Gino Delaere is master in Applied Economics (University of Antwerp) and holds an MBA (Xavier Institute of Management in Bhubaneswar, India). For over two decades he has been specializing in emerging markets worldwide and traveling the world looking for interesting investment opportunities. Previously he worked for several large asset managers where he was actively involved in several thematically inspired equity funds. He joined Econopolis in 2010 and in his current role he is co-responsible for managing the emerging markets and climate funds.

Global Wealth and Lifestyle Report 2020: focus on Asia

Julius Baer recently published its first “Global Wealth and Lifestyle Report” that looks at the trends behind consumption patterns. Driven by a booming number of wealthy residents who are reshaping the global high-end market, Asia is now home to the three most expensive cities in the world. But as consumers worldwide begin to put sustainability in focus, the high-end market is set to undergo further transformation in the coming years.

Most and least expensive cities

Julius Baer surveyed 28 cities around the world: 10 in Asia, 12 in Europe, Middle East and Africa, and 6 in the Americas. The report divides the lifestyle items into 5 categories: home, experiential, fashion, family, wellness. These are some of the main takeaways from the report:

- Asia is the most expensive region and home to the world’s top three most costly cities (Hong Kong, Shanghai and Tokyo) and the least expensive (Mumbai in 28th place).

- The Americas ranks second overall, led by New York (4th globally) while Vancouver lays claim to the most affordable city within the region (21st).

- European cities offer the best value, led by London (7th) while the continent’s best-value cities for luxurious living are Barcelona (24th) and Frankfurt (26th).

- Global luxury demand continues to grow steadily over time, as evident from the outperformance of listed high-end goods makers in the West against mainstream indices.

Zooming in on Asia, it’s clear that the emergence of vast numbers of newly wealthy Asians over the past decade has had a profound effect on global consumption. In particular, Chinese buyers now dominate purchases across categories, from cars to watches. This has obviously led to many western multinationals having to reshape their strategies around China. But it’s a two-way street as Asian demand is also being felt in the West itself. For some years now, the super-rich have been snapping up everything from fine art to football clubs. Now the better-off want to put their children through prestige schools and aspire to own apartments in overseas locations. That makes perfect sense as many of them are seeking a better quality of life compared to what they have at home, where rapid economic growth has led to crowded cities and a fast-paced life.

The conscious or sustainable consumer

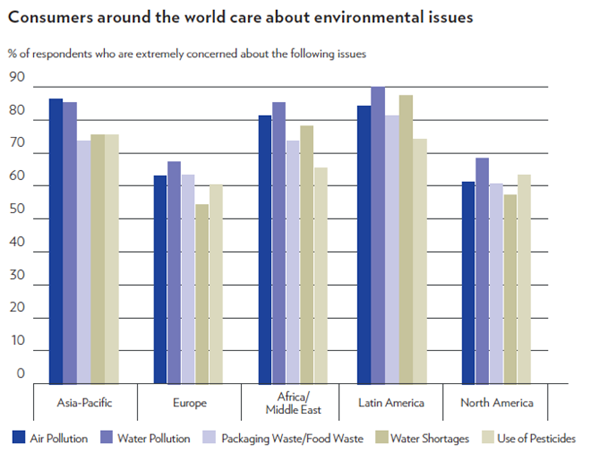

Specifically on sustainable shopping, these are some of the findings:

- With the corporate world changing and society pushing for a more sustainable future, governments, regulators and central banks are starting to address the topic of sustainability.

- In a recent global survey, 81% of companies reported that sustainability is more important to their business than five years ago, and 85% believe it will be even more important in five years’ time.

- Consumers from less developed countries in Asia and Latin America are willing to pay more for products from responsible companies as they are directly experiencing the negative effects of rapid economic growth and because trust in local brands is not high.

- European and North American consumers are less willing to pay a premium for more ethically sourced products due to strict environmental regulations and scepticism of big business.

An increasing awareness of rising temperatures, loss of habitat and species, polluted oceans, dirty drinking water,… is making consumers more mindful of how companies behave. Younger adults are quick to suspect dishonesty in corporate leaders and want more transparency on the origin of goods. They are also aware of the power of social media as a valuable tool to point to companies with ethical standards that fall short of promises or expectations.

A changing world

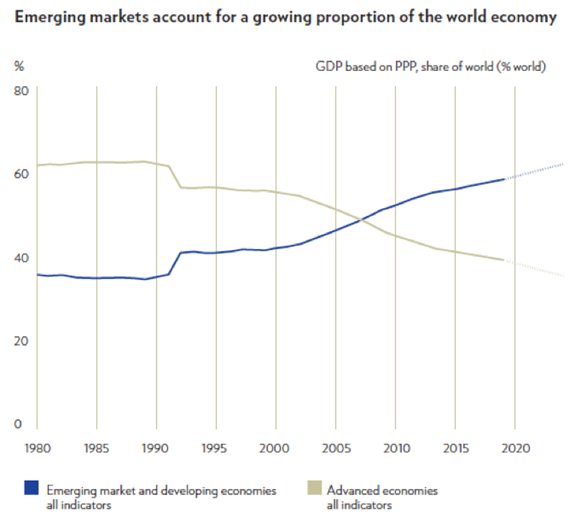

Demand for high-end goods and services may seem a good proxy for consumer sentiment, and hence the global economy. But that global economy has been undergoing some changes as the chart below points out. Over the past couple of decades, emerging markets have steadily been gaining market share in the global economy and are now responsible for a much higher proportion of the world economy compared to let’s say 1990. Especially since China became a member of the World Trade Organization at the end of 2001, there was a clear acceleration in this trend.

We expect this trend to continue whereby emerging markets continue to increase their share in the global economy. Companies will need to spend an increasing amount of time on their strategy reflecting this changing world. Also, the growing desire among consumers to balance their buying decisions with their social, environmental and political convictions has passed a point of no return. Companies will also need to pay much more attention to this part of their business, especially when the younger generation of consumers takes over.