Leona Tan Siew Hoon graduated from Indiana University Bloomington, US, majored in Finance and International Business. She started her career as an analyst in a financial-data company in the US. Upon her return to Singapore, she spent a few years in corporate finance before dedicating herself to working as an equity analyst at a brokerage firm in 2004. She joined a large Singaporean asset manager in 2007 and was involved in various roles such as portfolio manager for global and China-India equities funds. She joined Econopolis Singapore Pte Ltd in April 2017 and was responsible for stock selection in the emerging markets funds until 2023. Since then, she has been advising Econopolis on emerging market equity markets as an associate of Sunline (Singapore).

Returning to Normalcy Post-Covid

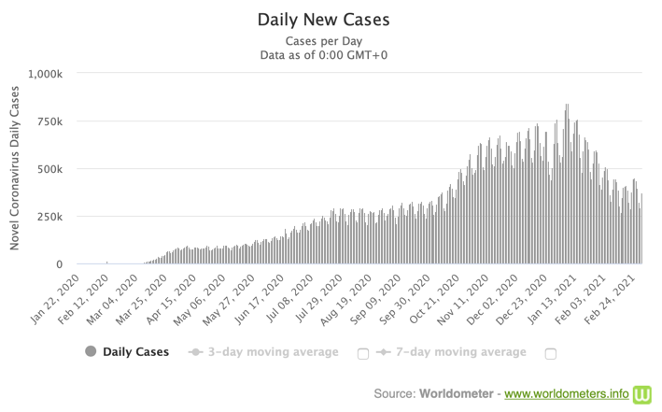

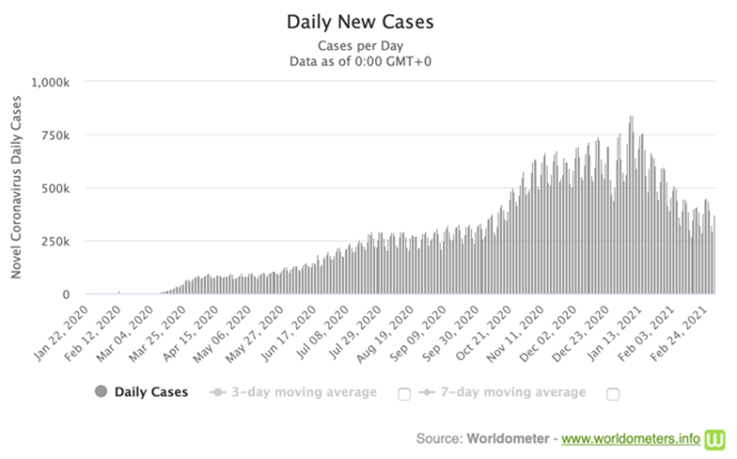

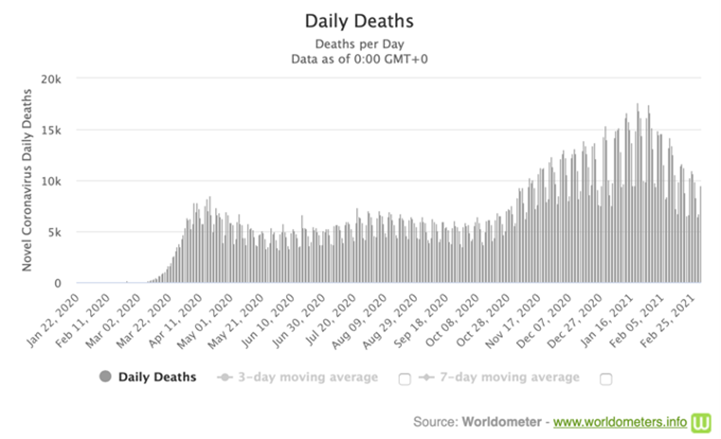

As we had all hoped, Covid-related conditions are generally improving, and quite rapidly in fact as infections and fatalities worldwide continue to decline with the arrival of Covid-19 vaccines.

The path to Covid-19 herd immunity

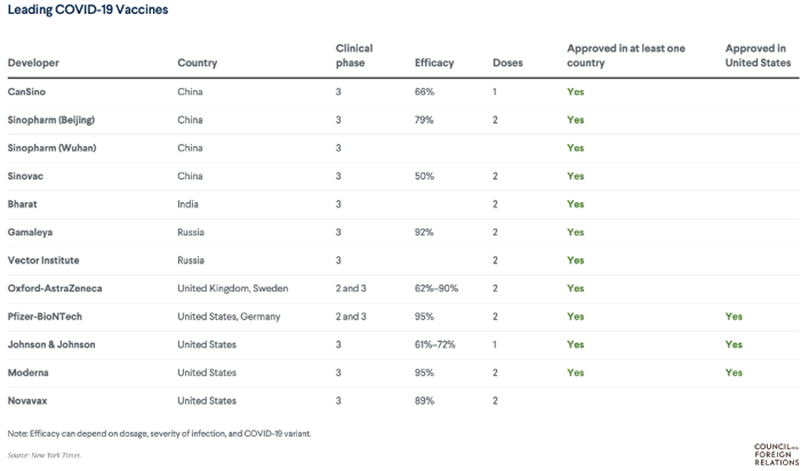

Thanks in part to Covid-19 vaccine investments, the UK, the US, China, India and Russia have all developed clinically approved vaccines. Experts estimate that 70-80% of the world’s population will need to be vaccinated in order to reach Covid-19 herd immunity. According to data collected by Bloomberg, more than 271 million doses of vaccines have now been administrated across 108 countries. At the latest vaccination rate of roughly 6.36 million doses a day worldwide, it would take an estimated 5 years to achieve herd immunity.

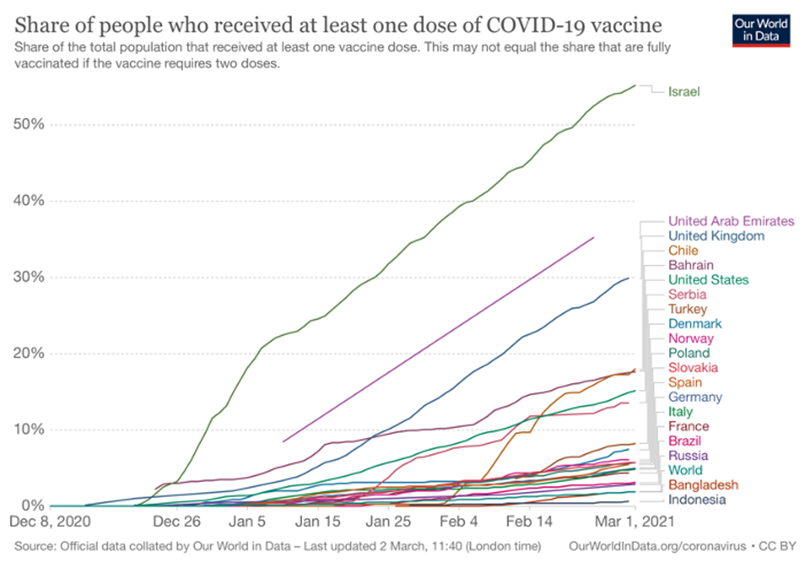

The rate, however, is steadily increasing, and new vaccines by additional manufacturers may soon be available. This is especially so in developed countries where it is observed that the receiving and distribution of vaccines has been faster than in developing nations. As you can see from the graph below, Israel has been the fastest to roll out inoculations. More than half of its population have already received at least one dose of vaccine. In the US, about 16% of Americans have received at least one dose of vaccine so far. It will take the US approximately another 6 months to cover 75% of the population with a two-dose vaccine assuming the rate of two million doses per day, on average. And this may be shortened with news of the US regulator’s recent approval of the Johnson & Johnson single-dose Covid-19 vaccine, the third vaccine to enter the US market. That should help Americans return to an “almost-normal” way of life as early as this fall. We can therefore expect good economic growth later this year for the world economy as the world’s largest economy recovery finally gets underway. More details on this follow in the latter part of this post.

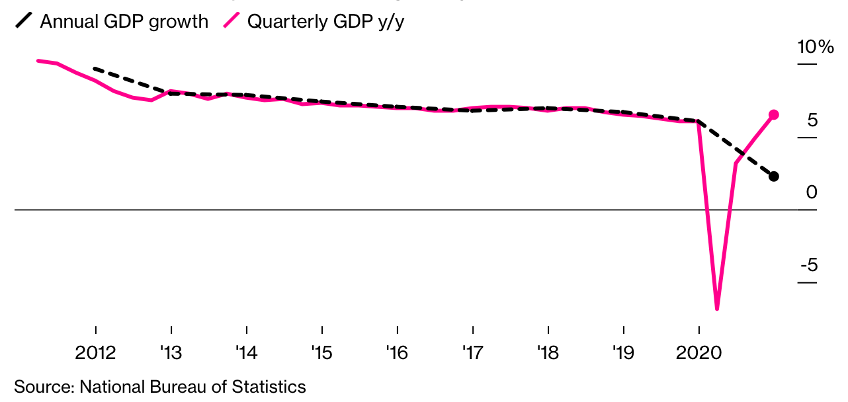

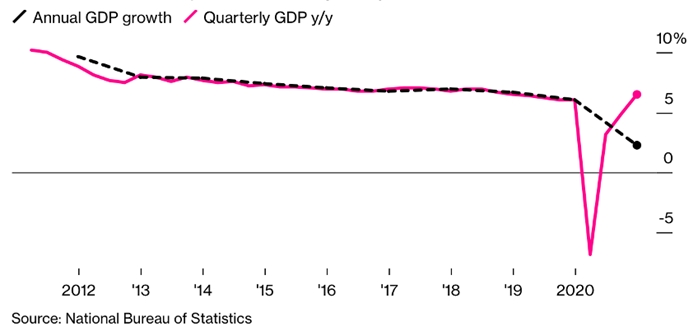

China's V-shaped economic recovery

While China was the country where the Covid-19 pandemic began, it was the only major economy in the world to avoid a Covid-19 recession last year. Its GDP grew 2.3% to 101.6 trillion yuan in 2020. Beijing’s quick intervention and strict virus curbs largely contained the outbreak, helping to restore consumer confidence, allowed the reopening of businesses and resuming domestic traveling, while government-led policy stimulus helped fire up momentum. This led to last year’s fourth quarter GDP expanding at its fastest rate of 6.5% year-on-year, following the third quarter’s solid 4.9% growth. More recently, all the new coronavirus cases in China were imported infections originating from overseas. China’s GDP could expand by 8 to 9 percent in 2021 as it continues to rebound from the pandemic.

US economy recovery gets underway

In contrast, the US with more infection cases than any other country in the world, remains the epicentre of the COVID-19 pandemic. Its GDP contracted 2.3% to $20.9 trillion in 2020. A surge in cases during fall and winter had forced many of its states to resume closure of some public spaces, ban indoor dining at restaurants and bars, limit gatherings, mandate mask-wearing and require a quarantine period or proof of a negative COVID-19 PCR test for incoming travellers. The good news is that the total number of case counts in the US are showing a decline. Virus cases have been down 72% since the January 12th peak and hospitalizations are following closely behind. Some of the restrictions imposed previously are beginning to be slowly lifted or phased out as vaccination rollout picks up speed.

In fact, many growth indicators are flagging a bullish signal. US manufacturing activity scaled a three-year high in February amidst a surge in new orders. Personal income jumped 10% in January after a 0.6% increase in December, partly thanks to a $600 stimulus check for every Americans as part of the $900 billion second bill package. Retail sales surged and pushed overall expenditures up 2.4% for January. In the monthly consumer survey, consumer spending expectations showed sequential improvement across all categories but gave indications of a shift in spending patterns tied to reopening. While still rising, grocery, cleaning supplies and food takeout experienced the largest sequential declines in expectations whereas intentions to buy big ticket items (car, appliances, and home improvement) registered sizable sequential increases.

With vaccinations accelerating, travel intentions are also recovering. We think the combination of an end to the winter season, rising inoculations, number of vaccines being made available, and antibodies developed naturally from those already infected, all spell the end of the coronavirus pandemic by summer, as surreal as this call still may sound. By then, the US could have tamed the virus enough to end the lockdowns and start learning to live alongside Covid.

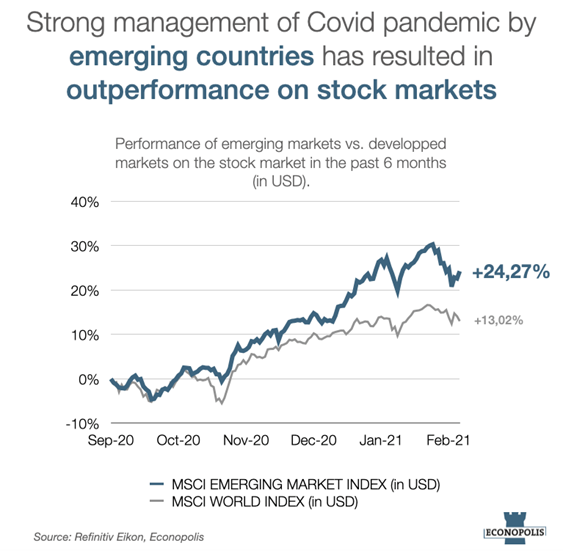

Swift and efficient management of the Covid crisis by emerging countries has also led to a significant outperformance of these countries on the stock market compared to the developed countries (see graph below). As you know already, Econopolis has been a strong advocate of emerging markets for a while, which has resulted in strong performances in our investment portfolios. Our physical presence in Asia (Singapore office) allows us to quickly identify new trends and interesting companies that lead to the necessary edge and competitive advantage. Feel free to reach out should you want more info on our EM products and strategies.

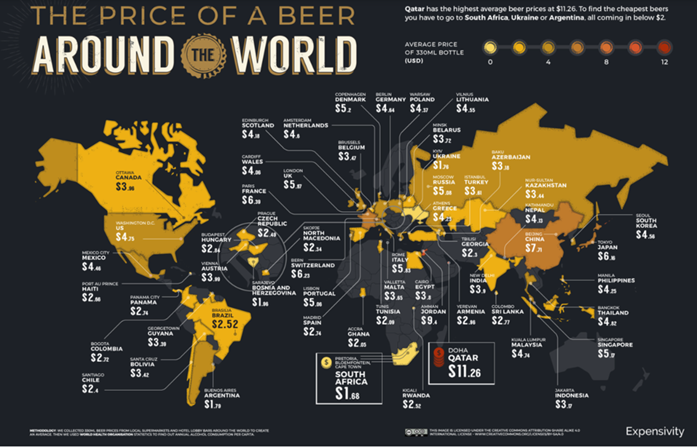

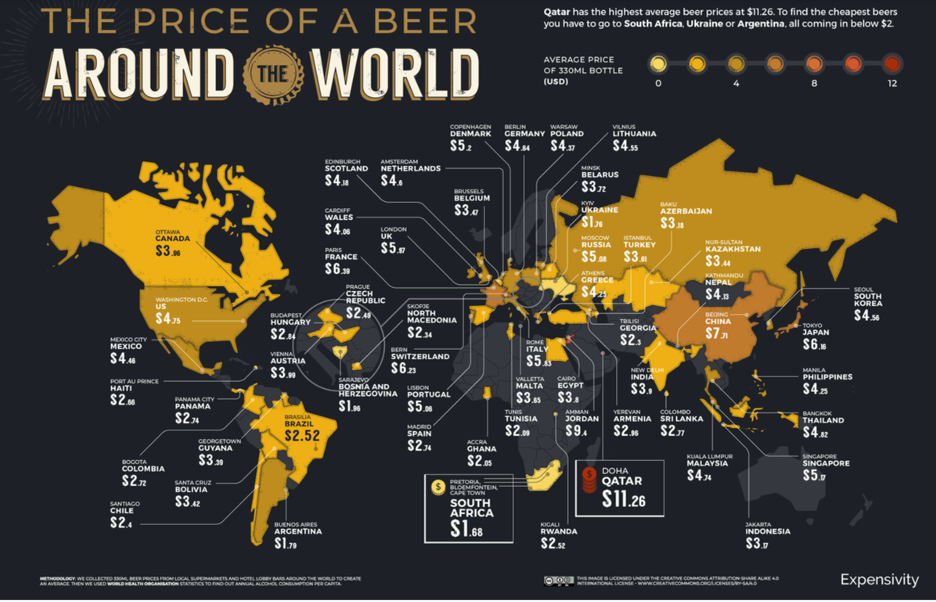

Lastly, I will leave you a map of the price of a beer around the world that you can grab at the pub when the world returns to normalcy and country borders reopen again. For now, stay safe and healthy, and chill with a beer at home. Cheers!