Bernard Thant graduated as master in Commercial Sciences at EHSAL (now known as Hogeschool-Universiteit Brussel). Afterwards he completed a one-year postgraduate in Finance and Investment Management. After his studies he joined Société Générale Private Banking Belgium (previously Bank De Maertelaere) where he worked for most of his career as a financial analyst. During that time, he also acted as portfolio manager equities at the same company for a number of years. Bernard joined the Econopolis Wealth Management team in September 2014 as an equity analyst.

Discovering the Mining Equipment Industry's Potential amidst the Surging Demand for Metals and Minerals

Mining May Be a Dirty Business ….

Mining, often rightfully so, is associated with a multitude of concerns encompassed by the ESG (Environmental, Social, and Governance) acronym. Activities such as drilling, boring, burrowing, quarrying, and blasting have profound impacts on the Environment. Improperly conducted mining operations can lead to environmental issues such deforestation, water contamination and even flooding. On the Social field, ensuring the safety of miners and appropriately rewarding them should be paramount, but this is not always the case. Governance presents another complex challenge as a meaningful number of mines are situated in countries with corrupt regimes. Considering the substantial financial stakes involved in the industry, with mined metals and minerals representing a significant percentage of GDP in multiple countries, the matter of governance becomes increasingly crucial. Unfortunately, in practice many of the mining groups have a mediocre to poor track record when it comes to sustainability.

…. But We Can’t Do Without It and Even Need More of It.

The global economy heavily relies on metals and minerals to sustain its operations. It may sound contradictory, but in order to address climate concerns, we will not only need to enhance our metals and minerals recycling efforts, but also will need to mine more of these in the (near) future. Why is this necessary? To effectively minimize the impact of human activities on the climate, we must transition from fossil fuels to renewable energy sources. This transition entails upgrading our electricity grids, electrifying transport systems, and transforming heavy industries. This will result in huge demand for copper (demand to nearly double by 2035 compared to 2021 according to S&P, https://orocoresourcecorp.com/_resources/blog/Future-of-Copper.pdf), lithium (demand to almost quadruple between by 2030 compared to 2022 according to Statista) and several other metals and minerals.

Mining Equipment Companies May Provide Comfort to ESG Conscious Investors

Investors find themselves grappling with a significant dilemma. On the one hand, the expected surge in demand for metals and minerals presents an enticing investment opportunity. On the other hand, only a handful of mining stocks meet the criteria for inclusion in investment portfolios that prioritize sustainability. However, a potential solution to this predicament can be found in mining equipment companies. These companies are – just like their counterparts in the mining industry – a play on the expected booming demand for metals and minerals, but they often have a (much) better track record in terms of ESG. This makes mining equipment players a more favorable choice for sustainability-focused portfolios.

Moreover, mining equipment companies play a pivotal role in enhancing the performance and ESG-friendliness of mining operations. Three key trends in the mining industry, namely automation, digitalization, and electrification, contribute to these advancements. Automation enables improved productivity within mines by reducing costs per drilled pit and reducing CO2 emissions. Digitalization increases safety and productivity by providing mining companies with comprehensive insights into their entire fleet, equipment and workforce. Real time data on factors such as CO2 emissions and water consumption can be measured. Electrification not only reduces dangerous fumes, but also results in reduced noise, heat and energy consumption, thereby promoting a more environmentally friendly and sustainable mining environment.

Finally, mining companies are less cyclical as a large part of their business stems from the aftermarket. Mining companies can stop or defer investments in new equipment, but skipping maintenance of equipment is more difficult.

Swedish Duo, Sandvik and Epiroc, Controlling 70% of the Market.

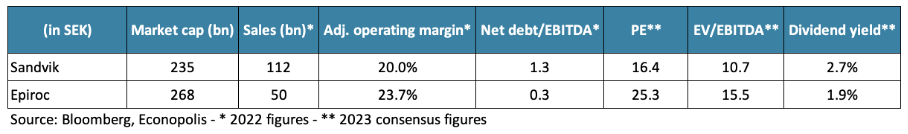

Underground mining is only a small, but growing part of the total mining market. Mining companies need to go more and more underground as open pit mines get depleted and as it becomes harder to get permits for new open pit mines. This evolution should support extra demand for specialized underground mining equipment. The market for the latter is dominated by 4 suppliers: Sandvik, Epiroc, Caterpillar and Komatsu. In this article, we will shine a light on Swedish peers, Sandvik and Epiroc. These companies have a respective market share of 42% and 29% in the installed fleet.

Both Sandvik and Epiroc are influenced by family holding companies that play a significant role in guiding their operations. Industrivärden, belonging to the Lundberg family, holds nearly 14% of the outstanding shares of Sandvik, whereas Investor AB, affiliated with the Wallenberg family, holds approximately 17% of the shares in Epiroc. Having a prominent family shareholder is often viewed as a positive attribute, as its fosters more focus on the long term and it reduces the risk of value destructive deals.

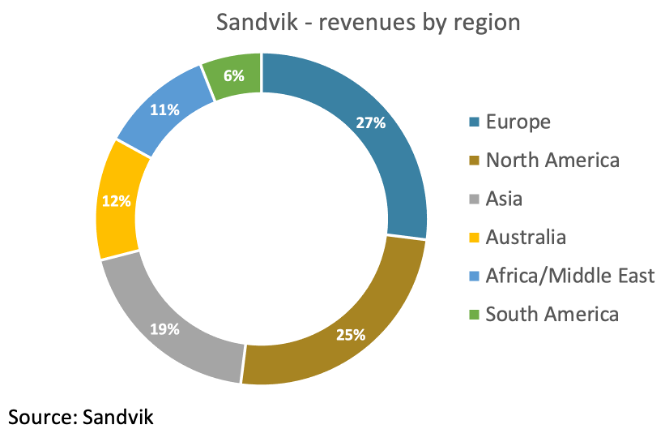

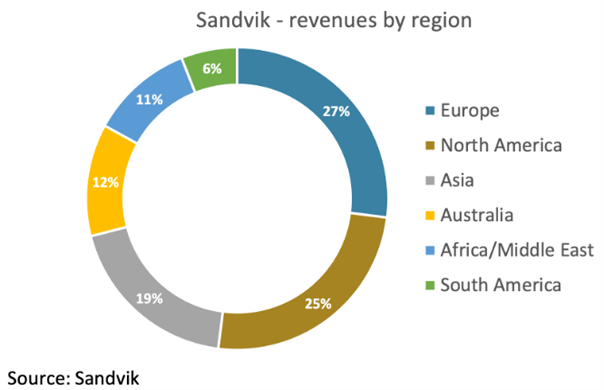

Sandvik has leading positions in equipment and tools for the mining and infrastructure industries. It also sells and manufactures metal-cutting tools, tooling systems for component manufactures and provides metrology technologies. In 2022, Sandvik spun off its materials technology business (tubes, strip steel, medical wires and heating technology products) under the name Alleima. Sandvik regularly carries out small to medium-sized acquisitions. Since 2020, Sandvik acquired 29 companies. The company was founded in 1862 and is listed since 1901. The group counts around 40,000 employees and operates in some 150 countries. Sandvik is led by Stefan Widing since 2020.

Sandvik boasts a strong track record with EPS having more than doubled since 2016. At its capital markets day last year, the company set new targets that call for annual sales growth of 7% through the cycle, an adjusted EBITA margin of 20-22%, a dividend payout ratio of 50% while maintaining a strong balance sheet (net debt/EBITDA below 1.5).

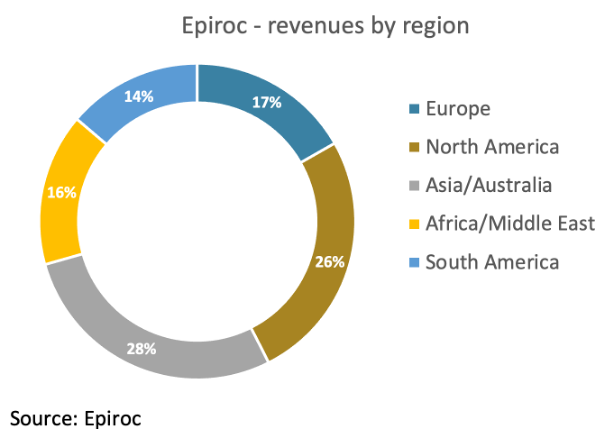

Epiroc was spun out of Atlas Copco in June 2018. The company’s roots go back some 150 years. Epiroc is active in around 150 countries and counts some 18,000 employees. The group is led by CEO Helena Hedblom since March 2020 and its chairman is Belgian Atlas Copco veteran Ronnie Leten. Epiroc is a true growth story. Over the past 20 years, the company recorded the strongest sales growth of all listed Nordic Industrial companies. Epiroc boasts an adjusted profit margin in excess of 20%. In terms of revenue breakdown, approximately 32% is derived from equipment while the remaining 68% comes from the aftermarket segment (i.e. 47% service and 21% tools and attachments). Regarding Epiroc's order composition, 79% stems from the mining sector, highlighting its significant presence in this industry, while the remaining 21% originates from Infrastructure sector.

Since 2015, Epiroc managed to grow its revenues by 8% on average. Going further the company expects to keep this growth figure over the cycle and to grow faster than the market. The group aims for an industry-best operating margin with strong resilience over the cycle. Growth is expected to be organic and supported by selective acquisitions (Epiroc did 23 acquisitions since the start of 2018). Epiroc has a low gearing, which leaves ample room for external growth.

Epiroc battery-powered MT42 high-speed articulated underground truck with 42-tonne payload capacity

Source: Epiroc

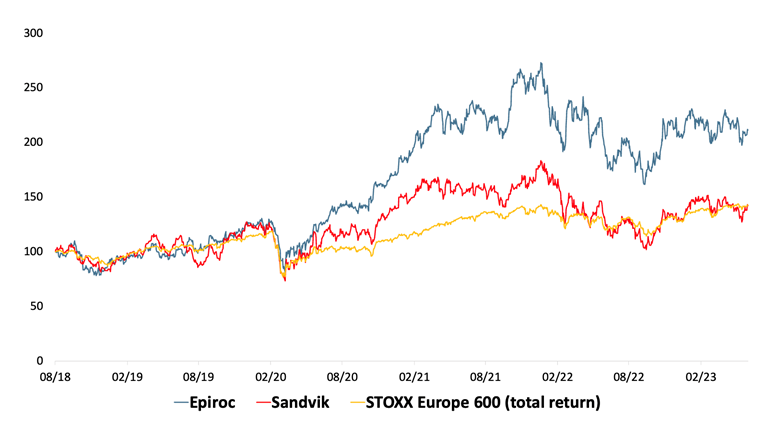

Since its listing in June 2018 shares of Epiroc more than doubled. Including dividends, the share offered shareholders the annual return amounts to 19.7%. Over that same period, shares of Sandvik delivered an annual return of 9.3%. The broad European market index STOXX Europe 600 delivered a performance similar to that of Sandvik.

Conclusion: The Lucrative Underground Mining Market and Investment Considerations

The underground mining market stands as a niche sector experiencing robust growth, set to be fueled further by the escalating demand for minerals and mining materials driven by the electrification of the economy. The oligopolistic market structure, the high barriers to enter (technology, capital intensity and materials know-how) and the high added value of mining equipment to the mining industry allow for high margins.

All of this sounds like music to the ears of investors. This however results in a relatively high valuation for Epiroc, especially when compared to Sandvik, which has exhibited somewhat slower growth in recent years.