with the exception of Tesla, the anticipated earnings acceleration has indeed manifested. Microsoft, Alphabet, Meta, and Amazon have all reported financial outcomes that reinforce the expectation of growth re-acceleration

Beyond the major players, several other prominent tech firms, including ServiceNow, LAM Research, Netflix, and Spotify, have recently released earnings reports that bolster the case for a tech sector growth reacceleration. These companies, despite their varied specializations and market segments, are collectively indicating a shift back to a more typical growth trajectory after a prior period of stagnation.

To put this into a broader historical context, consider the long-term performance of the tech-centric S&P 500 Technology Index. Over a 30-year span, the companies in this index have achieved an average growth rate of 16%. This robust figure stands in stark contrast to more recent fluctuations, characterized by growth rates of -0.2%, -10%, and 8.3% in the third and fourth quarters of 2022 and the first quarter of 2023, respectively. However, signs of recovery are evident in the subsequent upticks of +5% and 5.5% (pre-earnings estimate) in the second and third quarters of 2023. At the conclusion of this earnings season, it would not be surprising if the final growth rate were to reach the high single digits, exceeding the current 5.5% estimate.

Understanding the stock market reaction

One of the most enduring quotes in investing is indeed, "the market is always right". On the day of their earnings releases, Tesla fell by 9.3%, Microsoft enjoyed a 3.1% rise, Alphabet plunged by 9.5%, Meta declined by 3.7%, and Amazon increased by 8.3%. These immediate reactions are a composite of investor sentiment, positioning into the earnings, expectations, and interpretations of each company's financial health and future prospects, illustrating the market's dynamic nature in assimilating a multitude of factors into share prices.

As previously noted, Tesla's shift in messaging had a discernible impact on its long-term growth outlook, making the subsequent dip in its stock price not that surprising. However, Alphabet's case is intriguing. Despite posting robust third-quarter results that exceeded headline revenue, profit, and notably cash flow projections, its stock experienced a 10% decline on the day the results were announced. To understand the market's reaction, it's essential to consider several factors. Firstly, Alphabet's share price had already surged 57% since the year's beginning, outpacing the likes of Microsoft and Apple, which recorded rises between 34% and 38%. Such an impressive run-up obviously has led to heightened expectations, making the market more sensitive to any perceived shortcomings.

Digging into the details, Alphabet reported its cloud business revenue at $8.41 billion, a 22.5% increase, marking its most sluggish pace since at least early 2021 and falling slightly short of the $8.62 billion forecast by analysts. While the cloud unit turned an operating income of $266 million — a noteworthy improvement from the $440 million loss a year earlier — it paled in comparison to the performance of Microsoft’s Intelligent Cloud division. The latter, encompassing the Azure cloud services, reported revenues amounting to $24.3 billion, surpassing the analysts' prediction of $23.49 billion, and growing Azure sales by 29% year-on-year. After, Alphabet and Microsoft reported, Amazon reported AWS revenues of $23.06 billion, up 12% year-on-year.

As a contender in a cloud market dominated by Microsoft Azure and Amazon AWS, Alphabet's slower growth, at least versus Microsoft, raises concerns. Notably, with Azure's growth at 29%, Alphabet's market share is under threat. However, we feel it's critical to contextualize Alphabet primarily as an advertising powerhouse, not a cloud-first company like its rivals. Cloud services account for only 11% of Alphabet's third-quarter revenue and approximately 1% of its operating profit for the same period. Even looking ahead to 2025, analysts project that these figures will only rise to about 14% of revenue and 6% of operating profit. An analyst aptly described investing in Alphabet for its cloud segment as akin to supporting Michael Jordan's foray into baseball — it's not the main event. Consequently, the slower pace in the cloud arena has led some to infer Alphabet is trailing in the technological tussle with Microsoft, particularly concerning AI initiatives. Yet, it's crucial to recognize Alphabet's primary AI gains likely reside within its core advertising realm. Therefore, while the third-quarter figures for Alphabet’s cloud segment were underwhelming, they don't spell a comprehensive loss for the company. Its diverse strengths warrant a more nuanced interpretation of its market position and potential.

In the case of Meta, the initial market reaction was positive, reflecting their solid and better-than-expected third-quarter results. However, the share price eventually soured. The market fixated on a response provided by CFO Susan Li during the company's earnings call. She noted, "While we don't have a material direct revenue exposure to Israel and the Middle East, we've observed a softer ad spend at the beginning of the fourth quarter, correlating with the onset of the conflict, which is reflected in our Q4 revenue outlook." She added, "Historically, we've seen broader demand softness following other regional conflicts, such as the war in Ukraine."

Regarding Microsoft and Amazon, the market seemed to respond favorably to their extremely strong results. Nonetheless, in both instances, the share prices did not experience significant movement following the news.

The market is always right, but valuation is not to be ignored

As mentioned, there's a common saying in investing: 'The market is always right.' However, another key investment adagio counters: 'What truly matters isn’t simply being right or wrong, but rather how much money you earn when you're right and how much you lose when you're wrong.'

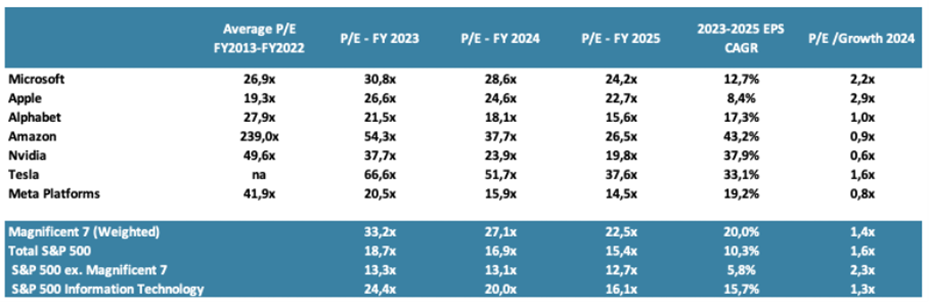

As illustrated in the initial graphs of this analysis, the 'Magnificent 7,' and by extension, the entire tech sector, have been driving the broader market's returns this year. This trend is so pronounced that some market observers argue there might be no fuel left in the tank. They point to the 2023 P/E multiples of the 'Magnificent 7' and the S&P 500 Technology sector, sitting at 33x and 24x, respectively, as evidence. However, if we take into account the growth these tech stocks are projected to generate in the next two years, an adjusted view emerges. When corrected for their growth, both the 'Magnificent 7' and the S&P 500 Technology index are, in fact, trading at multiples lower than those of the broader market.

Valuation Magnificent 7 vs. S&P 500 ex. Magnificent 7