Nike versus Adidas: The Importance of Making the Right Choices

In the current landscape of movie theaters, the selection of films leaves much to be desired. While personal tastes may vary, for those seeking a break from the influx of superhero movies, "Air" presents itself as an intriguing option for a night out.

Despite its underwhelming box office performance, "Air" possesses all the essential elements for a successful film: a substantial budget, an impressive ensemble cast including Matt Damon, Ben Affleck, and Viola Davis, a captivating narrative about a young sports hero and a daring underdog company, and a generous dose of 1980s nostalgia. The movie delves into the story behind the partnership between Michael Jordan, renowned by his nicknames "Air Jordan" and "His Airness," and the sporting goods giant, Nike.

At the outset of his career, Jordan entered into negotiations with Adidas and Converse around a sponsorship agreement. However, Nike managed to persuade Jordan, who initially showed little interest, to join forces with them in 1984. Nike, having only been in existence for two decades, not only dedicated its entire basketball budget to Jordan but also offered him his own line of basketball shoes, the iconic Air Jordan, with the promise of earning royalties. This was an unprecedented move within the industry.

Air Jordan swiftly became a phenomenon, surpassing all expectations. Nike had projected sales of $3 million dollar within three years of the shoe's launch, but the first year alone yielded a staggering $126 million in Air Jordan sales. The partnership between Nike and Michael Jordan has endured for over 38 years and is still running, with Jordan's brand operating as a separate entity under Nike since 1997. In fiscal year 2022, the Jordan brand contributed over $5 billion dollar, accounting for approximately 14% of Nike's wholesale sales.

Adidas, the European counterpart of Nike, was established in 1949, while Nike launched its first shoe in 1972. Through its sponsorship of successful athletes like Franz Beckenbauer, Rod Laver, Bob Beamon, and Nadia Comaneci, as well as its innovative products such as studded soccer shoes and expansion into leisurewear, Adidas grew to become the second-largest company in its sector worldwide, trailing only Nike.

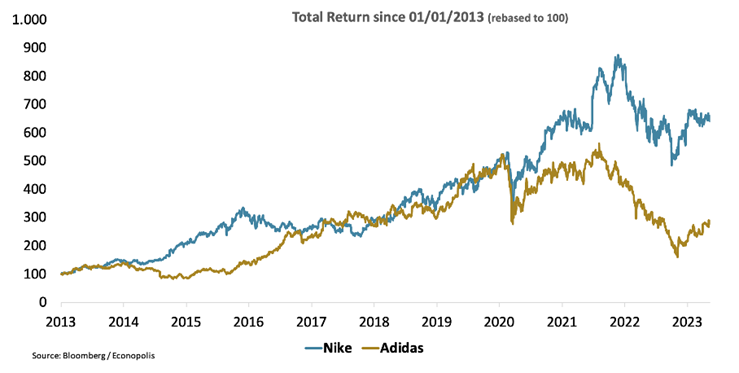

However, in the past two decades, Adidas has exhibited a more volatile performance compared to Nike. A glance at the comparative stock chart reveals that Adidas has faced challenges in the stock market since the early 2020s.

The COVID-19 pandemic led to temporary closures of both Adidas outlets and factories where the company's shoes and clothing are manufactured. Additionally, Adidas faced a temporary boycott by Chinese consumers due to its public statements about Uighur forced labor. Nike also encountered similar difficulties since 2020 but demonstrated greater resilience. In terms of direct sales, Nike holds a slight advantage over Adidas. Last year, Nike derived over 42% of its revenue from its own stores and e-commerce, while Adidas reached 39%. Nike's market share in China has fared better compared to Adidas. Overall, Nike currently exhibits greater strength in terms of innovation and product marketing.

One significant factor contributing to Adidas' weak stock price performance is the termination of its collaboration with Kanye West. In 2013, Adidas partnered with the highly popular rapper and fashion designer, and together they launched sneakers and fashion items under the Yeezy label. These products enjoyed immense success in the market. However, in 2020, Adidas ended the collaboration following anti-Semitic statements made by West.

As a result of the collaboration's termination, Adidas was left with a substantial inventory of unsold sneakers valued at approximately 1.2 billion euros. While Adidas has the capability to sell this stock, the company has chosen not to do so due to its decision not to pay royalties to Kanye West on principle. Destroying the stock is a possible option, but it would result in a 500 million euro loss and would be difficult to justify from a sustainability standpoint. Rebranding the shoes under a different label before selling them is also deemed unfair by the CEO of Adidas. Donating the shoes to charity is a viable alternative, but in practice, their popularity would likely lead to them reentering the international market. Consequently, Adidas will likely opt to sell the shoes and donate the proceeds to charity. Nonetheless, the conclusion of the collaboration with Kanye West represents a loss for Adidas, as the Yeezy line accounted for an estimated 15% of the company's net profit.

On January 1, Bjørn Gulden assumed the role of CEO at Adidas, bringing with him valuable experience from his previous position as a top executive at competitor brand Puma. Gulden is widely regarded by investors as the right person to lead Adidas, as evidenced by the 30% increase in the company's share price since the beginning of the year. However, Gulden faces significant challenges in his new role. Adidas is projected to only break even this year, and this does not take into account any potential loss on the stock of Yeezy sneakers. The recovery of the company will likely require time and effort. Adidas is making investments, including in digitalization, and implementing reforms aimed at restoring profitability. Nevertheless, achieving a double-digit operating profit margin in the next few years may be unrealistic.

The key takeaway of all of this? For a consumer goods company that depends on brands, picking the right business partners to build those brands is key. In today's interconnected world, where the influence of social media is significant, brands can experience rapid growth and enhanced strength. However, they can also face swift and severe backlash. From now on, adidas will think twice before signing new partnerships with athletes or designers. That said the success story of Nike and Jordan serves as a testament to the significance of making the right choices and selecting the right partners. Nike's strategic decision to invest in Jordan, despite being a relatively small player in the basketball realm at the time, propelled both the brand and the athlete to unprecedented heights. This enduring partnership showcases the impact of foresight, innovation, and calculated risks in the world of business and sports.